Question

E9-11 (Algo) Demonstrating the Effect of Book Value on Reporting an Asset Disposal [LO 9-5] Skip to question [ The following information applies to the

E9-11 (Algo) Demonstrating the Effect of Book Value on Reporting an Asset Disposal [LO 9-5]

Skip to question

[The following information applies to the questions displayed below.]

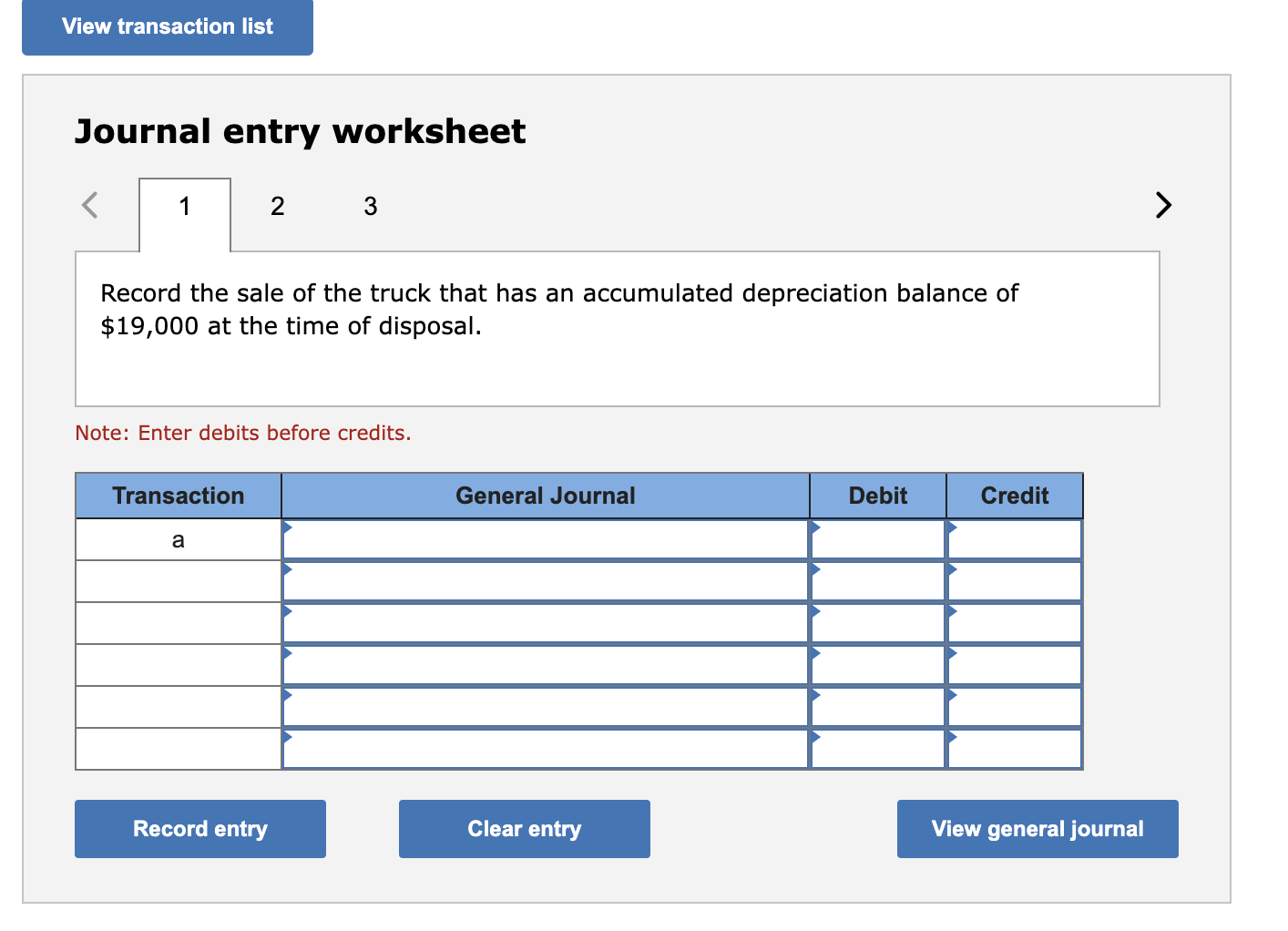

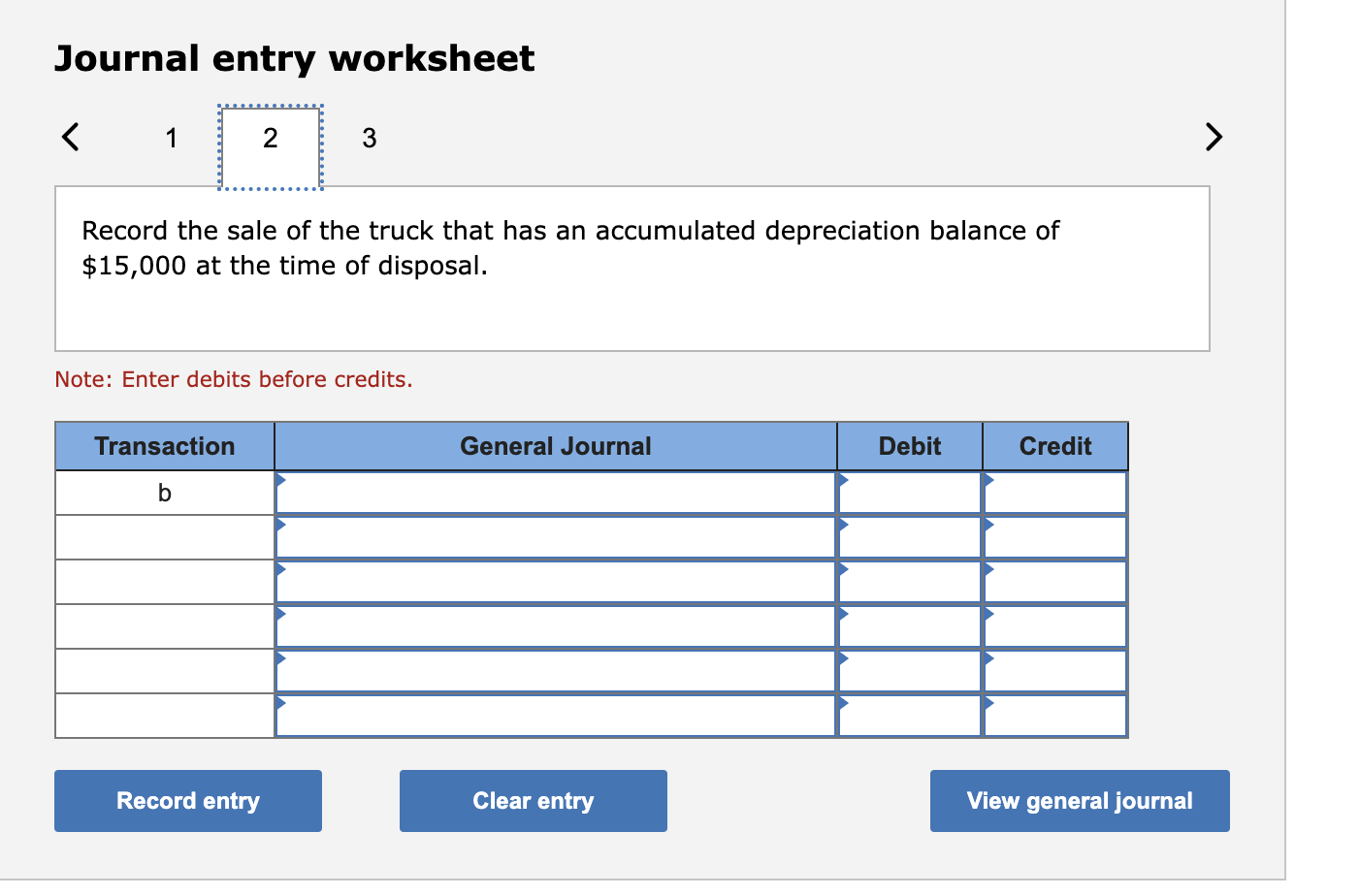

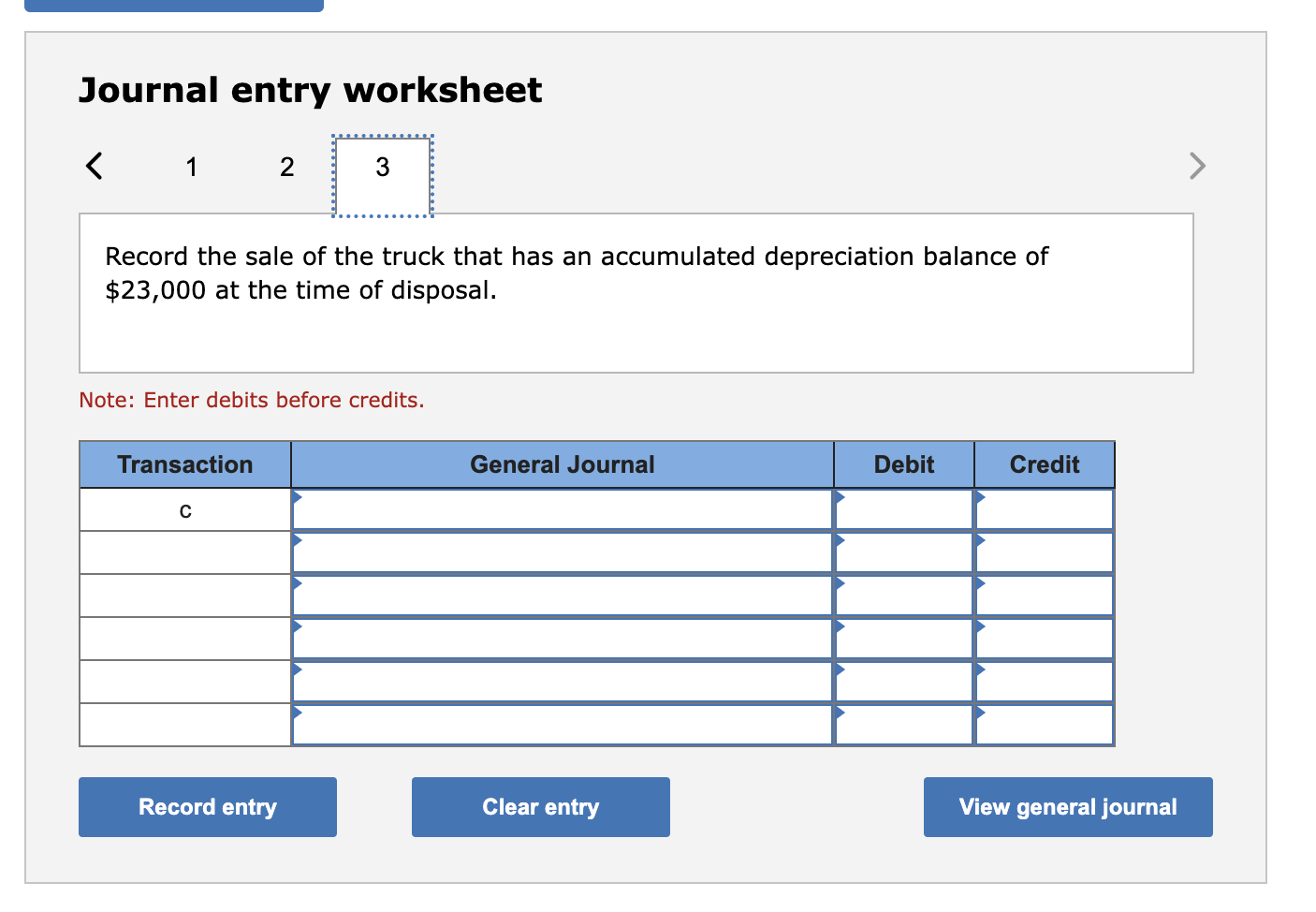

WeDeliver Incorporated is the worlds leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that WeDeliver sold a delivery truck for $28,000. WeDeliver had originally purchased the vehicle and recorded it in the Truck account for $47,000 and had recorded depreciation for three years.

E9-11 (Algo) Part 4

Prepare the journal entry to record the disposal of the truck, assuming Accumulated Depreciation--Truck was (a) $19,000, (b) $15,000, and (c) $23,000. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started