Answered step by step

Verified Expert Solution

Question

1 Approved Answer

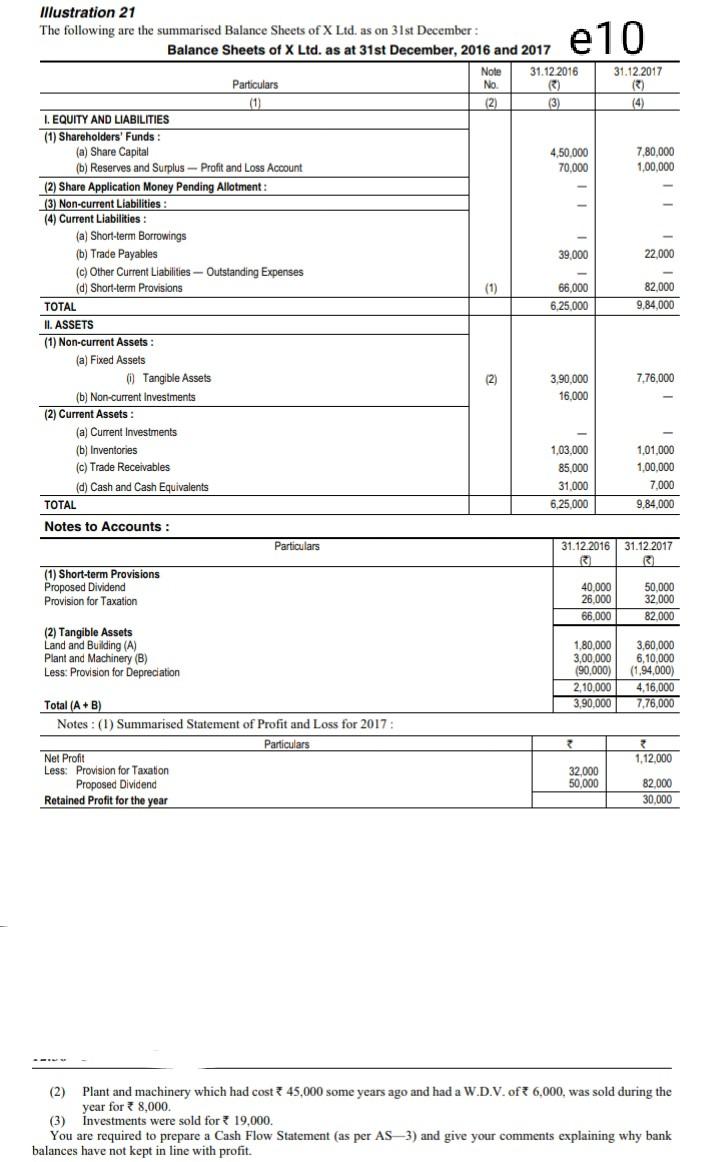

e10 1 66,000 Illustration 21 The following are the summarised Balance Sheets of X Ltd. as on 31st December : Balance Sheets of X Ltd.

e10 1 66,000 Illustration 21 The following are the summarised Balance Sheets of X Ltd. as on 31st December : Balance Sheets of X Ltd. as at 31st December, 2016 and 2017 Note 31.12.2016 31.12.2017 Particulars No ) (*) (1) (2) (3) (4) 1. EQUITY AND LIABILITIES (1) Shareholders' Funds: (a) Share Capital 4,50.000 7,80,000 (b) Reserves and Surplus - Profit and Loss Account 70,000 1,00,000 (2) Share Application Money Pending Allotment: (3) Non-current Liabilities: (4) Current Liabilities: (a) Short-term Borrowings (b) Trade Payables 39,000 22.000 (c) Other Current Liabilities - Outstanding Expenses (d) Short-term Provisions (1) 82.000 TOTAL 6,25,000 9,84,000 II. ASSETS (1) Non-current Assets : (a) Fixed Assets 0 Tangible Assets (2) 3,90,000 7.76,000 (b) Non-current Investments 16.000 (2) Current Assets : ) (a) Current Investments (b) Inventories 1,03,000 1,01,000 (c) Trade Receivables 85,000 1,00,000 (d) Cash and Cash Equivalents 31,000 7.000 TOTAL 6,25,000 9.84,000 Notes to Accounts: Particulars 31.12.2016 31.12.2017 ) ) () (1) Short-term Provisions Proposed Dividend 40.000 50,000 Provision for Taxation 26.000 32.000 66.000 82.000 (2) Tangible Assets Land and Building (A) 1,80,000 3,60,000 Plant and Machinery (B) 3,00 000 6,10,000 Less: Provision for Depreciation (90,000) (1.94,000) 2,10,000 4.16.000 Total (A+B) 3,90,000 7,76,000 Notes: (1) Summarised Statement of Profit and Loss for 2017: Particulars Net Profit 1,12,000 Less: Provision for Taxation 32.000 Proposed Dividend 50,000 82.000 Retained Profit for the year 30,000 (2) Plant and machinery which had cost 45.000 some years ago and had a W.D.V. of 6,000, was sold during the year for 8,000. (3) Investments were sold for * 19,000. You are required to prepare a Cash Flow Statement (as per AS3) and give your comments explaining why bank balances have not kept in line with profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started