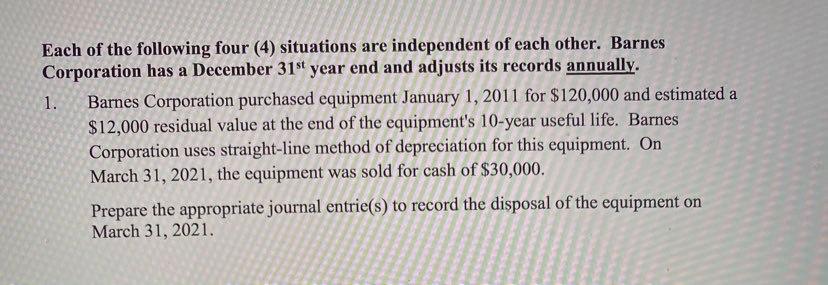

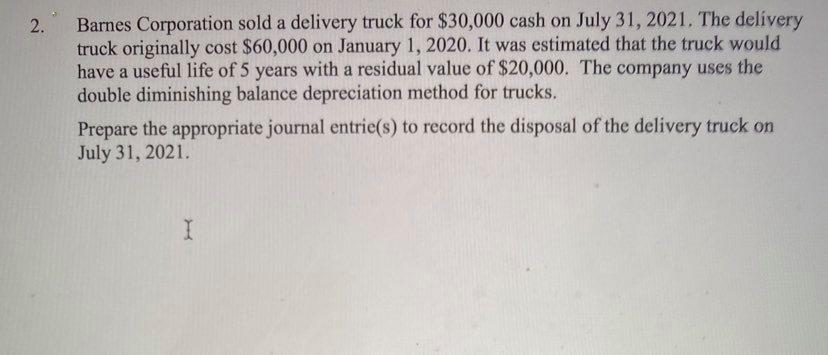

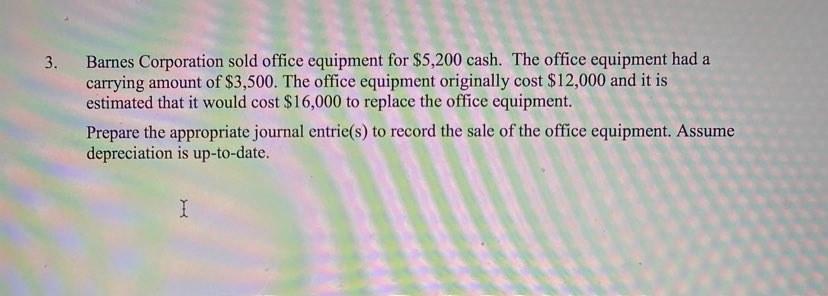

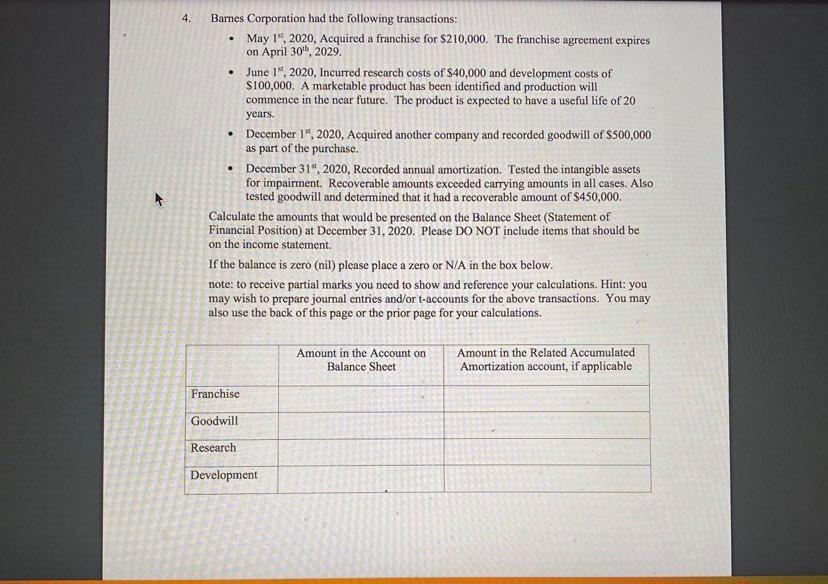

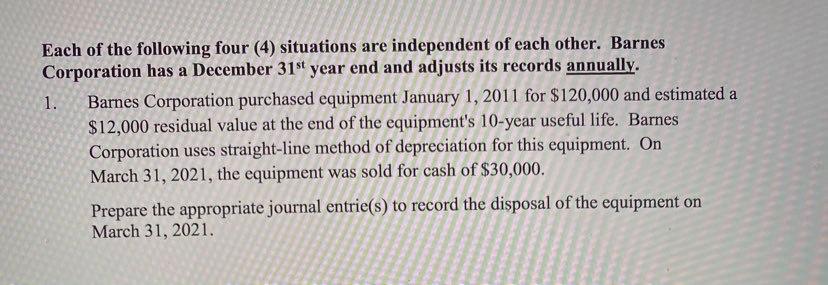

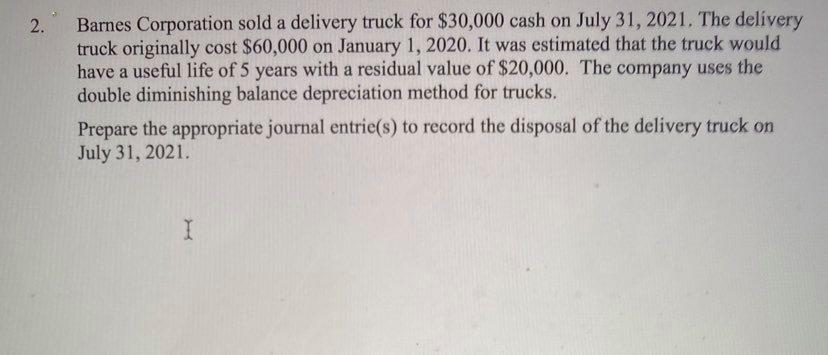

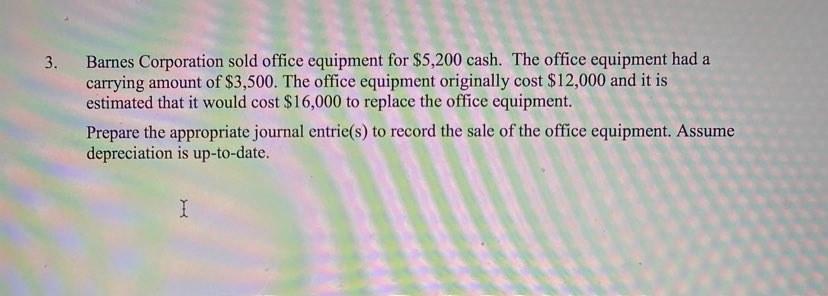

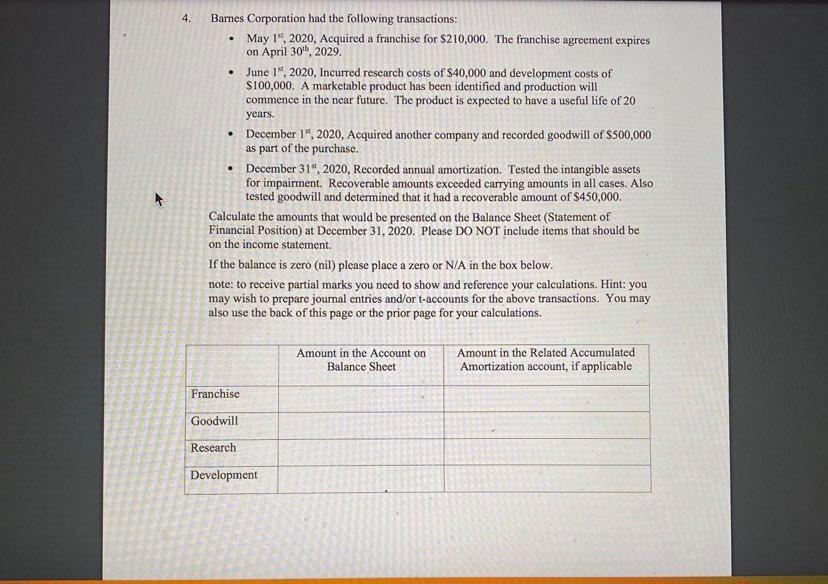

Each of the following four (4) situations are independent of each other. Barnes Corporation has a December 31st year end and adjusts its records annually. 1. Barnes Corporation purchased equipment January 1, 2011 for $120,000 and estimated a $12,000 residual value at the end of the equipment's 10-year useful life. Barnes Corporation uses straight-line method of depreciation for this equipment. On March 31, 2021, the equipment was sold for cash of $30,000. Prepare the appropriate journal entrie(s) to record the disposal of the equipment on March 31, 2021. 2. Barnes Corporation sold a delivery truck for $30,000 cash on July 31, 2021. The delivery truck originally cost $60,000 on January 1, 2020. It was estimated that the truck would have a useful life of 5 years with a residual value of $20,000. The company uses the double diminishing balance depreciation method for trucks. Prepare the appropriate journal entrie(s) to record the disposal of the delivery truck on July 31, 2021. I 3. Barnes Corporation sold office equipment for $5,200 cash. The office equipment had a carrying amount of $3,500. The office equipment originally cost $12,000 and it is estimated that it would cost $16,000 to replace the office equipment. Prepare the appropriate journal entrie(s) to record the sale of the office equipment. Assume depreciation is up-to-date. I 4. . . . Barnes Corporation had the following transactions: May 1", 2020, Acquired a franchise for $210,000. The franchise agreement expires on April 30th, 2029. June 15, 2020, Incurred research costs of $40,000 and development costs of $100,000. A marketable product has been identified and production will commence in the near future. The product is expected to have a useful life of 20 years. December 1, 2020, Acquired another company and recorded goodwill of $500,000 as part of the purchase. December 31", 2020, Recorded annual amortization. Tested the intangible assets for impairment. Recoverable amounts exceeded carrying amounts in all cases. Also tested goodwill and determined that it had a recoverable amount of $450,000. Calculate the amounts that would be presented on the Balance Sheet (Statement of Financial Position) at December 31, 2020. Please DO NOT include items that should be on the income statement If the balance is zero (nil) please place a zero or N/A in the box below. note: to receive partial marks you need to show and reference your calculations. Hint: you may wish to prepare journal entries and/or t-accounts for the above transactions. You may also use the back of this page or the prior page for your calculations. Amount in the Account on Balance Sheet Amount in the Related Accumulated Amortization account, if applicable Franchise Goodwill Research Development