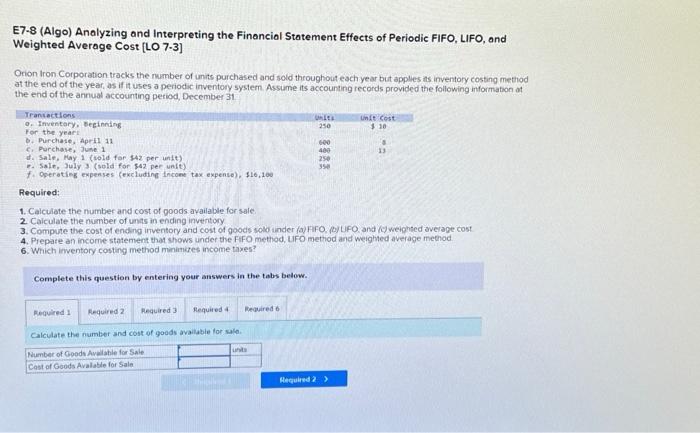

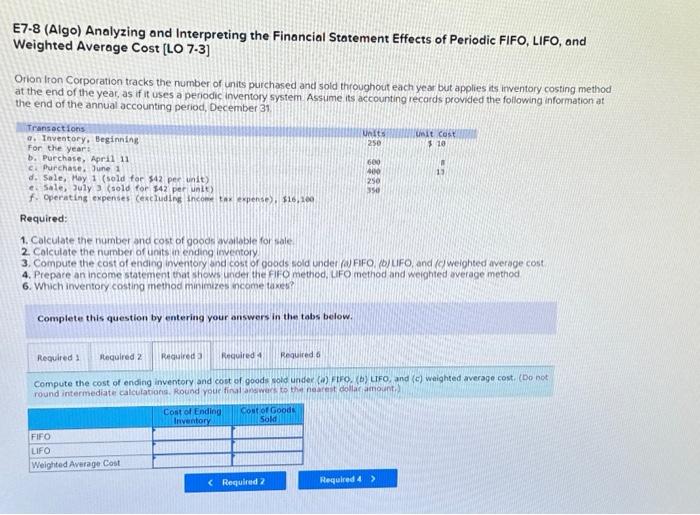

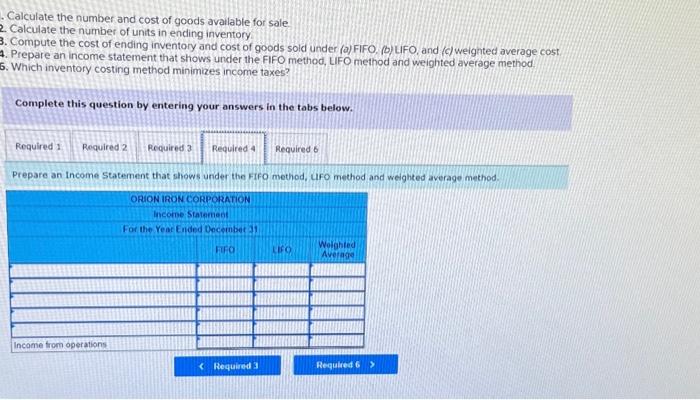

E7-8 (Algo) Analyzing and Interpreting the Financiol Statement Effects of Periodic FIFO, LIFO, and Weighted Average Cost [LO 7-3] Orion Iron Corporation tracks the rumber of units purchased and sold throughout esch year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting reconds provided the following information of the end of the annual accounting period, December 31 . Required: 1. Calculate the number and cost of poods available for sale 2. Caiculate the number of unis in ending inventory 3. Compune the cost of ending inventory and cost of goods solo under (a) FFO, por UFO, and (o) weiphted average cost 4. Prepare an income statement that shows under the FiFO method, UFO method and weighed average meehod. 6. Which inventory costing method minimizes income taves? Complete this question by entering your answers in the tabs below. Calculate the number and cost of goods avaliable for sula. E7-8 (Algo) Analyzing and Interpreting the Financial Statement Effects of Periodic FIFO, LIFO, and Weighted Average Cost [LO 7-3] Orion Iron Corporation tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31 . Required: 1. Calculate the number and cost of goods avallable for sale. 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) UFO, and (c) weighted average cost 4. Prepare an income statement that shiows under the Fifo method, LFO method and weiphted overage method 6. Which inventory costing method minimizes income taxes? Complete this question by entering your answers in the tabs below. Compute the cost of ending inventory and cost of goods pold under (a) FFO, (b) LFO, and (c) weighted average cost. (Do not - Calculate the number and cost of goods avallable for sale 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) UFO, and (c) weignted average cost. 4. Prepare an income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes income taxes? Complete this question by entering your answers in the tabs below. Prepare an Income statement that shows under the Fifo method, Cifo method and weighted average method