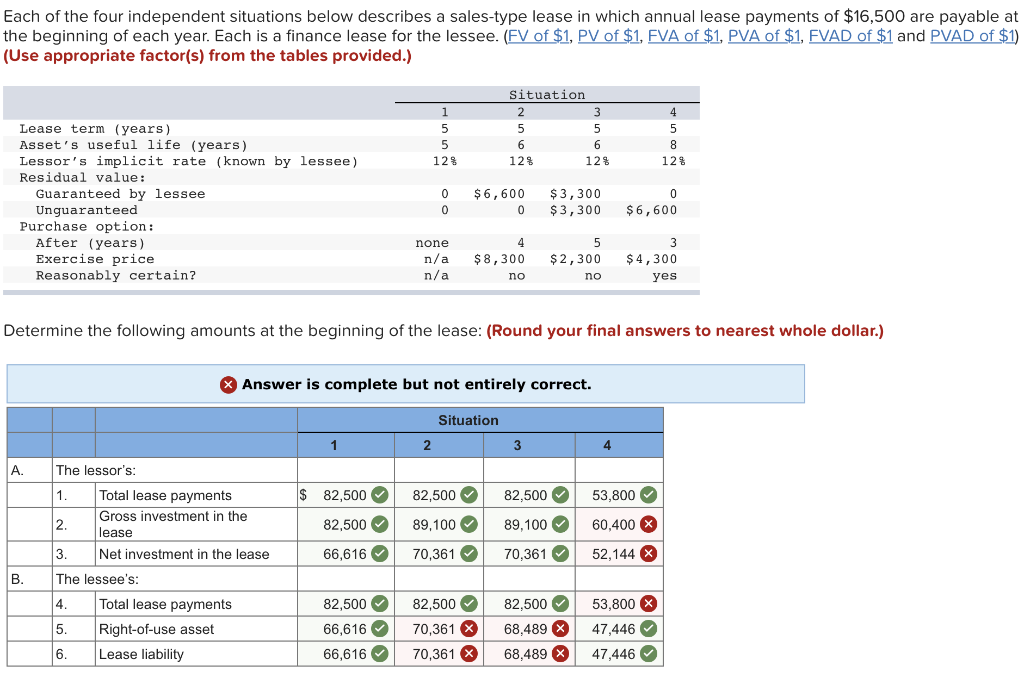

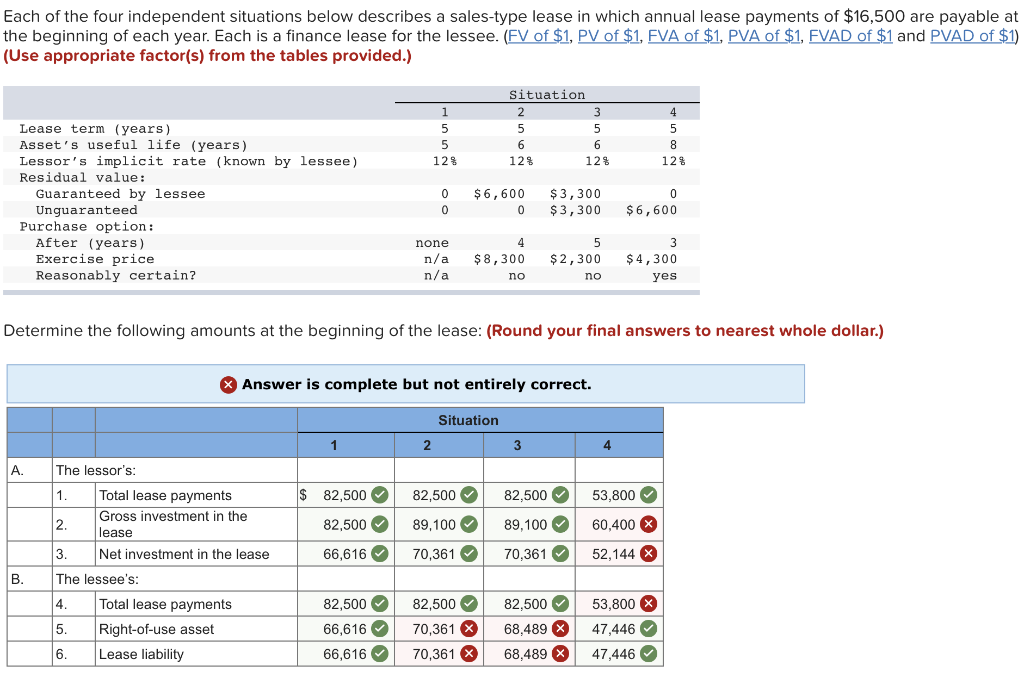

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $16,500 are payable at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Situation 2 5 6 12% 12% 12% O Lease term (years) Asset's useful life (years) Lessor's implicit rate (known by lessee) Residual value: Guaranteed by lessee Unguaranteed Purchase option: After (years) Exercise price Reasonably certain? $6,600 0 $3,300 $3,300 $6,600 none n/a n/a 4 $ 8,300 no 5 $2,300 no 3 $4,300 yes Determine the following amounts at the beginning of the lease: (Round your final answers to nearest whole dollar.) Answer is complete but not entirely correct. Situation 1 2 3 4 The lessor's: $ 82,500 82,500 66,616 82,500 89,100 70,361 82,500 89,100 70,361 53,800 60,400 52,144 B. Total lease payments Gross investment in the lease Net investment in the lease The lessee's: Total lease payments 5. Right-of-use asset Lease liability 4. 82,500 66,616 66,616 82,500 70,361 X 70,361 82,500 68,489 > 68,489 53,800 X 47,446 47,446 Each of the four independent situations below describes a sales-type lease in which annual lease payments of $16,500 are payable at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Situation 2 5 6 12% 12% 12% O Lease term (years) Asset's useful life (years) Lessor's implicit rate (known by lessee) Residual value: Guaranteed by lessee Unguaranteed Purchase option: After (years) Exercise price Reasonably certain? $6,600 0 $3,300 $3,300 $6,600 none n/a n/a 4 $ 8,300 no 5 $2,300 no 3 $4,300 yes Determine the following amounts at the beginning of the lease: (Round your final answers to nearest whole dollar.) Answer is complete but not entirely correct. Situation 1 2 3 4 The lessor's: $ 82,500 82,500 66,616 82,500 89,100 70,361 82,500 89,100 70,361 53,800 60,400 52,144 B. Total lease payments Gross investment in the lease Net investment in the lease The lessee's: Total lease payments 5. Right-of-use asset Lease liability 4. 82,500 66,616 66,616 82,500 70,361 X 70,361 82,500 68,489 > 68,489 53,800 X 47,446 47,446