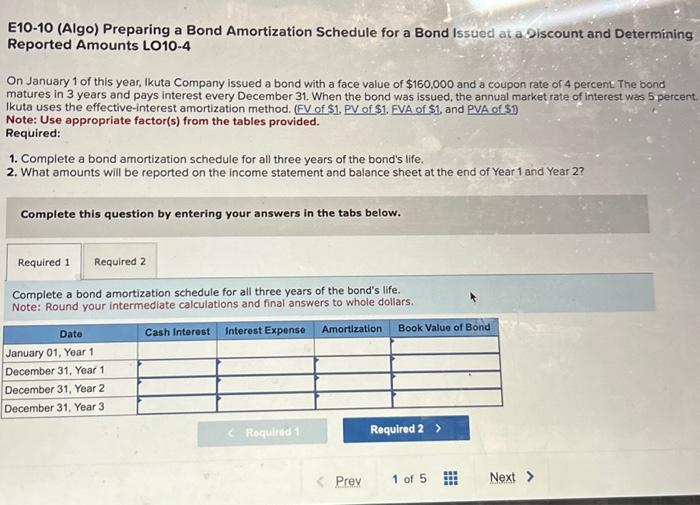

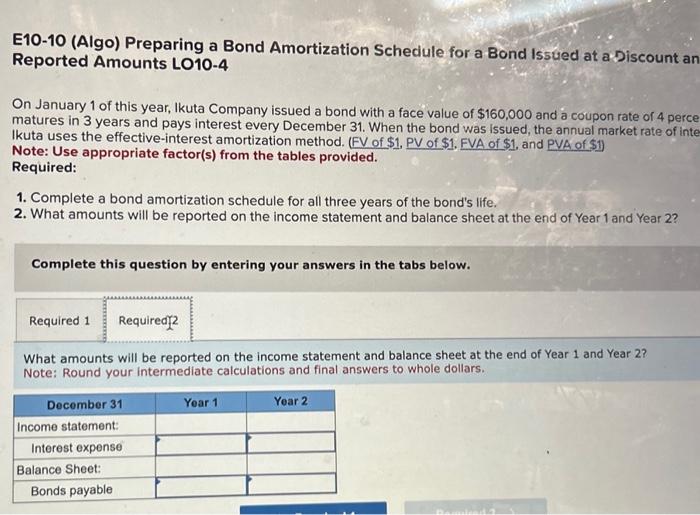

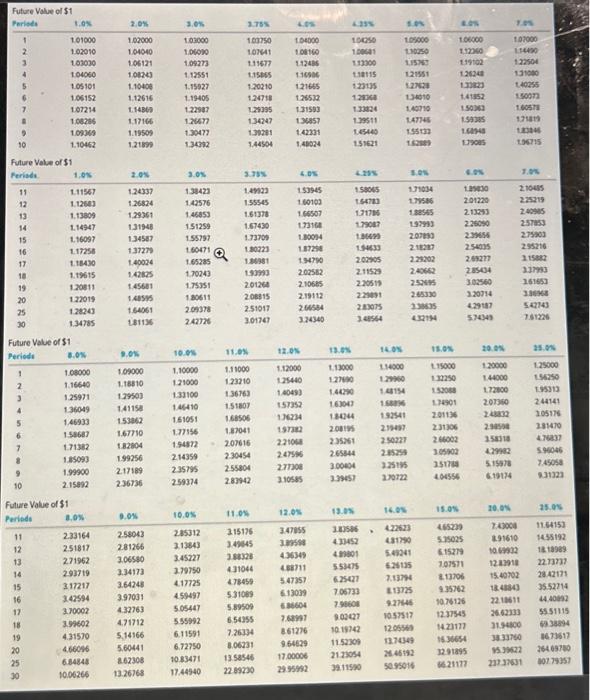

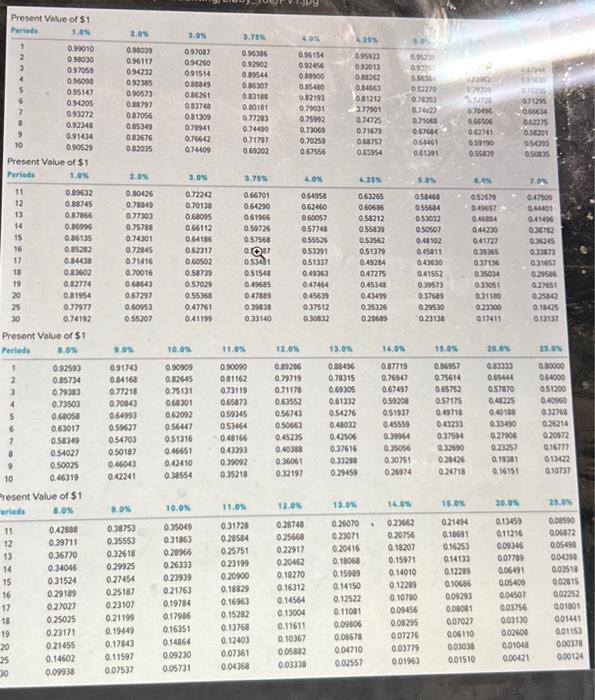

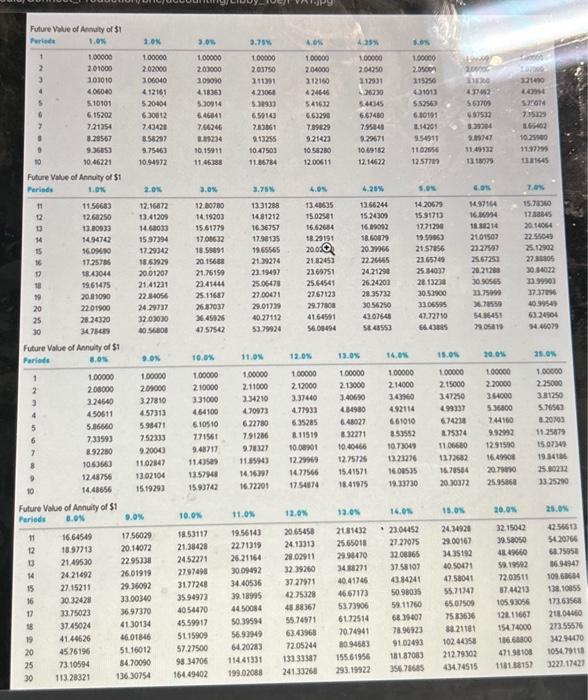

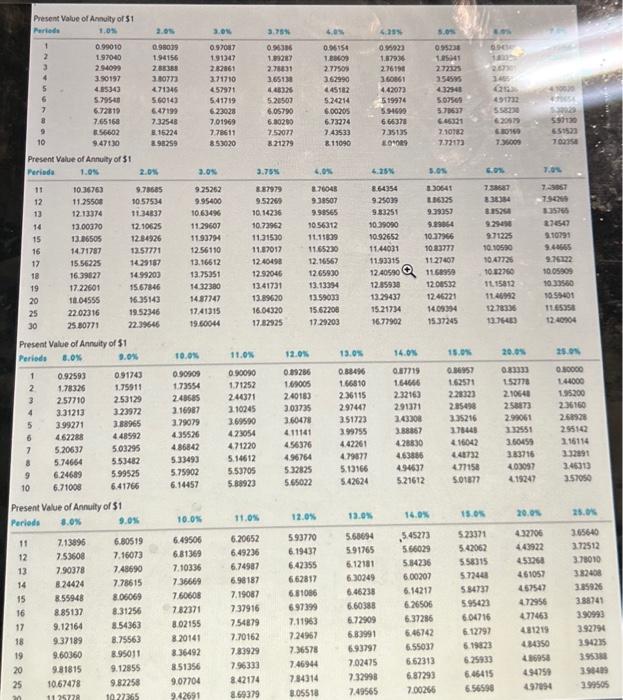

E10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Piscount and Determining Reported Amounts LO10-4 On January 1 of this year, Ikuta Company issued a bond with a face value of $160,000 and a coupon rate of 4 percent The bond matures in 3 years and pays interest every December 31 . When the bond was issued, the annual market rate of interest was 5 percent. Ikuta uses the effective-interest amortization method. (FV of \$1, PV of \$1. EVA of \$1, and PVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: 1. Complete a bond amortization schedule for all three years of the bond's life. 2. What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2? Complete this question by entering your answers in the tabs below. Complete a bond amortization schedule for all three years of the bond's life. Note: Round your intermediate calculations and final answers to whole dollars. E10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Discount an Reported Amounts LO10-4 On January 1 of this year, Ikuta Company issued a bond with a face value of $160,000 and a coupon rate of 4 perce matures in 3 years and pays interest every December 31 . When the bond was issued, the annual market rate of inte Ikuta uses the effective-interest amortization method. (FV of $1,PV of $1. FVA of $1, and PVA of $1 ) Note: Use appropriate factor(s) from the tables provided. Required: 1. Complete a bond amortization schedule for all three years of the bond's life. 2. What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2 ? Complete this question by entering your answers in the tabs below. What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2 ? Note: Round your intermediate calculations and final answers to whole dollars. Future Value of $1 Future Value of 51 future Value of $1 Present Volue of $1 Present Value of $1 resent Value of $1 Fulure Vilue of Anwaly of $1 Future Value of Annuity of $1 Present Value of Annulty of 51 Present Value of Annuity of 51 Present Value of Annaity of 51