Question

Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The

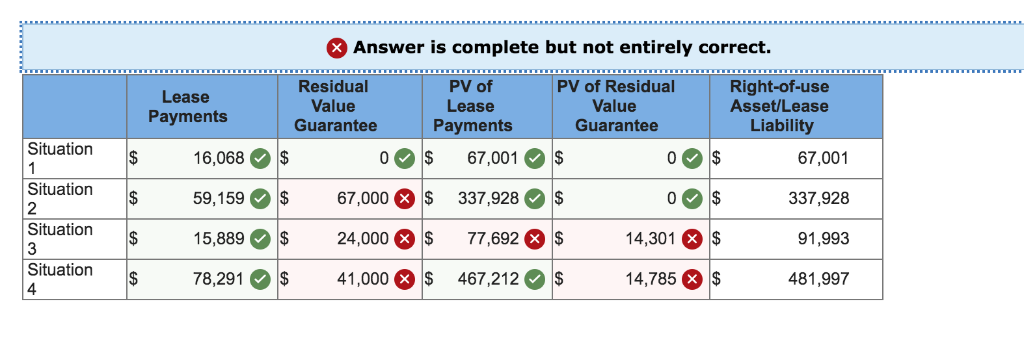

Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessors implicit rate of return. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Situation 1 2 3 4 Lease term (years) 5 8 6 9 Lessor's rate of return 10 % 11 % 9 % 12 % Fair value of lease asset $ 67,000 $ 367,000 $ 92,000 $ 482,000 Lessor's cost of lease asset $ 67,000 $ 367,000 $ 62,000 $ 482,000 Residual value: Estimated fair value 0 $ 67,000 $ 24,000 $ 36,000 Guaranteed fair value 0 0 $ 24,000 $ 41,000

Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for above situations. (Round your PV factor answers to 5 decimal places and other answer to nearest whole dollar.)

X Answer is complete but not entirely correct. Lease Payments Right-of-use Asset/Lease Liability Situation $ 67,001 Situation Residual PV of PV of Residual Value Lease Value Guarantee Payments Guarantee $ 0 $ 67,001 $ 0 $ 67,000 $ 337,928 $ 0 $ 24,000 $ 77,692 $ 14,301 $ 41,000 $ 467,212S 14,785 16,068 59,159 15,889 78,291 337,928 Situation 6 $ $ $ 91,993 Situation $ 481,997

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started