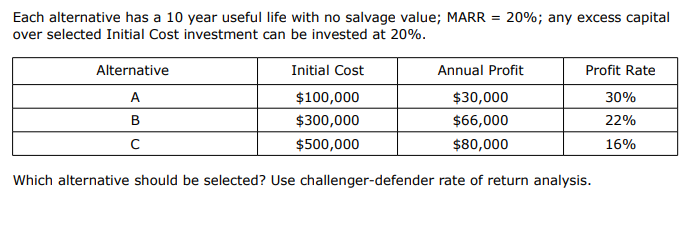

Question: Each alternative has a 10 year useful life with no salvage value; MARR = 20%; any excess capital over selected Initial Cost investment can

Each alternative has a 10 year useful life with no salvage value; MARR = 20%; any excess capital over selected Initial Cost investment can be invested at 20%. Alternative A B Initial Cost $100,000 $300,000 $500,000 Annual Profit Profit Rate 30% 22% 16% $30,000 $66,000 $80,000 Which alternative should be selected? Use challenger-defender rate of return analysis.

Step by Step Solution

3.57 Rating (164 Votes )

There are 3 Steps involved in it

To determine which alternative should be selected using the challengerdefender rate of return analys... View full answer

Get step-by-step solutions from verified subject matter experts