Question

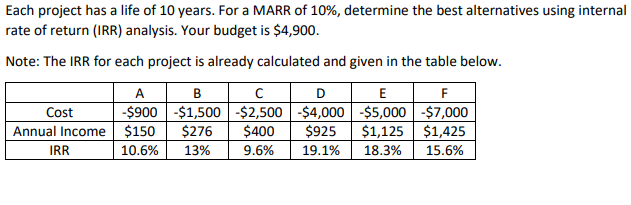

Each project has a life of 10 years. For a MARR of 10%, determine the best alternatives using internal rate of return (IRR) analysis.

Each project has a life of 10 years. For a MARR of 10%, determine the best alternatives using internal rate of return (IRR) analysis. Your budget is $4,900. Note: The IRR for each project is already calculated and given in the table below. A B D E F -$900 $1,500 $2,500 $4,000 -$5,000 - $7,000 $276 $400 $1,125 13% 9.6% Cost Annual Income IRR $150 10.6% $925 19.1% $1,425 18.3% 15.6%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can analyze the information in the image for you The table shows the Internal Rate of Return IRR for six different projects A through F The IRR is a discount rate that makes the net present val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones of Financial and Managerial Accounting

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

2nd edition

978-0538473484, 538473487, 978-1111879044

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App