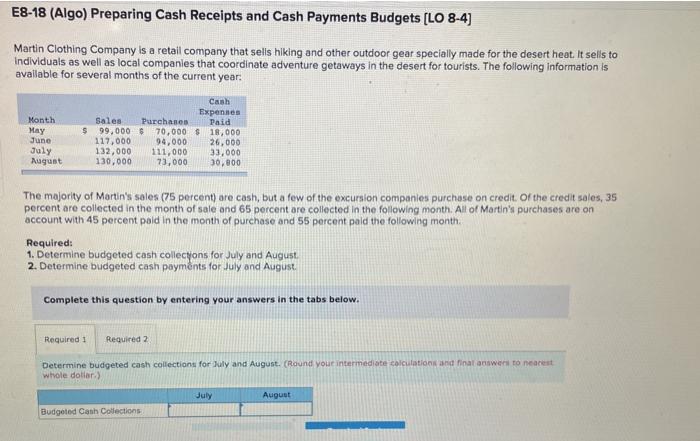

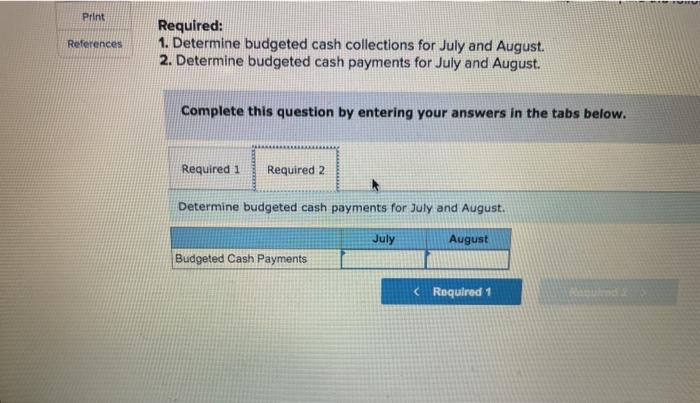

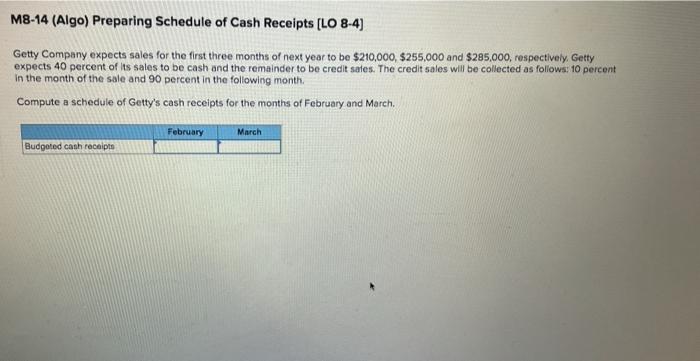

E8-18 (Algo) Preparing Cash Receipts and Cash Payments Budgets [LO 8-4) Martin Clothing Company is a retail company that sells hiking and other outdoor gear specially made for the desert heat. It sells to Individuals as well as local companies that coordinate adventure getaways in the desert for tourists. The following information is available for several months of the current year: Month May June July August Cash Expenses Sales Purchase Paid $99.000 $70,000 $ 18,000 117,000 94,000 26,000 132,000 111,000 33,000 130.000 73,000 30,000 The majority of Martin's sales (75 percent) are cash, but a few of the excursion companies purchase on credit of the credit sales, 35 percent are collected in the month of sale and 65 percent are collected in the following month. All of Martin's purchases are on account with 45 percent pold in the month of purchase and 55 percent pold the following month Required: 1. Determine budgeted cash collections for July and August. 2. Determine budgeted cash payments for July and August Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine budgeted cash collections for July and August. (Round your intermediate calculations and finanswers to nearest whole dotar) July August Budgeted Cash Collections Print References Required: 1. Determine budgeted cash collections for July and August. 2. Determine budgeted cash payments for July and August. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine budgeted cash payments for July and August. July August Budgeted Cash Payments (Required 1 M8-14 (Algo) Preparing Schedule of Cash Receipts [LO 8-4) Getty Company expects sales for the first three months of next year to be $210,000, $255,000 and $285,000, respectively, Getty expects 40 percent of its sales to be cash and the remainder to be credit sates. The credit sales will be collected as follows: 10 percent in the month of the sale and 90 percent in the following month Compute a schedule of Getty's cash receipts for the months of February and March. February March Budgeted cash receipts