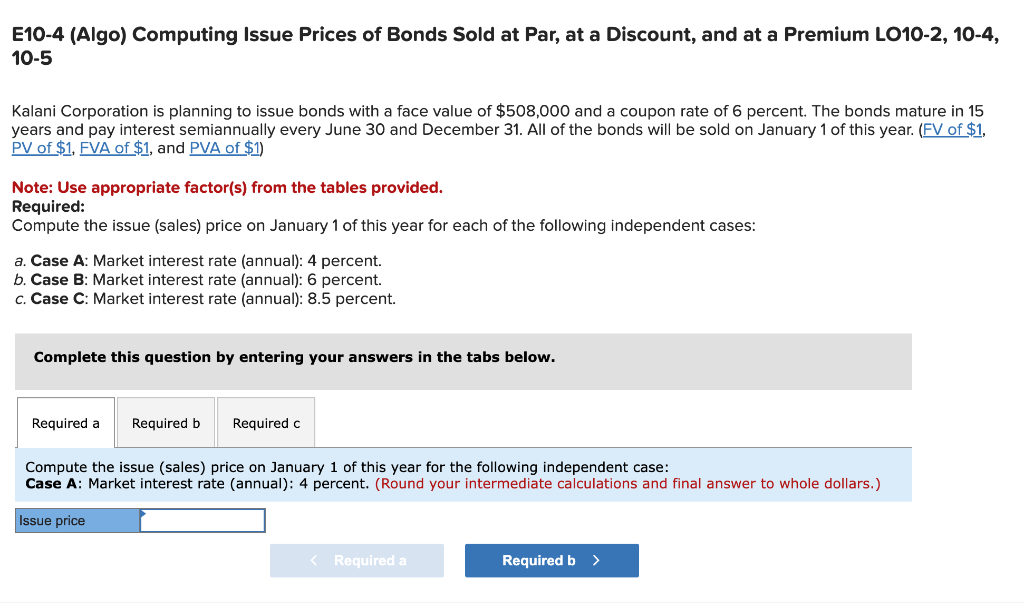

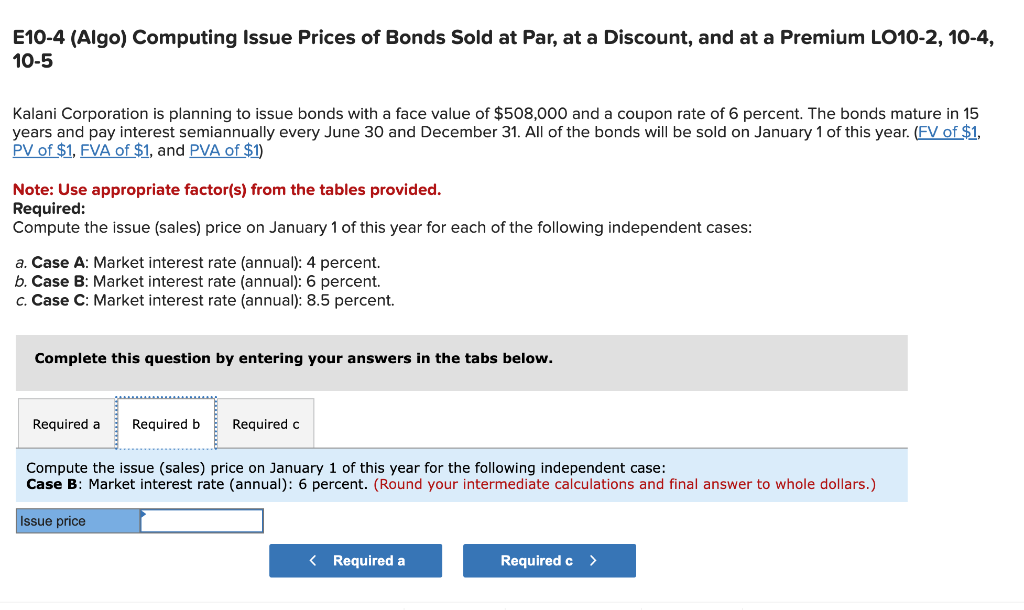

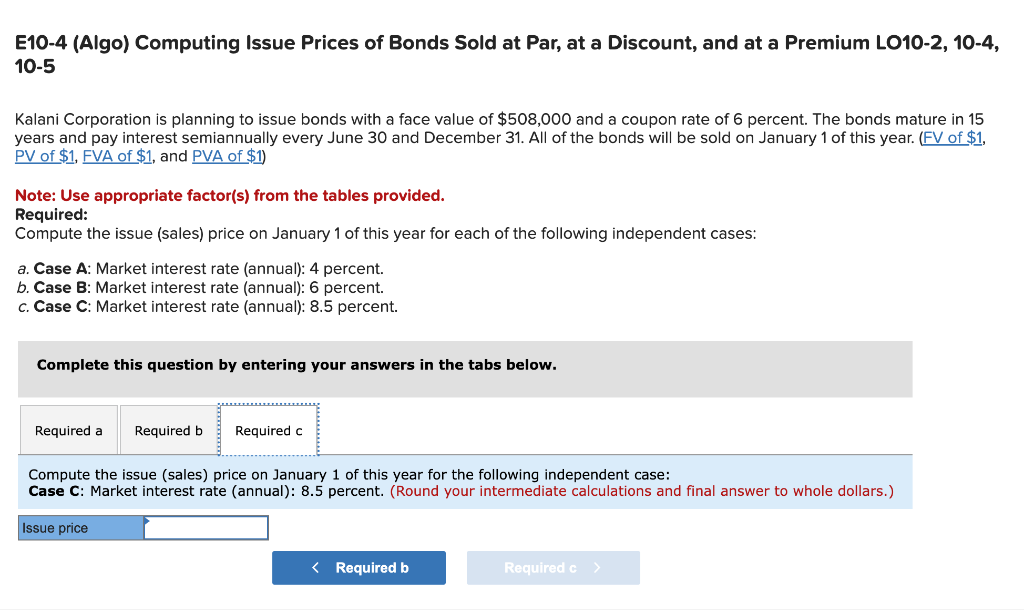

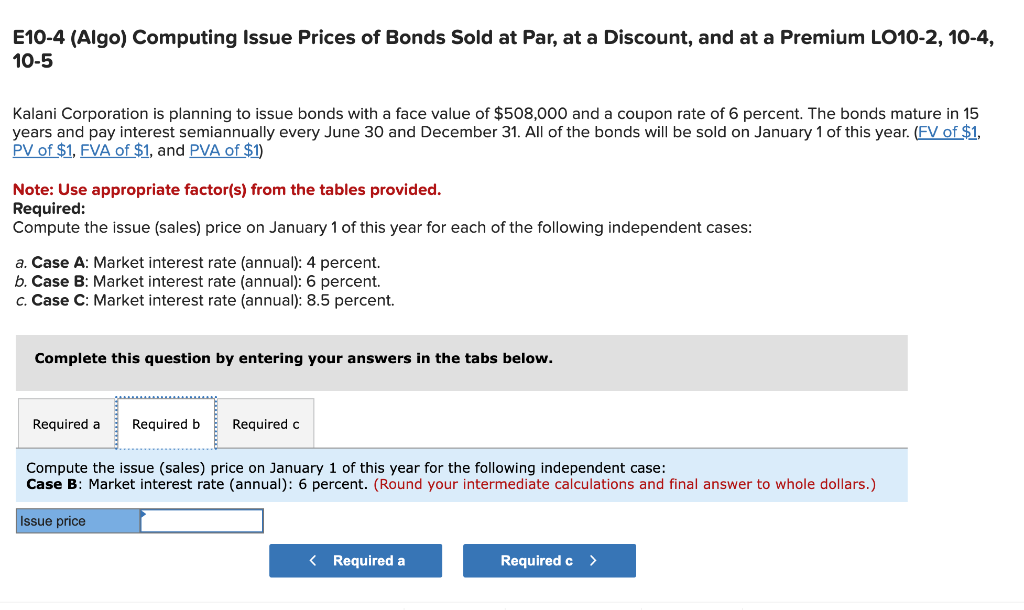

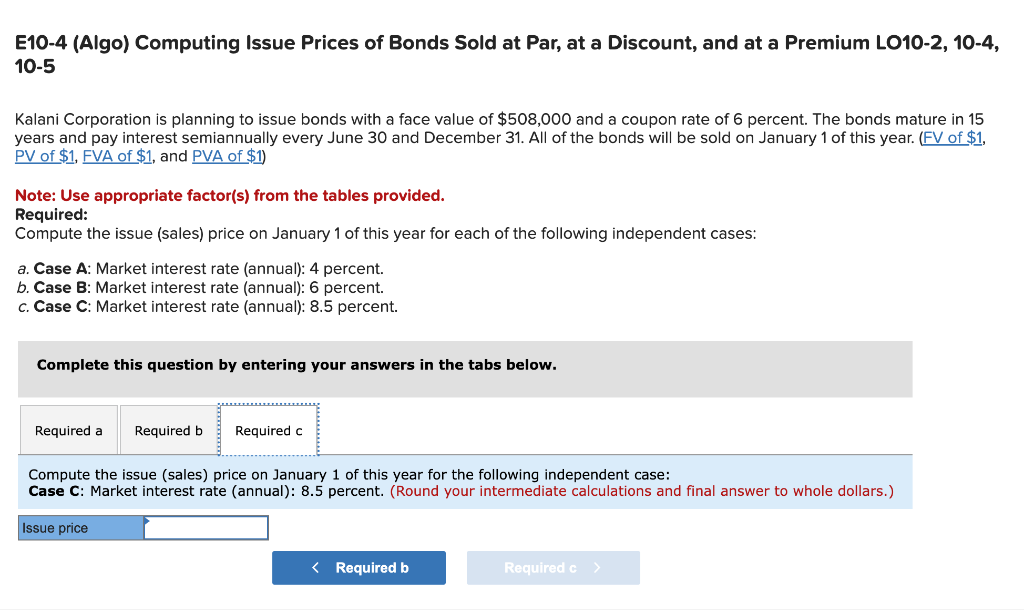

E10-4 (Algo) Computing Issue Prices of Bonds Sold at Par, at a Discount, and at a Premium LO10-2, 10-4, 105 Kalani Corporation is planning to issue bonds with a face value of $508,000 and a coupon rate of 6 percent. The bonds mature in 15 years and pay interest semiannually every June 30 and December 31 . All of the bonds will be sold on January 1 of this year. (FV of $1, PV of $1, FVA of $1, and PVA of $1 ) Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annual): 4 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual): 8.5 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case A: Market interest rate (annual): 4 percent. (Round your intermediate calculations and final answer to whole dollars.) E10-4 (Algo) Computing Issue Prices of Bonds Sold at Par, at a Discount, and at a Premium LO10-2, 10-4, 105 Kalani Corporation is planning to issue bonds with a face value of $508,000 and a coupon rate of 6 percent. The bonds mature in 15 years and pay interest semiannually every June 30 and December 31 . All of the bonds will be sold on January 1 of this year. (FV of $1, PV of $1, FVA of $1, and PVA of $1 ) Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annual): 4 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual): 8.5 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case B: Market interest rate (annual): 6 percent. (Round your intermediate calculations and final answer to whole dollars.) E10-4 (Algo) Computing Issue Prices of Bonds Sold at Par, at a Discount, and at a Premium LO10-2, 10-4, 105 Kalani Corporation is planning to issue bonds with a face value of $508,000 and a coupon rate of 6 percent. The bonds mature in 15 years and pay interest semiannually every June 30 and December 31 . All of the bonds will be sold on January 1 of this year. (FV of $1, PV of $1, FVA of $1, and Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annual): 4 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual): 8.5 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case C: Market interest rate (annual): 8.5 percent. (Round your intermediate calculations and final answer to whole dollars.)