Answered step by step

Verified Expert Solution

Question

1 Approved Answer

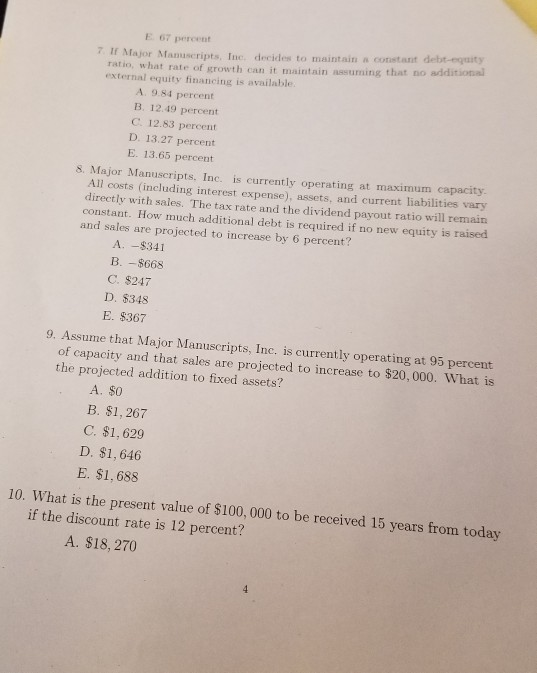

E67 percent Ir Major Manuscripts, Inc. decides to maintain a constant debt-equity Tato, what rate of growth can it maintain suming that no additional external

E67 percent Ir Major Manuscripts, Inc. decides to maintain a constant debt-equity Tato, what rate of growth can it maintain suming that no additional external equity financing is available A 9.8 percent B. 12.19 percent C 12.83 percent D. 13.27 percent E. 13.65 percent 8. Major Manuscripts, Inc. is currently operating at maximum capacity All costs (including interest expense), assets, and current liabilities vary directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 6 percent? A. -$341 B. - $668 C. $247 D. $348 E. $367 9. Assume that Major Manuscripts, Inc. is currently operating at 95 percent of capacity and that sales are projected to increase to $20,000. What is the projected addition to fixed assets? A. $0 B. $1,267 C. $1.629 D. $1,646 E. $1, 688 10. What is the present value of $100,000 to be received 15 years from today if the discount rate is 12 percent? A. $18, 270 E67 percent Ir Major Manuscripts, Inc. decides to maintain a constant debt-equity Tato, what rate of growth can it maintain suming that no additional external equity financing is available A 9.8 percent B. 12.19 percent C 12.83 percent D. 13.27 percent E. 13.65 percent 8. Major Manuscripts, Inc. is currently operating at maximum capacity All costs (including interest expense), assets, and current liabilities vary directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 6 percent? A. -$341 B. - $668 C. $247 D. $348 E. $367 9. Assume that Major Manuscripts, Inc. is currently operating at 95 percent of capacity and that sales are projected to increase to $20,000. What is the projected addition to fixed assets? A. $0 B. $1,267 C. $1.629 D. $1,646 E. $1, 688 10. What is the present value of $100,000 to be received 15 years from today if the discount rate is 12 percent? A. $18, 270

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started