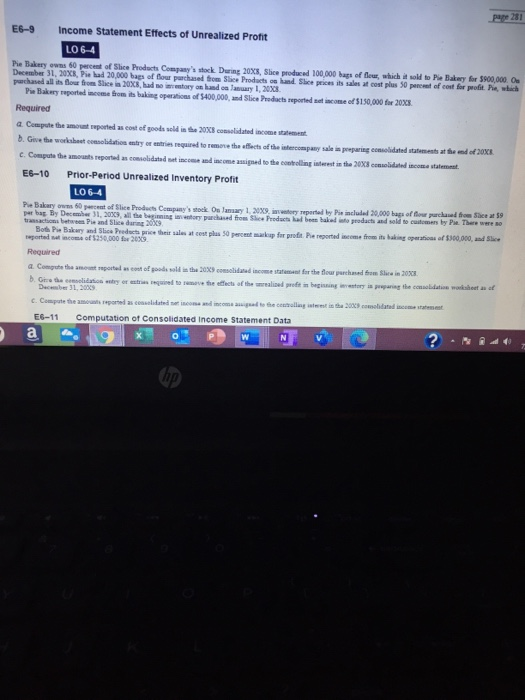

E6-9 Income Statement Effects of Unrealized Profit LO 6-4 Pie Bakery owns 60 percent of Slice Products Company's stock. During 20x8, Slice produced 100,000 bags of flour, which it sold to Pie Bakery for $900,000. Os December 31, 20x8, Pie had 20,000 bags of flour purchased from Slice Products on hand. Slice prices its sales at cost plus 50 percent of cost for profit. Pie, which purchased all its flour from Slice in 20x8, had no inventory on hand on January 1, 20X8. Pie Bakery reported income from its baking operations of $400,000, and Slice Products reported net income of $150,000 for 20x8 Required a. Compute the amount reported as cost of goods sold in the 20x8 consolidated income statement. b. Give the worksheet consolidation entry or entries required to remove the effects of the intercompany sale in preparing consolidated statements at the end of 20XE c. Compute the amounts reported as consolidated net income and income assigned to the controlling interest in the 20x8 consolidated income tarmant E6-10 Prior-Period Unrealized Inventory Profit LO 6-4 Pie Bakery owns 60 percent of Slice Products Company's stock. On January 1, 2029 ventory reported by Pre included 20,000 bags of four purchased Som Slice at 59 per bag By December 31, 20X9, all the beginning inventory purchased from Slice Products had bere baked into products and sold to customers by Pe There were no transactions between Pie and Slace during 2039 Both Pie Bakery and Slice Products price their sales at cost plus 50 percent markup for profit. Pie reported income from its baking pet of $300.000 and she reported net income of $250,000 for 20X9 Required a. Compute the amount reported as cost of goods sold in the 20x9 consolidated case statement for the flour purchased from Slice in 20x8. b. Gre the consolidation entry er en tres required to more the effect of the realized profit in being rester is preparing the cridat as of December 31, 2039 c. Compute the amounts reported as comolidated net income and income and to the controlling interest in the 2039 consolidated income ? E6-11 Computation of Consolidated Income Statement Data W o a up par 281 E6-9 Income Statement Effects of Unrealized Profit LOG-4 Pie Bakery was 60 percent of Slice Products Company's stock. During 2008, Sice produced 100,000 bags of Bows, which it sold to Pe Bakery for $900,000. O December 31, 2038, Piekad 20,000 bags of four purchased from Slice Products and Slice prices its sales at cont plus 50 perc purchased all is flow from Slice 203had more on and only 1, 2008 cost for profit. Pa, which Pie Bakery oported income from its baking operation of $430,000, and Slice Products reported income of $150,000 for 2018 Required a Compute the amount ported as cost of goods sold in the 2008 colidated income D. Give the worksheet consolidation entry or entries required to remove the affects of the intercompany sale in preparing consolidated statement at the end of 2018 c. Compute the amounts reported as consolidated not income and income amigod to the controlling interest in the 2018 commolidated income tatement. E6-10 Prior-Period Unrealized Inventory Profit LO 6-4 Pie Bakery 60 percent of Slice Products Company's stock On January 1, 2039 story reported by Pit included 20,000 hap of four purchased from Sice 9 per bag By December 31, 2003, All the beginning to purchased from sice Product is bes ball products and sold to customers by Poe. There were o transaction betwee and Slice dar 309 Bota Pie Bakery and Slice Products price their sale at cont plus 50 percent makeup for profit. Pe reported income from its baking operations of $300,000, and Slice portal income of $250,000 for 2009 Required a Compute the amount reported scout of food sold in the 20 colidated income statement for the flour purchased from Slice in 2001 b. Gre the consolidation where to remove the effects of the raid profit is being investory is preparing the commodation worksheets of C. Compute the amounts reportes considdet income and income and to the calling it in the 2009 combated income E6-11 Computation of Consolidated Income Statement Data a