Answered step by step

Verified Expert Solution

Question

1 Approved Answer

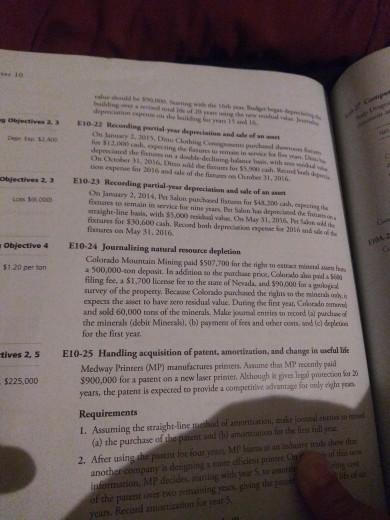

E10-24 deprocistion esenne on she buiiongft yran 15 and 16 2.3 810-32 Reconding parsial year depreciation and sale of n lepeeciated she fstures on a

E10-24

deprocistion esenne on she buiiongft yran 15 and 16 2.3 810-32 Reconding parsial year depreciation and sale of n lepeeciated she fstures on a double declinine bdiunce in, with a miu On October 31, 2016 Dirso sold the fissunes for 559) csh. Recund beels d tion expense for 2016 and sale of the fistum on October 31, 2016. Objectives 2, 3 E10-23 Reconding partial-year depreciation and sale of an ase On Jannuary 2, 2014, Pet Salon purchaned fistures fox 548,200 ch, expesiog tha fixnares to remain in service for nine years Pet Salon has deprecioned the fnuas e a stralght-line basis, witlh $5,000 residoal value. On May 31, 2016 Pet Salon oild the fixtures for $30,600 cash, Recoed both depreclatioe expense Sor 20lh and sake o a fismures on May 31, 2016 objective 4 E10-24 Journalizing natural resource depletion Colorado Mountain Mining paid $507,700 fr de ighn esu 51 20 per ton mineral alenen 500,000-4on deposit la addition so the purchase price. Colorado abo paid 560 filing fee, a $1,700 license foe to the state of Nevada, and $90,000 for a gokojial survey of the property. expects the asset to have axro residual value. During the first year, Cakoradn cesmved and sold 60,000 tons of the minerals. Make joumal entries to recornd la) purchuas of the minerals (debit Minerals). (b) paymens of fees and odher costs, and (c) deplet for the first year ry. BeanColorado puidased the rights in the minerahm, tives 2, 5 E10-25 Handling acquisition of patent, amortization, and change ia sseful lie Medway Printers (MP) manufactures printens, Assume that MP recently paid $900,000 for a patent on a new laser printer. Although i gires l putecin or 3 years, the patent is expected to provide a competitive adhantage Sor oly ciga yoans. $225,000 Requirements I. Assuming the straight-ine mabid of amoriliation, make joermal moies toal t and th) amomation for thie fest bll ye (a) the purchase of an canry tmd deth rent for four years Mi lear anothet company is deigninga motr efficien prin Op information, MP decides tartiang with year 5toa f the pacent over two remaining, years.iving te 2. After usings amStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started