EACH RAZOR COST 15 DOLLARS

EACH RAZOR COST 15 DOLLARS

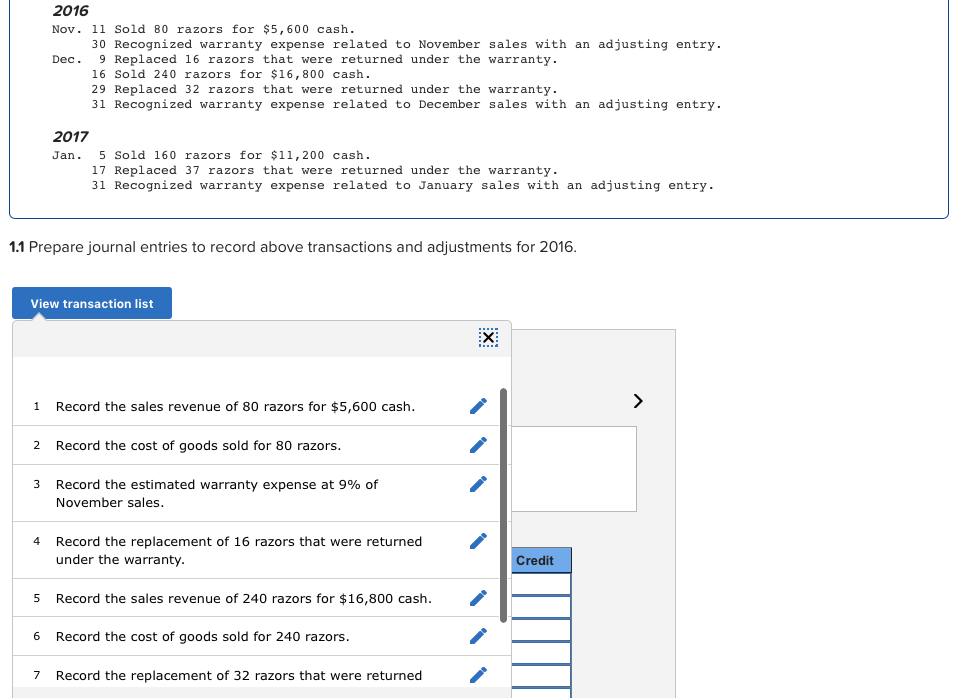

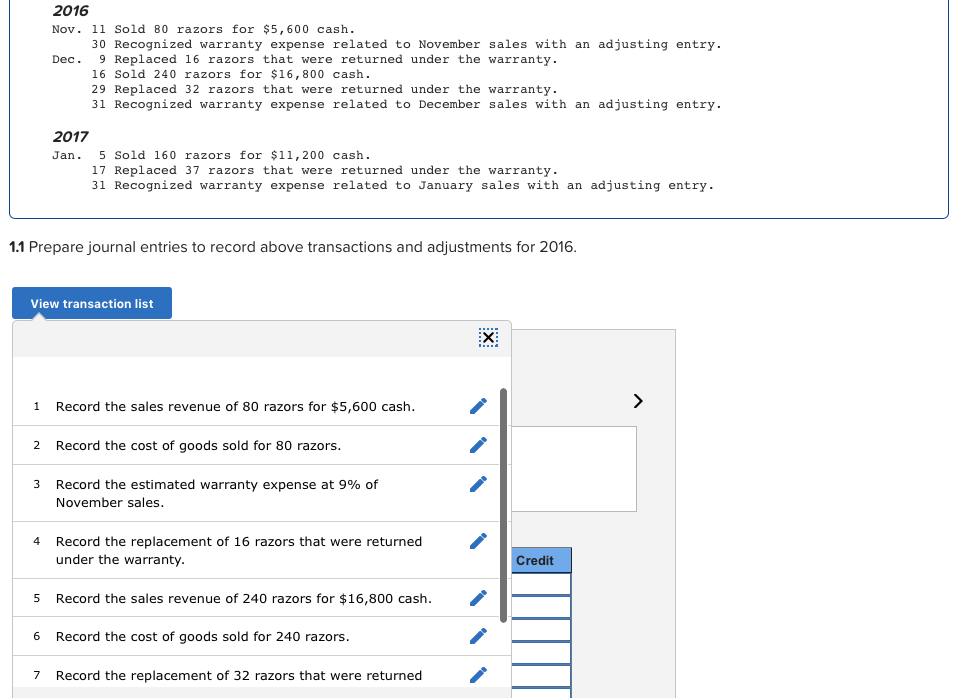

2016 Nov. 11 Sold 80 razors for $5,600 cash. 30 Recognized warranty expense related to November sales with an adjusting entry. Dec. 9 Replaced 16 razors that were returned under the warranty. 16 Sold 240 razors for $16,800 cash. 29 Replaced 32 razors that were returned under the warranty. 31 Recognized warranty expense related to December sales with an adjusting entry. 2017 Jan. 5 Sold 160 razors for $11,200 cash. 17 Replaced 37 razors that were returned under the warranty. 31 Recognized warranty expense related to January sales with an adjusting entry. 1.1 Prepare journal entries to record above transactions and adjustments for 2016. View transaction list 1 Record the sales revenue of 80 razors for $5,600 cash. 2 Record the cost of goods sold for 80 razors. 3 Record the estimated warranty expense at 9% of November sales. 4 Record the replacement of 16 razors that were returned under the warranty. Credit 5 Record the sales revenue of 240 razors for $16,800 cash. 6 Record the cost of goods sold for 240 razors. 7 Record the replacement of 32 razors that were returned 2016 Nov. 11 Sold 80 razors for $5,600 cash. 30 Recognized warranty expense related to November sales with an adjusting entry. Dec. 9 Replaced 16 razors that were returned under the warranty. 16 Sold 240 razors for $16,800 cash. 29 Replaced 32 razors that were returned under the warranty. 31 Recognized warranty expense related to December sales with an adjusting entry. 2017 Jan. 5 Sold 160 razors for $11,200 cash. 17 Replaced 37 razors that were returned under the warranty. 31 Recognized warranty expense related to January sales with an adjusting entry. 1.1 Prepare journal entries to record above transactions and adjustments for 2016. View transaction list 1 Record the sales revenue of 80 razors for $5,600 cash. 2 Record the cost of goods sold for 80 razors. 3 Record the estimated warranty expense at 9% of November sales. 4 Record the replacement of 16 razors that were returned under the warranty. Credit 5 Record the sales revenue of 240 razors for $16,800 cash. 6 Record the cost of goods sold for 240 razors. 7 Record the replacement of 32 razors that were returned

EACH RAZOR COST 15 DOLLARS

EACH RAZOR COST 15 DOLLARS