Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Toytown is a company which distributes and sells a popular toytrain. The company, which is based in Australia, imports trains from the USA which

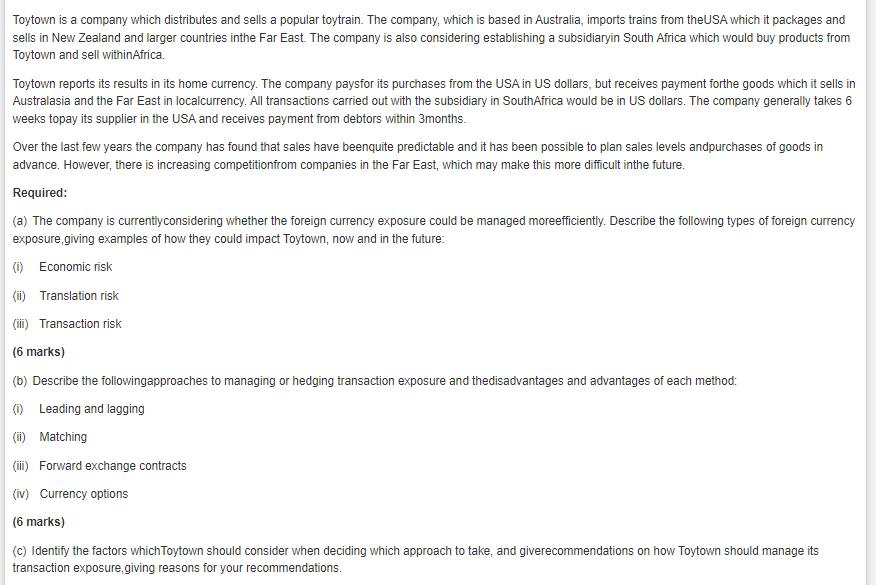

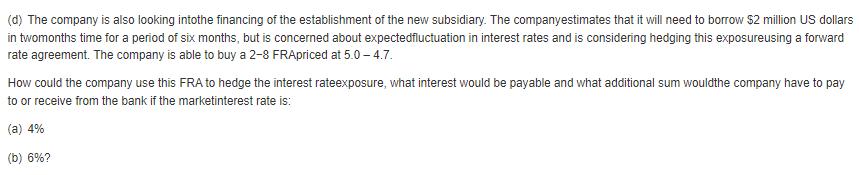

Toytown is a company which distributes and sells a popular toytrain. The company, which is based in Australia, imports trains from the USA which it packages and sells in New Zealand and larger countries inthe Far East. The company is also considering establishing a subsidiaryin South Africa which would buy products from Toytown and sell withinAfrica. Toytown reports its results in its home currency. The company paysfor its purchases from the USA in US dollars, but receives payment forthe goods which it sells in Australasia and the Far East in localcurrency. All transactions carried out with the subsidiary in South Africa would be in US dollars. The company generally takes 6 weeks topay its supplier in the USA and receives payment from debtors within 3months. Over the last few years the company has found that sales have beenquite predictable and it has been possible to plan sales levels andpurchases of goods in advance. However, there is increasing competition from companies in the Far East, which may make this more difficult inthe future. Required: (a) The company is currently considering whether the foreign currency exposure could be managed moreefficiently. Describe the following types of foreign currency exposure, giving examples of how they could impact Toytown, now and in the future: (i) Economic risk (ii) Translation risk (iii) Transaction risk (6 marks) (b) Describe the followingapproaches to managing or hedging transaction exposure and thedisadvantages and advantages of each method: (i) Leading and lagging (ii) Matching (iii) Forward exchange contracts (iv) Currency options (6 marks) (c) Identify the factors which Toytown should consider when deciding which approach to take, and giverecommendations on how Toytown should manage its transaction exposure, giving reasons for your recommendations. (d) The company is also looking intothe financing of the establishment of the new subsidiary. The companyestimates that it will need to borrow $2 million US dollars in twomonths time for a period of six months, but is concerned about expectedfluctuation in interest rates and is considering hedging this exposureusing a forward rate agreement. The company is able to buy a 2-8 FRApriced at 5.0-4.7. How could the company use this FRA to hedge the interest rateexposure, what interest would be payable and what additional sum would the company have to pay to or receive from the bank if the marketinterest rate is: (a) 4% (b) 6%?

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a i Economic risk Economic risk is the variation in the value of the business iethe present value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started