Answered step by step

Verified Expert Solution

Question

1 Approved Answer

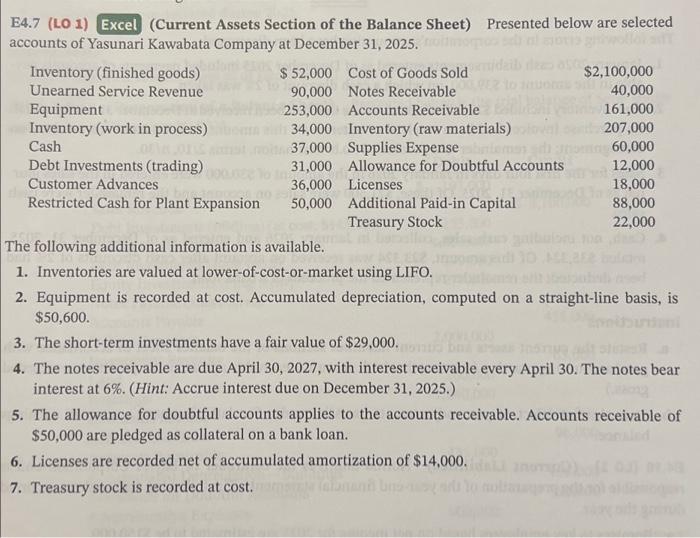

E4.7 (LO 1) Excel (Current Assets Section of the Balance Sheet) accounts of Yasunari Kawabata Company at December 31, 2025. Inventory (finished goods) Unearned Service

E4.7 (LO 1) Excel (Current Assets Section of the Balance Sheet) accounts of Yasunari Kawabata Company at December 31, 2025. Inventory (finished goods) Unearned Service Revenue Equipment Inventory (work in process) Cash Debt Investments (trading) 1007 PROSTO dan 08S 8pmst Customer Advances bog togoog Restricted Cash for Plant Expansion $ 52,000 90,000 253,000 ir 34,000 noils 37,000 nos 37,000 31,000 Infod $2,100,000 Cost of Goods Sold Notes Receivable to incomb 40,000 Accounts Receivable b 161,000 Inventory (raw materials) color Destlo 207,000 Supplies Expenserontamen erti anome 60,000 Allowance for Doubtful Accounts at C 12,000 18,000 88,000 22,000 36,000 Licenses Presented below are selected 290.000 50,000 Additional Paid-in Capital Treasury Stock SUC acons The following additional information is available. to au E ACE 1. Inventories are valued at lower-of-cost-or-market using LIFO. KE2E8 2. Equipment is recorded at cost. Accumulated depreciation, computed on a straight-line basis, is $50,600. 3. The short-term investments have a fair value of $29,000. no bus at 4. The notes receivable are due April 30, 2027, with interest receivable every April 30. The notes bear interest at 6%. (Hint: Accrue interest due on December 31, 2025.) (22013 5. The allowance for doubtful accounts applies to the accounts receivable. Accounts receivable of $50,000 are pledged as collateral on a bank loan. 6. Licenses are recorded net of accumulated amortization of $14,000. 7. Treasury stock is recorded at cost. stele (stanenil brs-tssy od Ing1 olaraqen pr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started