Answered step by step

Verified Expert Solution

Question

1 Approved Answer

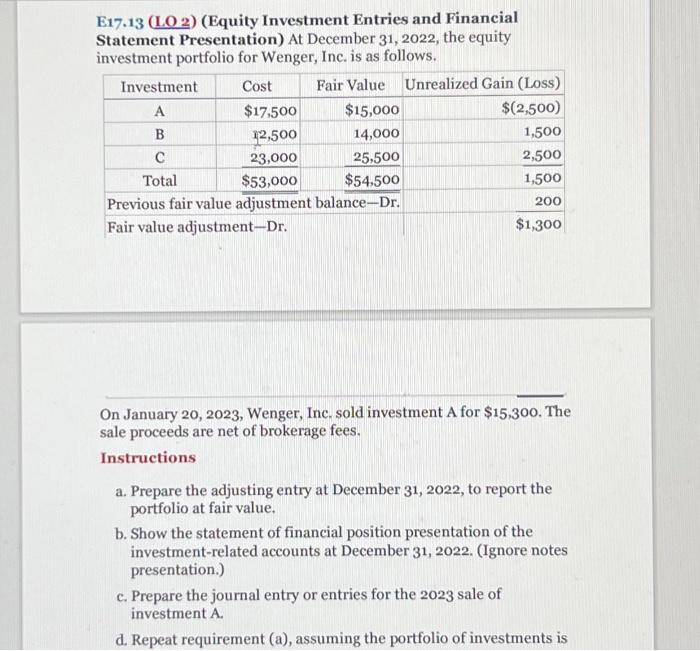

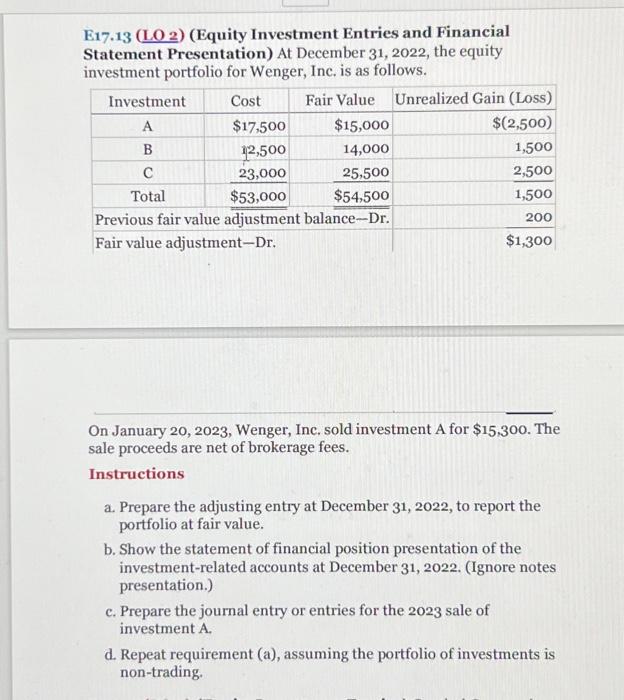

E17.13 (LO 2) (Equity Investment Entries and Financial Statement Presentation) At December 31, 2022, the equity investment portfolio for Wenger, Inc. is as follows. Cost

E17.13 (LO 2) (Equity Investment Entries and Financial Statement Presentation) At December 31, 2022, the equity investment portfolio for Wenger, Inc. is as follows. Cost Fair Value Unrealized Gain (Loss) $17,500 $15,000 $(2,500) 12,500 14,000 1,500 23,000 25,500 2,500 $53,000 $54,500 1,500 Previous fair value adjustment balance-Dr. 200 Fair value adjustment-Dr. $1,300 Investment A B C Total On January 20, 2023, Wenger, Inc. sold investment A for $15,300. The sale proceeds are net of brokerage fees. Instructions a. Prepare the adjusting entry at December 31, 2022, to report the portfolio at fair value. b. Show the statement of financial position presentation of the investment-related accounts at December 31, 2022. (Ignore notes presentation.) c. Prepare the journal entry or entries for the 2023 sale of investment A. d. Repeat requirement (a), assuming the portfolio of investments is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started