Answered step by step

Verified Expert Solution

Question

1 Approved Answer

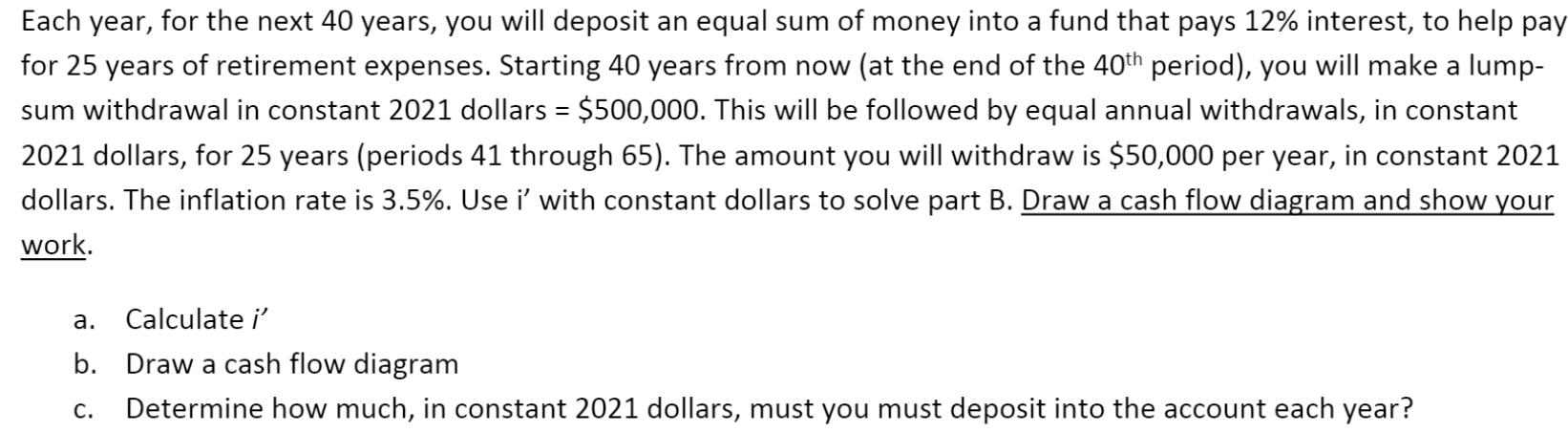

Each year, for the next 40 years, you will deposit an equal sum of money into a fund that pays 12% interest, to help

Each year, for the next 40 years, you will deposit an equal sum of money into a fund that pays 12% interest, to help pay for 25 years of retirement expenses. Starting 40 years from now (at the end of the 40th period), you will make a lump- sum withdrawal in constant 2021 dollars = $500,000. This will be followed by equal annual withdrawals, in constant %3D 2021 dollars, for 25 years (periods 41 through 65). The amount you will withdraw is $50,000 per year, in constant 2021 dollars. The inflation rate is 3.5%. Use i' with constant dollars to solve part B. Draw a cash flow diagram and show your work. . Calculate i' b. Draw a cash flow diagram . Determine how much, in constant 2021 dollars, must you must deposit into the account each year?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Nominal rate of interest 12 Inflation rate 35 Real rate of interest 1 012 1 0035 1 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started