Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Each of the following invoices was entered into a sales journal for Karl's Delivery Service during July 2023. (Click the icon to view the invoices

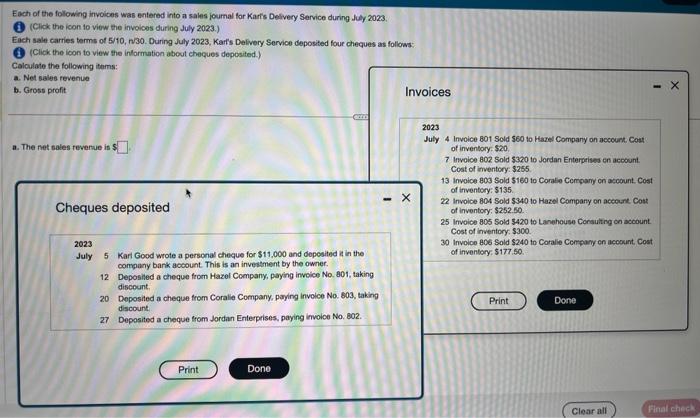

Each of the following invoices was entered into a sales journal for Karl's Delivery Service during July 2023. (Click the icon to view the invoices during July 2023.) Each sale carries terms of 5/10, n/30. During July 2023, Karl's Delivery Service deposited four cheques as follows: (Click the icon to view the information about cheques deposited.) Calculate the following items: a. Net sales revenue b. Gross profit a. The net sales revenue is $ Cheques deposited 2023 July 5 Karl Good wrote a personal cheque for $11,000 and deposited it in the company bank account. This is an investment by the owner. ... Deposited a cheque from Hazel Company, paying invoice No. 801, taking discount. 12 20 Deposited a cheque from Coralie Company, paying invoice No. 803, taking discount. 27 Deposited a cheque from Jordan Enterprises, paying invoice No. 802. Print Done Invoices - - X 2023 July 4 Invoice 801 Sold $60 to Hazel Company on account. Cost of inventory: $20. 7 Invoice 802 Sold $320 to Jordan Enterprises on account. Cost of inventory: $255. 13 Invoice 803 Sold $160 to Coralie Company on account. Cost of inventory: $135. 22 Invoice 804 Sold $340 to Hazel Company on account. Cost of inventory: $252.50. 25 Invoice 805 Sold $420 to Lanehouse Consulting on account. Cost of inventory: $300. 30 Invoice 806 Sold $240 to Coralie Company on account. Cost of inventory: $177.50. Print Done Clear all - X Final check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started