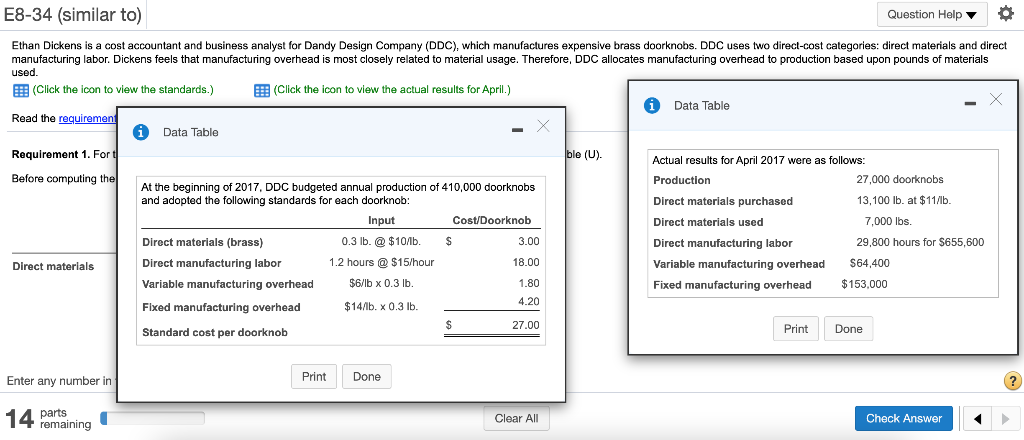

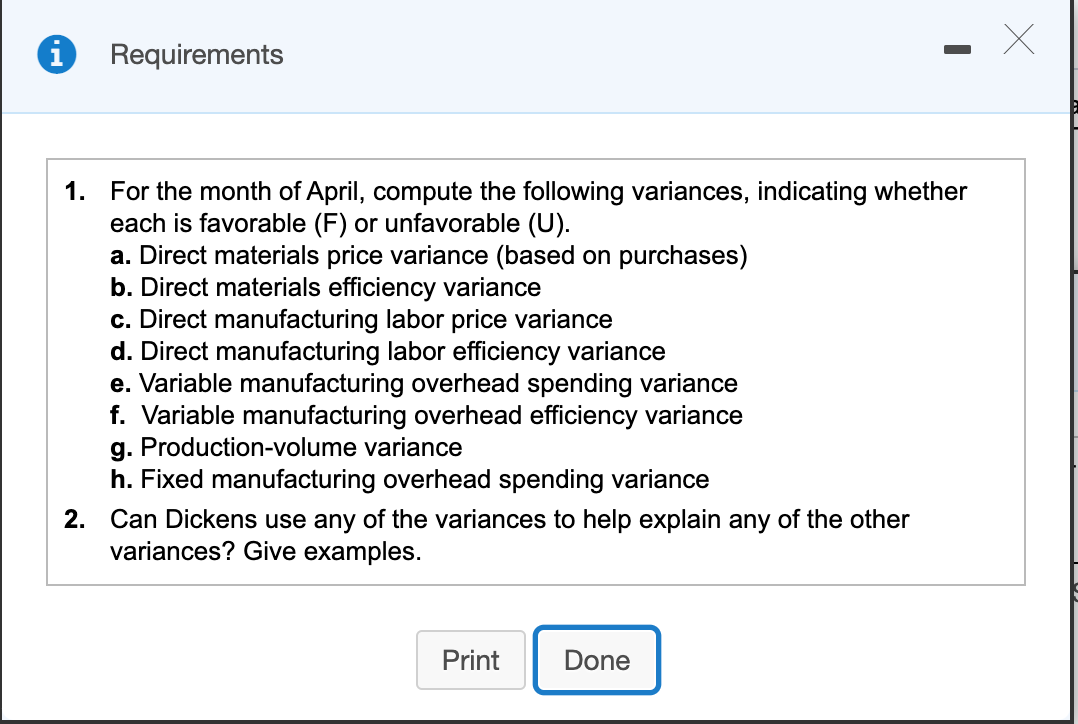

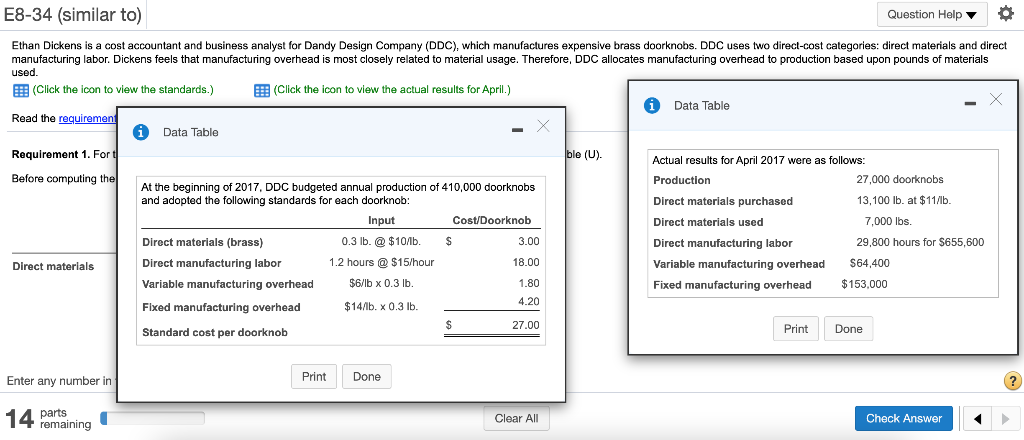

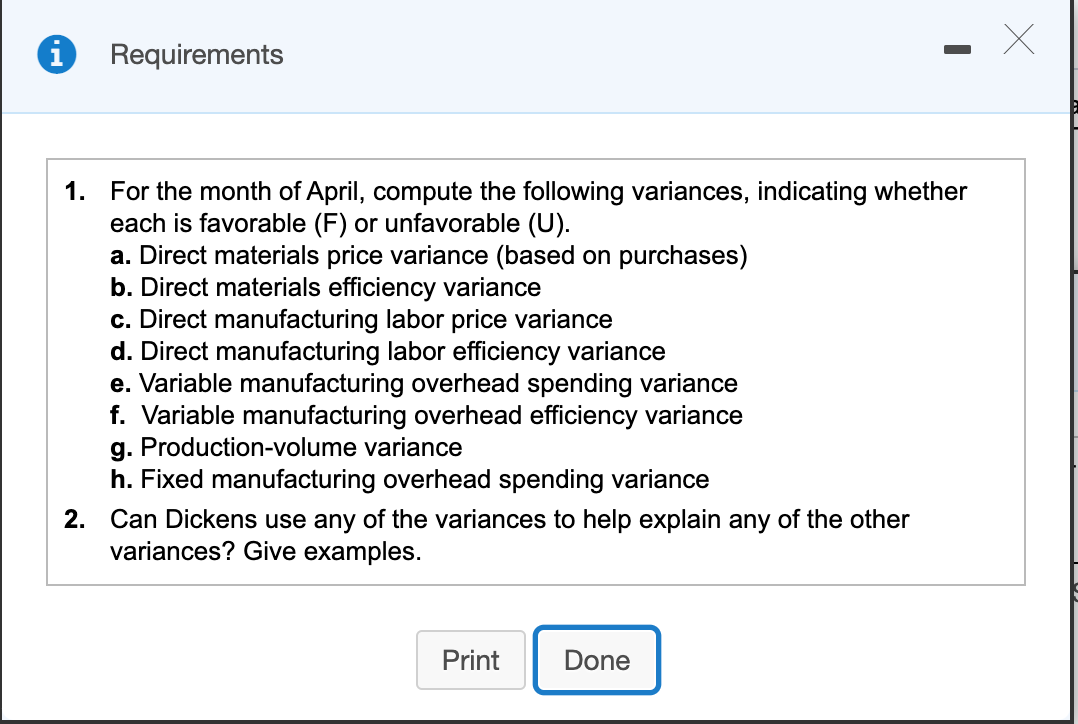

E8-34 (similar to) Question Help O Ethan Dickens is a cost accountant and business analyst for Dandy Design Company (DDC), which manufactures expensive brass doorknobs. DDC uses two direct-cost categories: direct materials and direct manufacturing labor. Dickens feels that manufacturing overhead is most closely related to material usage. Therefore, DDC allocates manufacturing overhead to production based upon pounds of materials used. E (Click the icon to view the standards.) (Click the icon to view the actual results for April.) i Data Table Read the requirement i Data Table Requirement 1. Fort ble (U). Actual results for April 2017 were as follows: Before computing the Production 27,000 doorknobs At the beginning of 2017, DDC budgeted annual production of 410,000 doorknobs and adopted the following standards for each doorknob: Direct materials purchased 13,100 lb. at $11/lb. Input Cost/Doorknob Direct materials used 7,000 lbs Direct materials (brass) 0.3 lb. @ $10/b. $ 3.00 Direct manufacturing labor 29,800 hours for $655,600 Direct materials Direct manufacturing labor 18.00 1.2 hours @ $15/hour Variable manufacturing overhead $64,400 Variable manufacturing overhead $6/lb x 0.3 lb 6 1.80 Fixed manufacturing overhead $153,000 4.20 Fixed manufacturing overhead $14/b. x 0.3 lb. $ 27.00 Standard cost per doorknob Print Done Enter any number in Print Done ? 14 Pemaining Clear All Check Answer i Requirements 1. For the month of April, compute the following variances, indicating whether each is favorable (F) or unfavorable (U). a. Direct materials price variance (based on purchases) b. Direct materials efficiency variance c. Direct manufacturing labor price variance d. Direct manufacturing labor efficiency variance e. Variable manufacturing overhead spending variance f. Variable manufacturing overhead efficiency variance g. Production-volume variance h. Fixed manufacturing overhead spending variance 2. Can Dickens use any of the variances to help explain any of the other variances? Give examples. Print Done