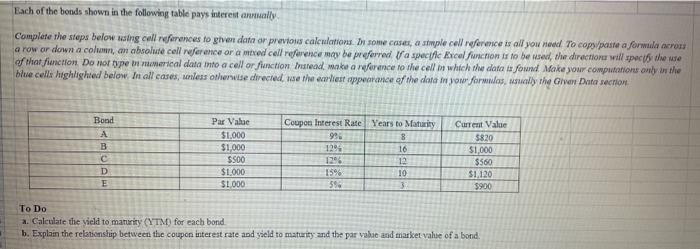

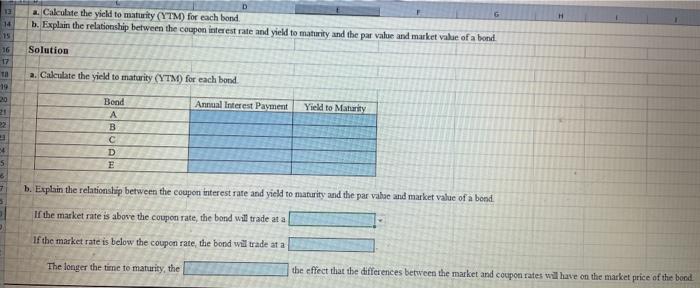

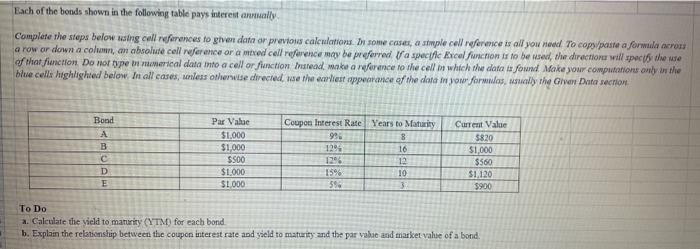

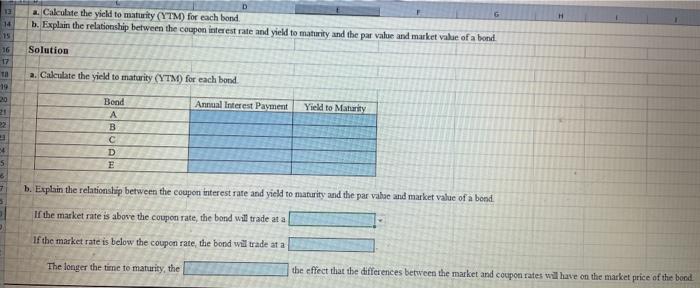

Each of the bonds shown in the following table pays interest annually Complete the steps below using coll references to given data ar previous calculation. Du some cases, a simple cell reference is all you need to copy/paste a formula excross a row or down a colum, an absolute cell reference or a mixed cell reference may be preferred a specific Excel function is to be used the director will spect the of that fonction Domor type bimmerical data into a cell or function Inread make a france to the call bt which the data fowl Make your computations only as the blue cells highlighted below. In all cases, unless otherwise directed the earliest appearance of the data in your formules, wally the Giver Data section Bond A B D E Par Value $1.000 $1.000 $ $1.000 $1.000 Coupon Interest Rate Years to Maturity 990 12% 1294 12 1598 10 59 3 18156 Current Value 5820 $1.000 $560 $1.120 $900 To Do a. Calculate the yield to maturity (YTM for each bond b. Explain the relationship between the coupon interest rate and yield to maturity and the par vabae and market value of a bond D 13 14 15 a. Calculate the yield to maturity (YTM) for each bond b. Explain the relationship between the coupen interest rate and yield to maturity and the par value and market value of a bond Solution a. Calculate the yield to maturity (YTM) for each bond 16 17 TB 19 20 21 2 Annual Interest Payment Yield to Maturity Bond B c D E 34 5 7 b. Explain the relationship between the coupon interest rate and yield to maturity and the par value and market value of a bond If the market rate is above the coupon rate, the band will trade at a If the market rate is below the coupon rate, the bond wil trade at a The longer the time to maturity, the the effect that the differences between the market and coupon rates will have on the market price of the bord Each of the bonds shown in the following table pays interest annually Complete the steps below using coll references to given data ar previous calculation. Du some cases, a simple cell reference is all you need to copy/paste a formula excross a row or down a colum, an absolute cell reference or a mixed cell reference may be preferred a specific Excel function is to be used the director will spect the of that fonction Domor type bimmerical data into a cell or function Inread make a france to the call bt which the data fowl Make your computations only as the blue cells highlighted below. In all cases, unless otherwise directed the earliest appearance of the data in your formules, wally the Giver Data section Bond A B D E Par Value $1.000 $1.000 $ $1.000 $1.000 Coupon Interest Rate Years to Maturity 990 12% 1294 12 1598 10 59 3 18156 Current Value 5820 $1.000 $560 $1.120 $900 To Do a. Calculate the yield to maturity (YTM for each bond b. Explain the relationship between the coupon interest rate and yield to maturity and the par vabae and market value of a bond D 13 14 15 a. Calculate the yield to maturity (YTM) for each bond b. Explain the relationship between the coupen interest rate and yield to maturity and the par value and market value of a bond Solution a. Calculate the yield to maturity (YTM) for each bond 16 17 TB 19 20 21 2 Annual Interest Payment Yield to Maturity Bond B c D E 34 5 7 b. Explain the relationship between the coupon interest rate and yield to maturity and the par value and market value of a bond If the market rate is above the coupon rate, the band will trade at a If the market rate is below the coupon rate, the bond wil trade at a The longer the time to maturity, the the effect that the differences between the market and coupon rates will have on the market price of the bord