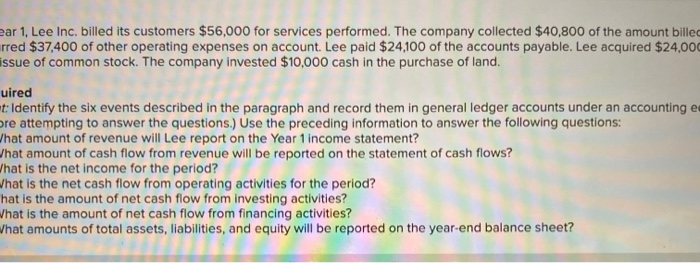

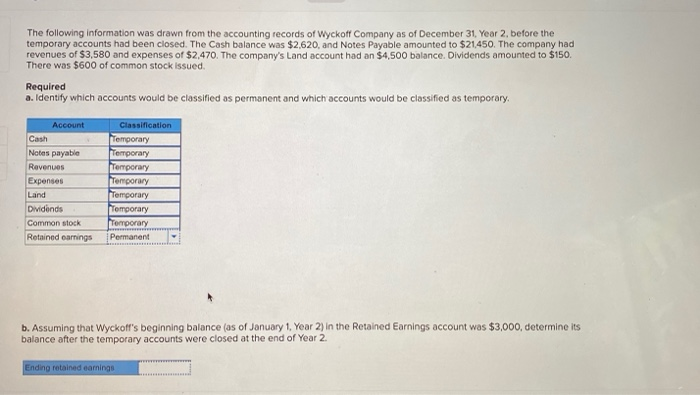

ear 1, Lee Inc. billed its customers $56,000 for services performed. The company collected $40,800 of the amount bille rred $37,400 of other operating expenses on account. Lee paid $24,100 of the accounts payable. Lee acquired $24,00 issue of common stock. The company invested $10,000 cash in the purchase of land. uired t: Identify the six events described in the paragraph and record them in general ledger accounts under an accounting e pre attempting to answer the questions. Use the preceding information to answer the following questions: hat amount of revenue will Lee report on the Year 1 income statement? What amount of cash flow from revenue will be reported on the statement of cash flows? That is the net income for the period? What is the net cash flow from operating activities for the period? hat is the amount of net cash flow from investing activities? what is the amount of net cash flow from financing activities? what amounts of total assets, liabilities, and equity will be reported on the year-end balance sheet? The following information was drawn from the accounting records of Wyckoff Company as of December 31, Year 2. before the temporary accounts had been closed. The Cash balance was $2.620 and Notes Payable amounted to $21.450. The company had revenues of $3,580 and expenses of $2,470. The company's Land account had an $4,500 balance. Dividends amounted to $150. There was $600 of common stock issued. Required a. Identify which accounts would be classified as permanent and which accounts would be classified as temporary. Account Cash Notes payable Revenues Expenses Land Dividends Common stock Retained earnings Classification Temporary Temporary Termporary Temporary Temporary Temporary Temporary Permanent b. Assuming that Wyckoff's beginning balance (as of January 1, Year 2) in the Retained Earnings account was $3,000, determine its balance after the temporary accounts were closed at the end of Year 2 Ending retained earnings ear 1, Lee Inc. billed its customers $56,000 for services performed. The company collected $40,800 of the amount bille rred $37,400 of other operating expenses on account. Lee paid $24,100 of the accounts payable. Lee acquired $24,00 issue of common stock. The company invested $10,000 cash in the purchase of land. uired t: Identify the six events described in the paragraph and record them in general ledger accounts under an accounting e pre attempting to answer the questions. Use the preceding information to answer the following questions: hat amount of revenue will Lee report on the Year 1 income statement? What amount of cash flow from revenue will be reported on the statement of cash flows? That is the net income for the period? What is the net cash flow from operating activities for the period? hat is the amount of net cash flow from investing activities? what is the amount of net cash flow from financing activities? what amounts of total assets, liabilities, and equity will be reported on the year-end balance sheet? The following information was drawn from the accounting records of Wyckoff Company as of December 31, Year 2. before the temporary accounts had been closed. The Cash balance was $2.620 and Notes Payable amounted to $21.450. The company had revenues of $3,580 and expenses of $2,470. The company's Land account had an $4,500 balance. Dividends amounted to $150. There was $600 of common stock issued. Required a. Identify which accounts would be classified as permanent and which accounts would be classified as temporary. Account Cash Notes payable Revenues Expenses Land Dividends Common stock Retained earnings Classification Temporary Temporary Termporary Temporary Temporary Temporary Temporary Permanent b. Assuming that Wyckoff's beginning balance (as of January 1, Year 2) in the Retained Earnings account was $3,000, determine its balance after the temporary accounts were closed at the end of Year 2 Ending retained earnings