Answered step by step

Verified Expert Solution

Question

1 Approved Answer

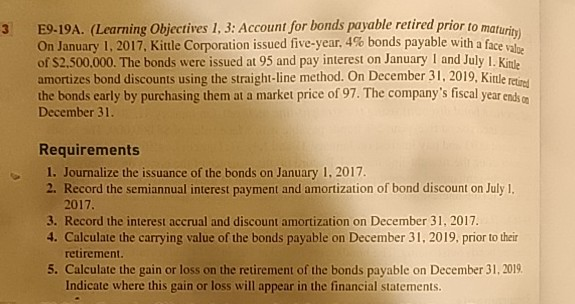

E9 19A. (Learning Objectives 1, 3: Account for bonds payable retired prior to maturi ) On January 1, 2017, Kittle Corporation issued five-year, 4% bonds

E9 19A. (Learning Objectives 1, 3: Account for bonds payable retired prior to maturi ) On January 1, 2017, Kittle Corporation issued five-year, 4% bonds payable with a face of $2.500,000. The bonds were issued at 95 and pay interest on January I and July I. Kitl amortizes bond discounts using the straight-line method. On December 31,2019, Kitle rin the bonds early by purchasing them at a market price of 97. The company's fiscal year ends o December 31. 3 rctad Requirements 1. Journalize the issuance of the bonds on January 1, 2017. 2. Record the semiannual interest payment and amortization of bond discount on July I. 2017. 3. Record the interest accrual and discount amortization on December 31, 2017 4. Calculate the carrying value of the bonds payable on December 31.2019, prior to their retirement 5. Calculate the gain or loss on the retirement of the bonds payable on December 31, 2019 Indicate where this gain or loss will appear in the financial staterments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started