Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Earbeats Ltd. made the following expenditures in Fiscal 2021. Please indicate whether each of the following costs should be recorded to the land, building,

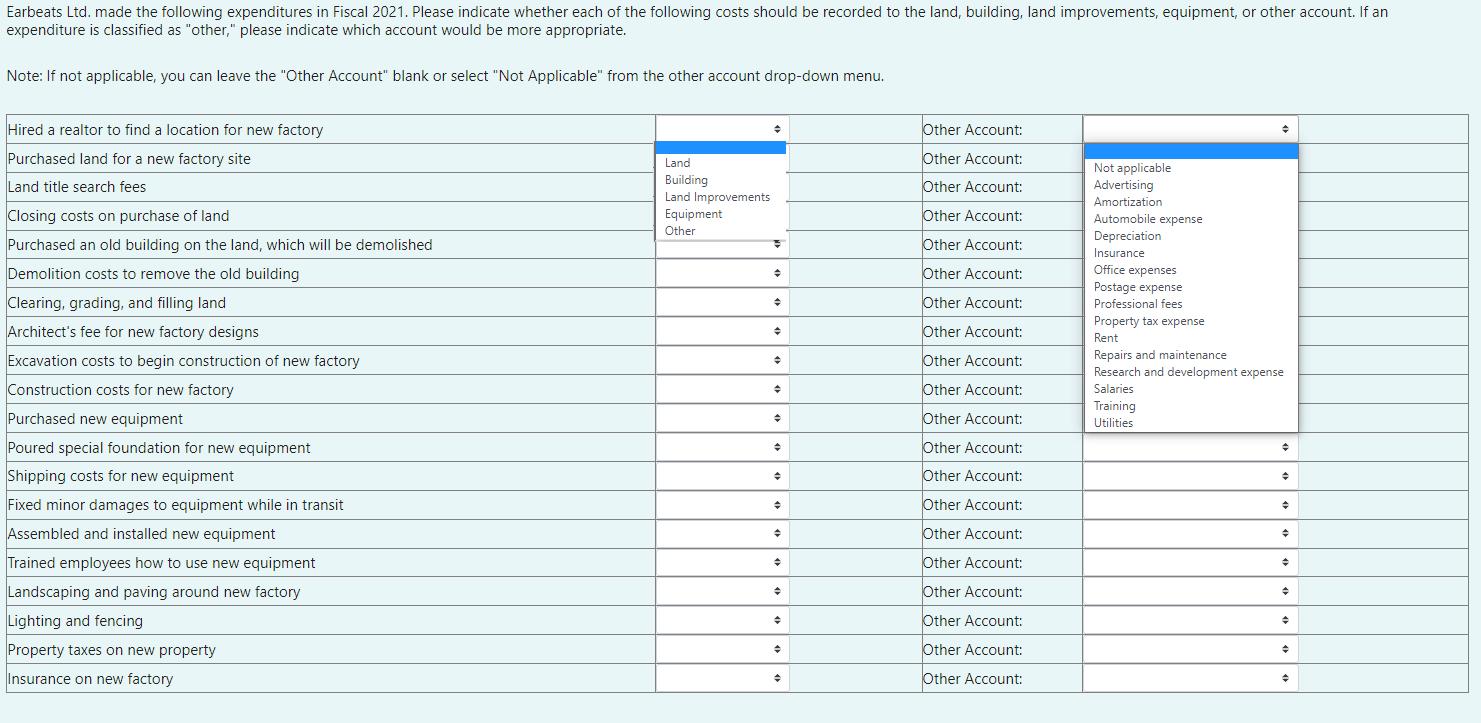

Earbeats Ltd. made the following expenditures in Fiscal 2021. Please indicate whether each of the following costs should be recorded to the land, building, land improvements, equipment, or other account. If an expenditure is classified as "other," please indicate which account would be more appropriate. Note: If not applicable, you can leave the "Other Account" blank or select "Not Applicable" from the other account drop-down menu. Hired a realtor to find a location for new factory Purchased land for a new factory site Land title search fees Closing costs on purchase of land Purchased an old building on the land, which will be demolished Demolition costs to remove the old building Clearing, grading, and filling land Architect's fee for new factory designs Excavation costs to begin construction of new factory Construction costs for new factory Purchased new equipment Poured special foundation for new equipment Shipping costs for new equipment Fixed minor damages to equipment while in transit Assembled and installed new equipment Trained employees how to use new equipment Landscaping and paving around new factory Lighting and fencing Property taxes on new property Insurance on new factory Land Building Land Improvements Equipment Other + 3 + = + + + + + + + Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: Other Account: + Not applicable Advertising Amortization Automobile expense Depreciation Insurance Office expenses Postage expense Professional fees Property tax expense Rent Repairs and maintenance Research and development expense Salaries Training Utilities. + + + + +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Other Professional Fees 2 Land 3 Land 4 Land 5 Building 6 Building 7 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started