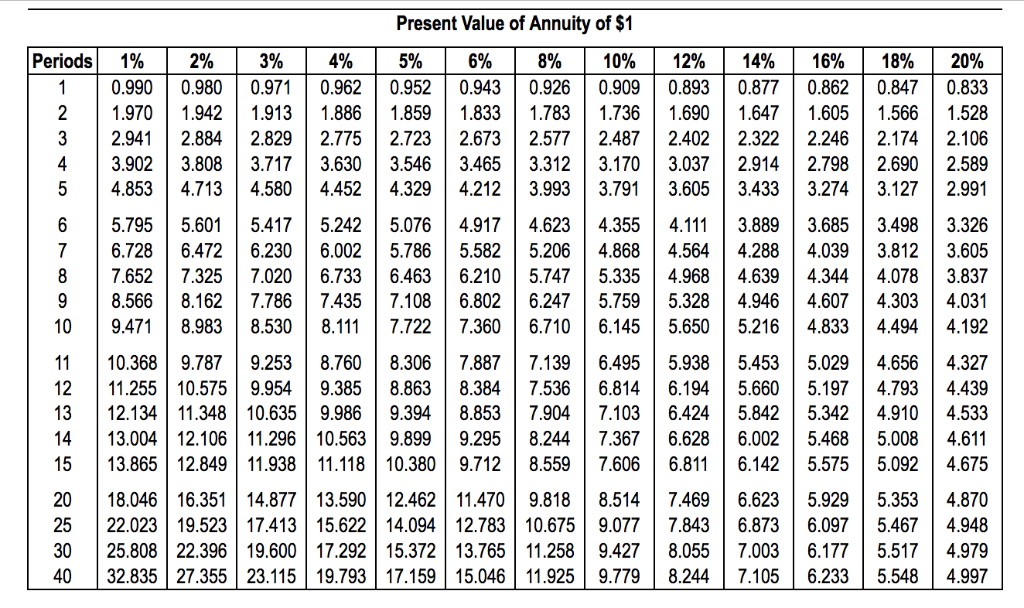

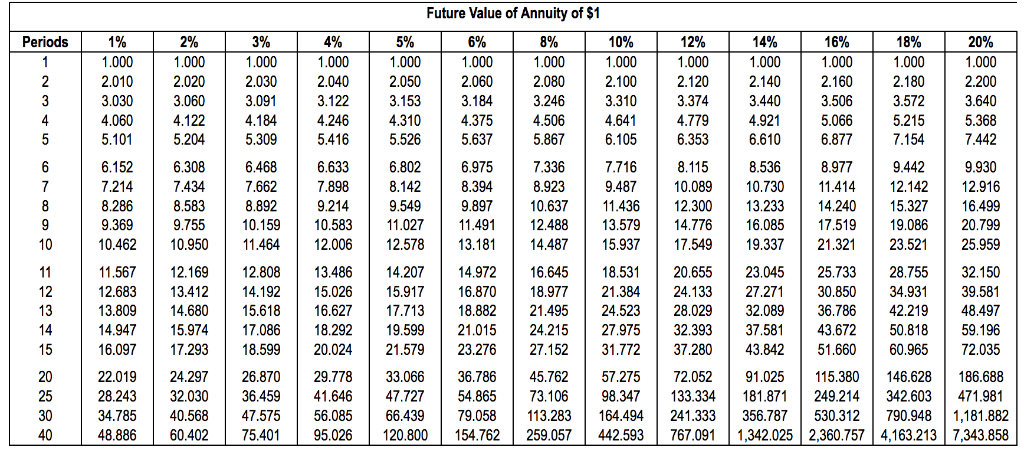

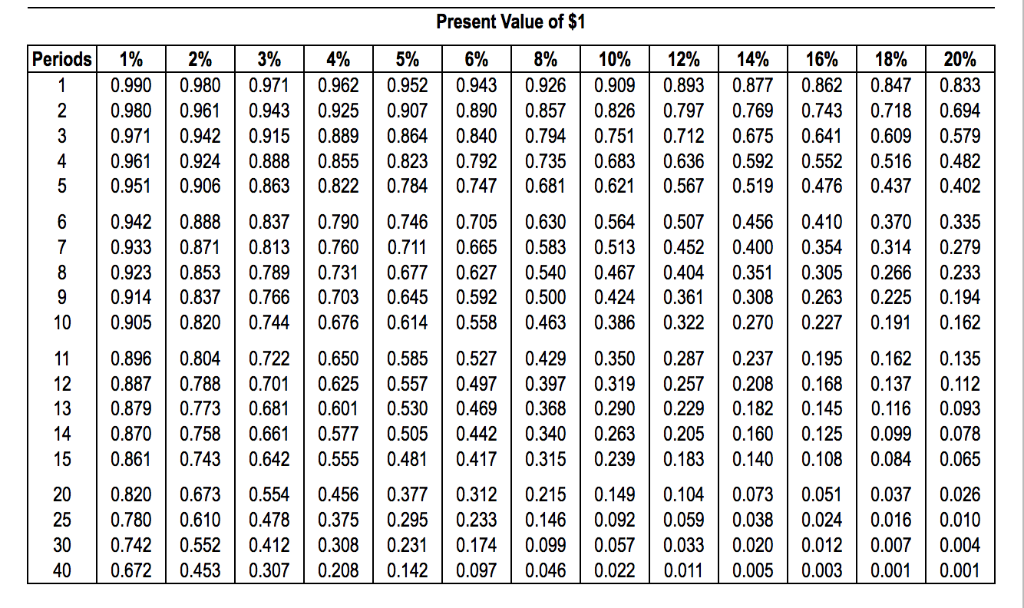

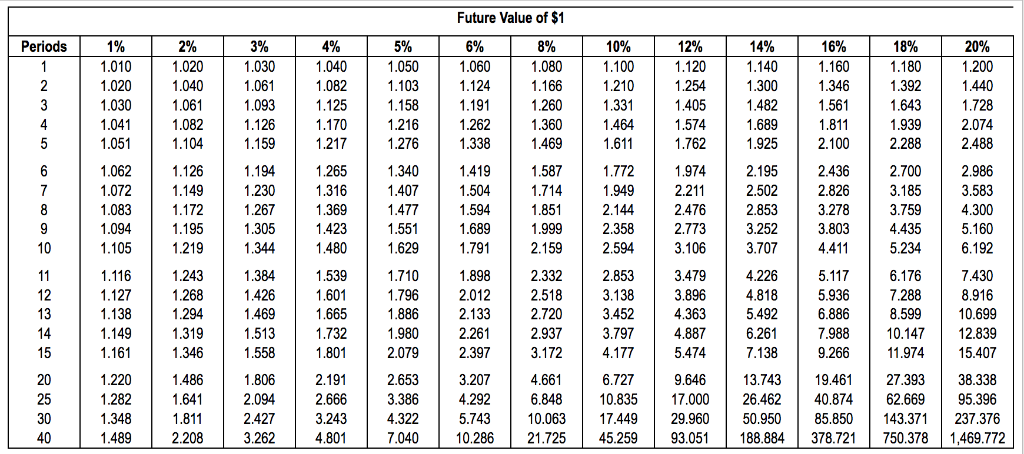

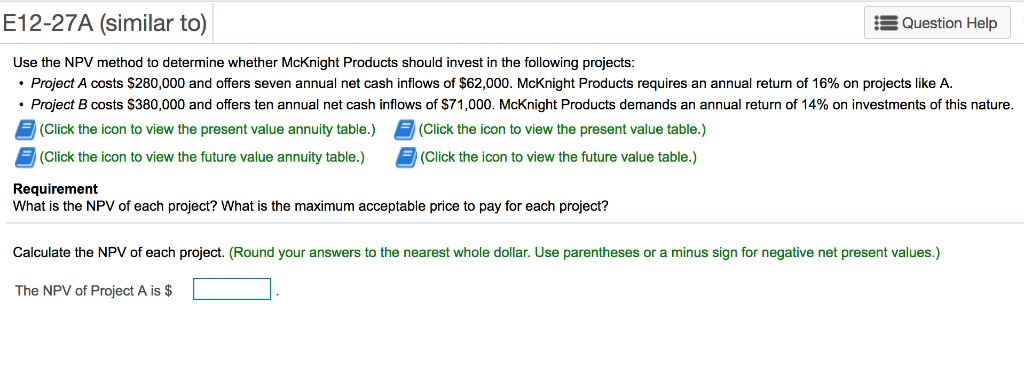

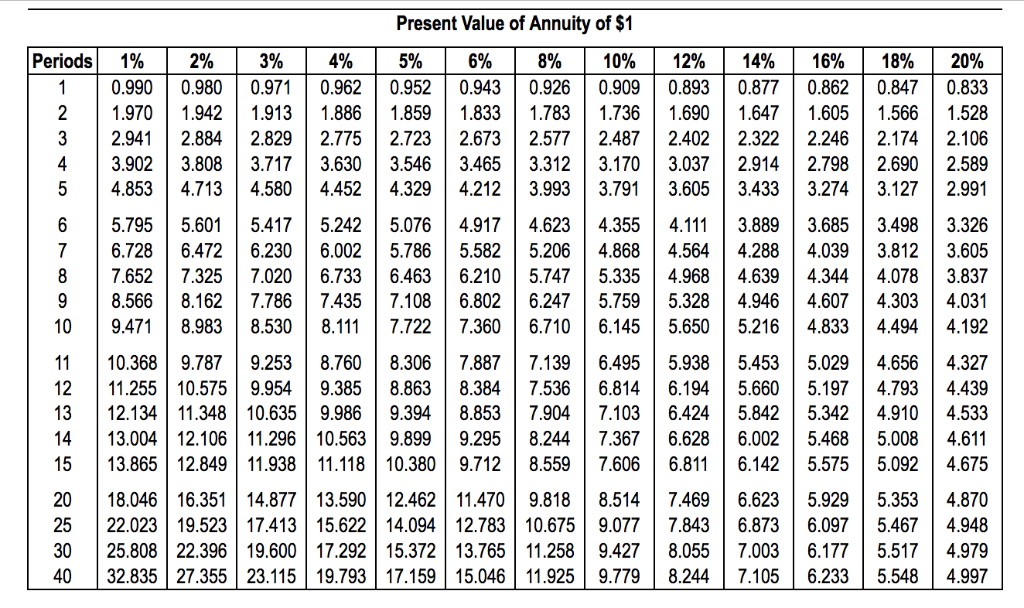

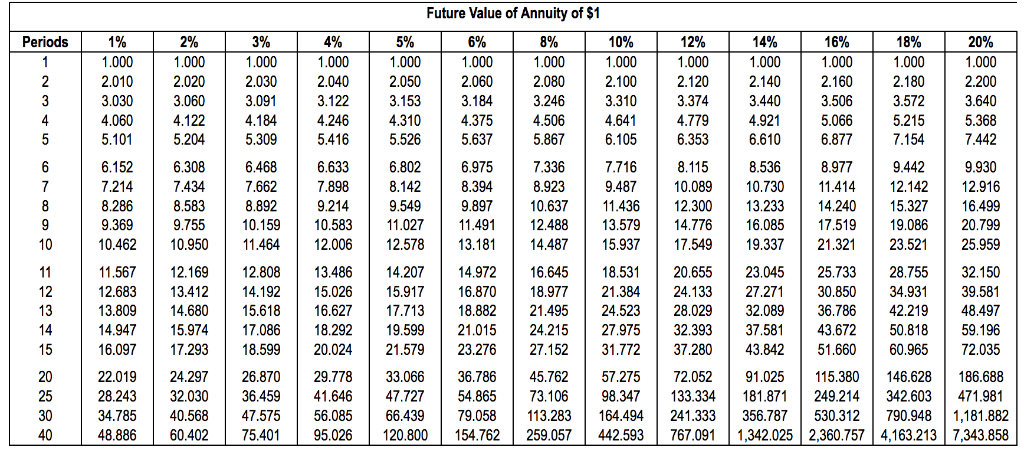

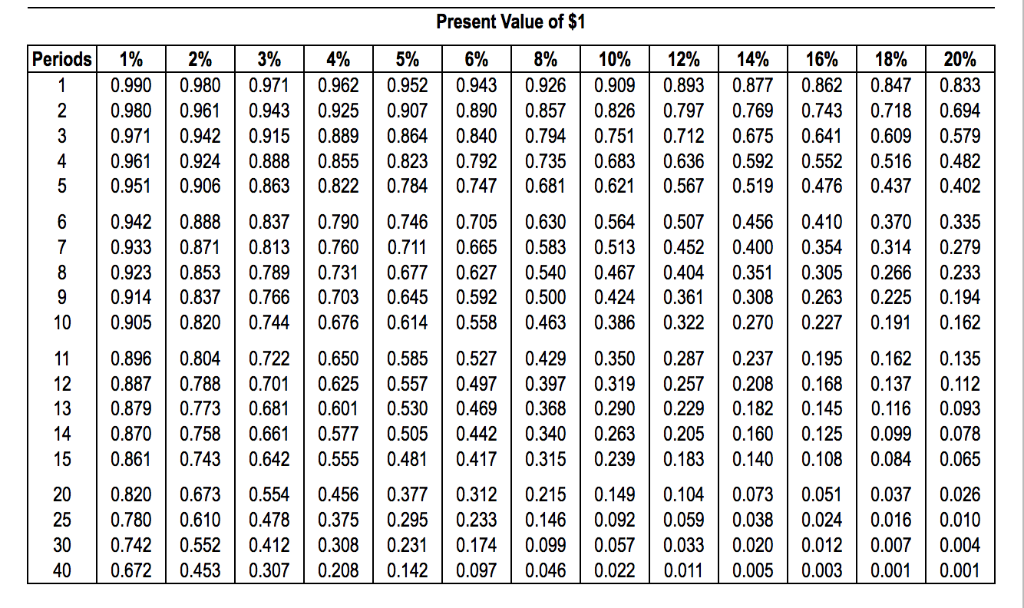

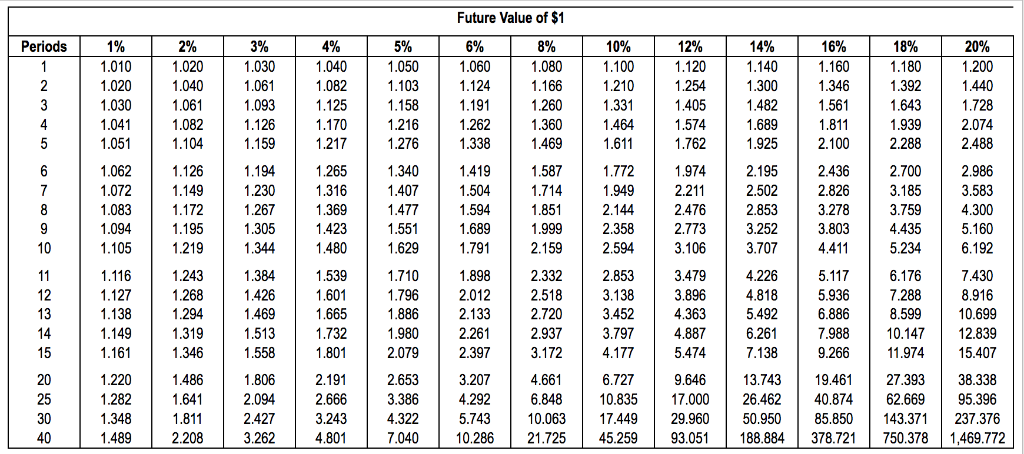

E12-27A (similar to) Question Help Use the NPV method to determine whether McKnight Products should invest in the following projects: . Project A costs $280,000 and offers seven annual net cash inflows of $62,000. McKnight Products requires an annual retum of 16% on projects like A. Project B costs $380,000 and offers ten annual net cash inflows of $71,000. McKnight Products demands an annual return of 14% on investments of this nature. (Click the icon to view the present value annuity table.) (Click the icon to view the present value table.) (Click the icon to view the future value annuity table.) (Click the icon to view the future value table.) Requirement What is the NPV of each project? What is the maximum acceptable price to pay for each project? Calculate the NPV of each project. (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) The NPV of Project A is $ Present Value of Annuity of $1 Periods 1% | 2% | 3% | 4% | 5% | 6% | 8% | 10% | 12% | 14% | 16% | 18% | 20% 1 0.9900.9800.971 0.962 0.9520.943 0.9260.9090.8930.877 0.862 0.847 0.833 2 1.970 1.9421.913 1.886 1.859 1.8331.783 1.736 1.690 1.6471.6051.566 1.528 3 2.9412.8842.829 2.7752.723 2.673 2.577 2.487 2.4022.322 2.2462.1742.106 43.902 3.808 3.7173.6303.546 3.465 3.312 3.1703.037 2.9142.7982.690 2.589 54.8534.7134.5804.4524.3294.2123.9933.7913.605 3.4333.2743.1272.991 65.7955.601 5.4175.242 5.076 4.917 4.6234.3554.111 3.8893.685 3.498 3.326 7 6.7286.4726.230 6.0025.7865.5825.2064.8684.5644.2884.0393.8123.605 8 7.652 7.325 7.020 6.733 6.463 6.210 5.7475.335 4.9684.6394.3444.078 3.837 98.5668.162 7.7867.4357.108 6.8026.2475.7595.3284.9464.6074.303 4.031 10 9.4718.9838.5308.1117.7227.360 6.710 6.145 5.6505.2164.8334.4944.192 1110.3689.787 9.2538.7608.306 7.887 7.1396.4955.9385.4535.0294.6564.327 12 11.255 10.575 9.9549.3858.863 8.384 7.536 6.8146.1945.6605.197 4.7934.439 13 12.134 11.348 10.635 9.9869.3948.8537.9047.103 6.424 5.842 5.3424.9104.533 14 13.00412.106 11.29610.5639.8999.2958.2447.3676.6286.002 5.4685.0084.611 15 13.865 12.849 11.938 11.118 10.380 9.712 8.5597.606 6.811 6.142 5.5755.092 4.675 2018.046 16.351 14.877 13.590 12.462 11.4709.8188.5147.4696.6235.9295.3534.870 25 22.023 19.523 17.413 15.622 14.094 12.783 10.675 9.077 7.843 6.873 6.097 5.467 4.948 30 25.808 22.396 19.600 17.292 15.372 13.765 11.2589.4278.0557.0036.1775.5174.979 40 32.835 27.35523.115 19.79317.15915.046 11.925 9.7798.2447.105 6.2335.5484.997 Future Value of Annuity of $1 Periods00 2309142465526 5.416 | 4.310 | 3.184 | 2.080 | 1.000 + 12% 6.633 7.898 9.214 16% 20% 0002100 3374492687 1.000 1.000 1.000 2.030 1.000 2.040 1.000 1.000 2.060 5.86746413.3742140 7.336 8.923 2.200 3.060 3.572 5.215 5.368 7.442 9.930 9.48710.08910.730 11.41412.14212.916 9.89710.63711.436 12.30013.23314.240 15.32716.499 9.755 10.15910.58311.027 11.49112.488 13.579 14.77616.085 17.519 19.086 20.799 10.462 10.950 11.464 12.006 12.57813.18114.487 15.937 17.549 19.33721.321 23.521 25.959 11.56712.169 12.808 13.48614.20714.972 16.645 18.53120.655 23.045 25.733 28.755 32.150 12.68313.412 14.192 15.026 15.917 16.870 18.97721.384 24.13327.27130.850 34.93139.581 13.80914.680 15.618 16.627 17.71318.882 21.495 24.523 28.02932.089 36.786 42.21948.497 4.94715.974 17.08618.29219.59921.015 24.21527.97532.39337.58143.67250.818 59.196 16.097 17.293 18.59920.02421.57923.27627.152 31.772 37.28043.842 51.660 60.96572.035 22.01924.29726.870 29.778 33.066 36.78645.76257.27572.052 91.025 115.380146.628 186.688 28.24332.030 36.459 41.64647.72754.865 73.10698.347 133.334181.871 249.214342.603 471.981 4.060 4.779 5.066 4.506 5.204 6.308 7.434 8.583 5.309 6.468 7.662 8.892 6.975 8.394 6.802 8.142 9.549 7.716 8.536 8.977 9.442 7.214 8.286 9.369 13 14 15 20 25 30 40 34.78540.56847.575 56.08566.43979.058113.283 164.494241.333356.787530.312790.9481,181.882 48.886 60.40275.401 95.026120.800 154.762259.057442.593767.0911,342.025 2,360.7574,163.213 7,343.858 Present Value of $1 Periods | 1% | 2% | 3% | 4% | 5% | 6% | 8% | 10% | 12% | 14% | 16% | 18% | 20% 10.990 0.9800.9710.962 0.952 0.9430.926 0.909 0.8930.877 0.862 0.847 0.833 2 0.9800.9610.9430.925 0.907 0.890 0.857 0.8260.7970.7690.7430.7180.694 3 0.971 0.942 0.915 0.8890.8640.840 0.7940.7510.7120.6750.6410.609 0.579 40.9610.9240.8880.8550.823 0.792 0.735 0.6830.636 0.5920.5520.516 0.482 50.951 0.906 0.8630.822 0.7840.7470.6810.621 0.5670.5190.4760.437 0.402 60.9420.8880.837 0.7900.7460.7050.630 0.5640.5070.4560.4100.370 0.335 70.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.3540.3140.279 80.9230.8530.7890.7310.677 0.627 0.540 0.467 0.4040.3510.3050.2660.233 9 0.914 0.837 0.766 0.7030.645 0.592 0.500 0.4240.361 0.308 0.2630.2250.194 10 0.9050.820 0.744 0.6760.6140.5580.4630.3860.3220.2700.2270.1910.162 11 0.8960.8040.722 0.650 0.5850.5270.4290.3500.2870.2370.1950.162 0.135 12 0.8870.7880.701 0.625 0.557 0.4970.3970.3190.2570.2080.1680.1370.112 13 0.879 0.773 0.6810.601 0.5300.4690.3680.2900.2290.1820.145 0.1160.093 14 0.870 0.7580.6610.577 0.505 0.4420.3400.2630.2050.160 0.1250.099 0.078 15 0.861 0.743 0.642 0.555 0.481 0.417 0.315 0.239 0.1830.140 0.108 0.0840.065 20 0.820 0.6730.5540.4560.3770.3120.2150.149 0.1040.0730.0510.037 0.026 250.7800.610 0.4780.375 0.2950.2330.146 0.092 0.059 0.038 0.0240.0160.010 30 0.742 0.5520.412 0.308 0.2310.1740.0990.057 0.033 0.020 0.012 0.007 0.004 400.672 0.4530.3070.208 0.142 0.0970.0460.0220.011 0.0050.0030.001 0.001 662 930 684 33 025 85 111 39 3 24704 95311 49 11122 23456 78 2398 4 3 7 8-13692 71742 125 5 3 01 72 5 67811 2617 06110 66831 76686 610 32701 13886 6-13581 48284 19892 67 4887 90 15 76 148 821 74 9: 469 1 842 827 6 4163 90 4 3 33445 9 5 0-1 2 3 4 6 79135 81471 7 842 075 9 74199 6 81595 of-89 0 1 2 3 4 57891 35791 6 8072-8 1237 6 2 91 82317 723 89 91369 094 0 1 1 2 3 45567 80123 227 04128 9 62963 I 66 07 4456 77890 633 5 507 693 3344 1 2234 1369 3 6 34455 8042 3-0 0012 69259 38 24791 46 96 6118 8 00011 22345 67891 0289 123 5 67890 12346 1000 rio- 1 12345 20 25 30 40 12345 6789