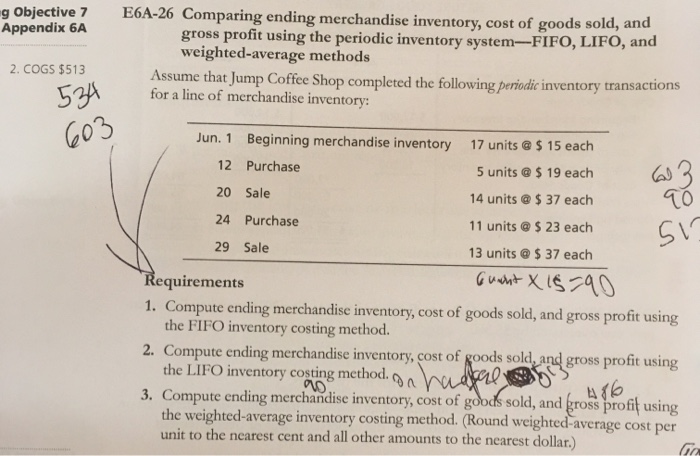

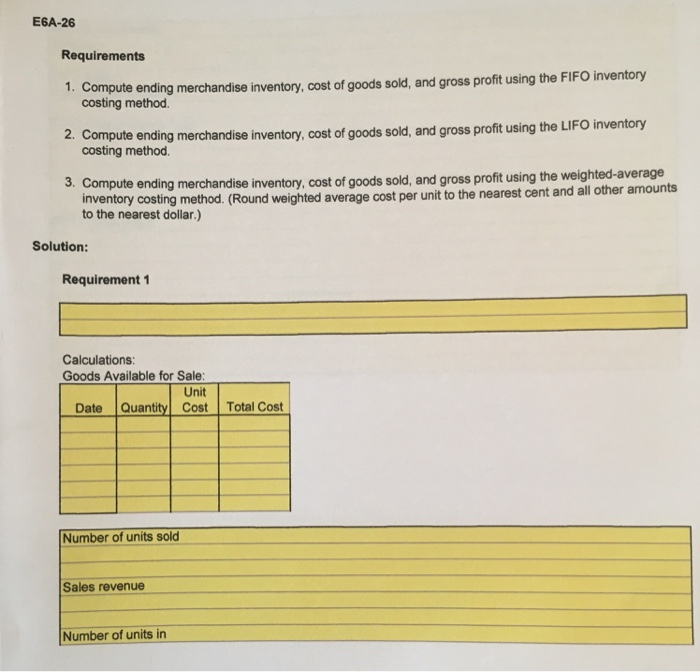

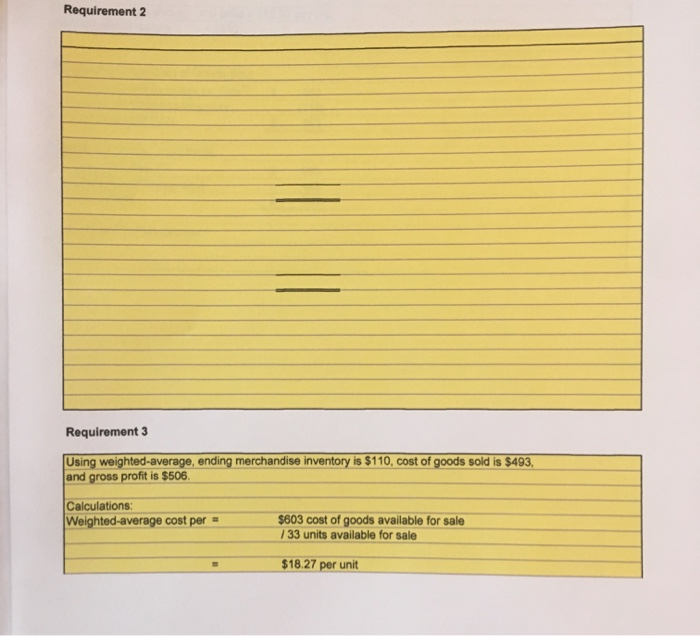

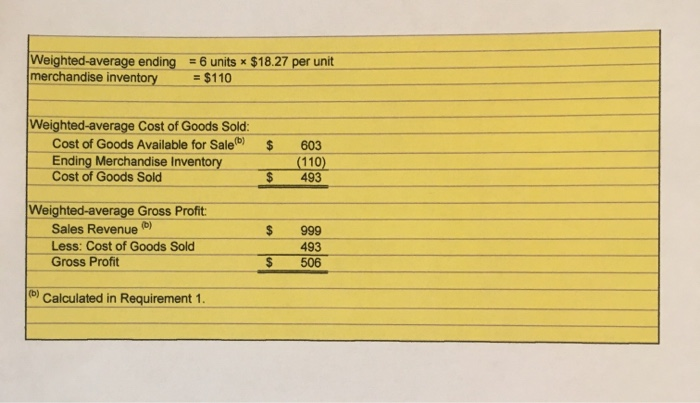

E6A-26 Comparing ending merchandise inventory, cost of goods sold, and gross profit using the periodic inventory system-FIFO, LIFO, and weighted-average methods Assume that Jump Coffee Shop completed the following periodic inventory trans actions for a line of merchandise inventory: g Objective 7 Appendix 6A 2. COGS $513 53A G03 Jun. 1 Beginning merchandise inventory 17 units @ $ 15 each 12 Purchase 5 units @$19 each 20 Sale TO 14 units @$37 each 24 Purchase 11 units @ $ 23 each 29 Sale 13 units @$37 each Guant XISA0 Requirements 1. Compute ending merchandise inventory, cost of goods sold, and gross profit using the FIFO inventory costing method. 2. Compute ending merchandise inventory, cost of goods sold, and gross profit using the LIFO inventory costing method. 3. Compute ending merchandise inventory, cost of goods sold, and gross profit using the weighted-average inventory costing method. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) E6A-26 Requirements 1. Compute ending merchandise inventory, cost of goods sold, and gross profit using the FIFO inventory costing method. 2. Compute ending merchandise inventory, cost of goods sold, and gross profit using the LIFO inventory costing method. 3. Compute ending merchandise inventory, cost of goods sold, and gross profit using the weighted-average inventory costing method. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Solution: Requirement 1 Calculations: Goods Available for Sale: Unit Quantity Cost Total Cost Date Number of units sold Sales revenue Number of units in ending merchandise inventory FIFO ending merchandise inventory FIFO Cost of Goods Sold: FIFO Gross Profit Requirement 2 Requirement 3 Using weighted-average, ending merchandise inventory is $110, cost of goods sold is $493, and gross profit is $506. Calculations: Weighted-average cost per= $603 cost of goods available for sale 33 units available for sale $18.27 per unit Weighted-average ending merchandise inventory = 6 units x $18.27 per unit = $110 Weighted-average Cost of Goods Sold: Cost of Goods Available for Sale) Ending Merchandise Inventory Cost of Goods Sold $ 603 (110) $ 493 Weighted-average Gross Profit Sales Revenue() $ 999 Less: Cost of Goods Sold 493 506 Gross Profit Calculated in Requirement 1 (b)