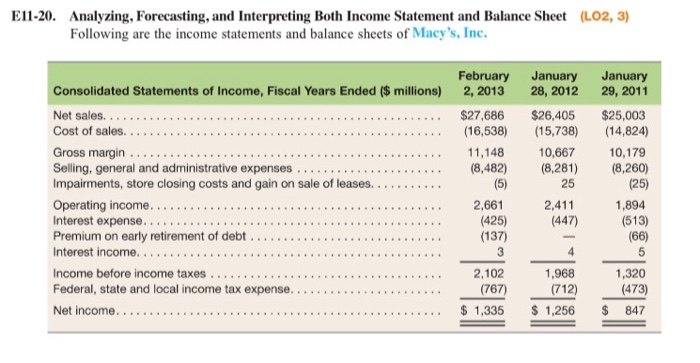

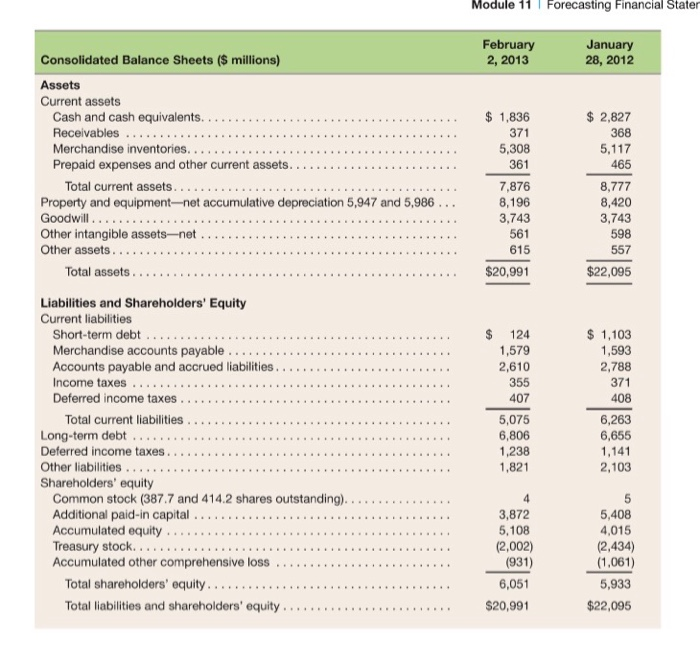

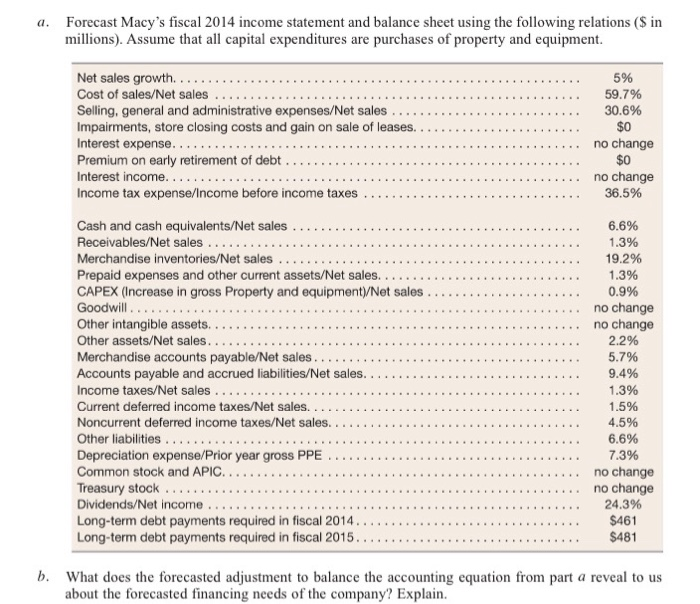

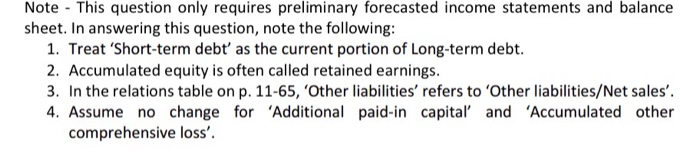

E11-20. Analyzing, Forecasting, and Interpreting Both Income Statement and Balance Sheet (LO2, 3) Following are the income statements and balance sheets of Macy's, Inc. Consolidated Statements of Income, Fiscal Years Ended ($ millions) February 2, 2013 January 28, 2012 January 29, 2011 $27,686 (16,538) 11,148 (8,482) $26,405 (15,738) 10,667 (8,281) 25 2,411 (447) Net sales..... Cost of sales........ Gross margin ......... Selling, general and administrative expenses ........ Impairments, store closing costs and gain on sale of leases........... Operating income... Interest expense........... Premium on early retirement of debt ....... Interest income.. Income before income taxes .................. Federal, state and local income tax expense....... Net income....................... $25,003 (14,824) 10,179 (8,260) (25) 1,894 (513) (66) (5) 2,661 (425) (137) 2,102 (767) $ 1,335 1,968 (712) $ 1,256 1,320 (473) 847 $ Module 11 Forecasting Financial Stater Consolidated Balance Sheets ($ millions) February 2, 2013 January 28, 2012 Assets Current assets Cash and cash equivalents... Receivables ....... Merchandise inventories........... Prepaid expenses and other current assets......................... Total current assets.............. Property and equipment-net accumulative depreciation 5,947 and 5,986 ... Goodwill..... Other intangible assets-net...... Other assets..... Total assets........... $ 1,836 371 5,308 361 7,876 8,196 3,743 561 615 $20,991 $ 2,827 368 5,117 465 8,777 8,420 3,743 598 557 $22,095 $ Liabilities and Shareholders' Equity Current liabilities Short-term debt ........... Merchandise accounts payable ............ Accounts payable and accrued liabilities........... Income taxes ...... Deferred income taxes ........... Total current liabilities Long-term debt Deferred income taxes...... Other liabilities ... Shareholders' equity Common stock (387.7 and 414.2 shares outstanding). Additional paid-in capital. Accumulated equity .......... Treasury stock. ......... Accumulated other comprehensive loss ................... Total shareholders' equity.................................... Total liabilities and shareholders' equity ......... 124 1,579 2,610 355 407 5,075 6,806 1,238 1,821 $ 1,103 1,593 2,788 371 408 6,263 6,655 1,141 2,103 3,872 5,108 (2,002) (931) 6,051 $20,991 5,408 4,015 (2,434) (1.061) 5,933 $22,095 a. Forecast Macy's fiscal 2014 income statement and balance sheet using the following relations ($ in millions). Assume that all capital expenditures are purchases of property and equipment. Net sales growth. ... Cost of sales/Net sales .................... Selling, general and administrative expenses/Net sales ...... Impairments, store closing costs and gain on sale of leases...... Interest expense............ Premium on early retirement of debt ....................... Interest income. ......... Income tax expense/Income before income taxes ............ 5% 59.7% 30.6% $0 no change $0 no change 36.5% Cash and cash equivalents/Net sales .......... Receivables/Net sales .......... Merchandise inventories/Net sales ........................................... Prepaid expenses and other current assets/Net sales................ CAPEX (Increase in gross Property and equipment)/Net sales Goodwill...... Other intangible assets. ........................................... Other assets/Net sales........... Merchandise accounts payable/Net sales ........... Accounts payable and accrued liabilities/Net sales. ... Income taxes/Net sales ......... Current deferred income taxes/Net sales...................... Noncurrent deferred income taxes/Net sales. ................................... Other liabilities .................... .. Depreciation expense/Prior year gross PPE ................ Common stock and APIC.. Treasury stock ........... Dividends/Net Income .......................... ..... Long-term debt payments required in fiscal 2014...... Long-term debt payments required in fiscal 2015... 6.6% 1.3% 19.2% 1.3% 0.9% no change no change 2.2% 5.7% 9.4% 1.3% 1.5% 4.5% 6.6% 7.3% no change no change 24.3% $461 $481 b. What does the forecasted adjustment to balance the accounting equation from part a reveal to us about the forecasted financing needs of the company? Explain. Note - This question only requires preliminary forecasted income statements and balance sheet. In answering this question, note the following: 1. Treat 'Short-term debt' as the current portion of Long-term debt. 2. Accumulated equity is often called retained earnings. 3. In the relations table on p. 11-65, 'Other liabilities' refers to 'Other liabilities/Net sales'. 4. Assume no change for 'Additional paid-in capital' and 'Accumulated other comprehensive loss