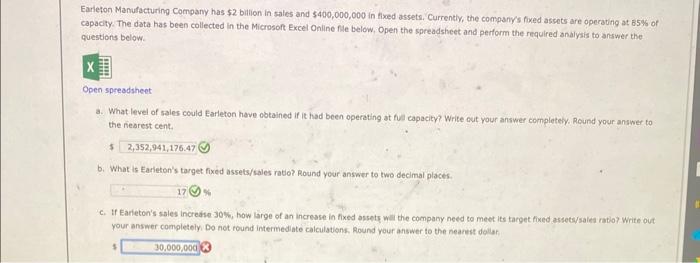

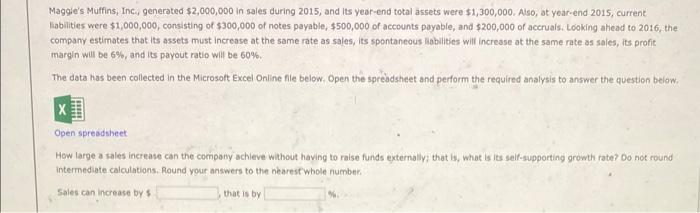

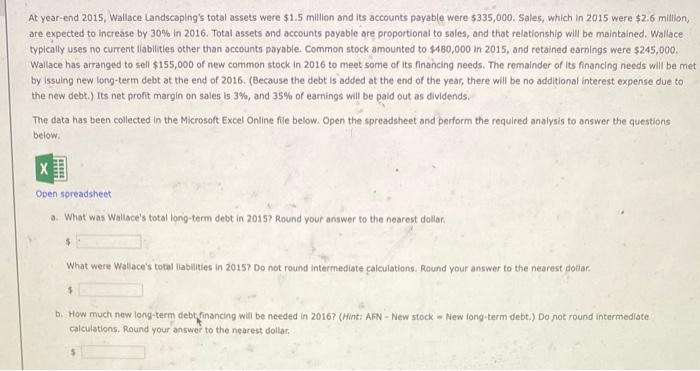

Earleton Manufacturing Company has $2 bilion in sales and 5400,000,000 in fixed assets. Currently, the company's fixed ascets are operating at 65 ts of capacity. The data has been collected in the Microsoft Excel Online file below, Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What level of sales could Earleton have obtained if it had been operating at ful capacity? Write cut your answer completely. Round your answer to the nearest cent. 3 b. What is Earleton's target fixed assets/sales ratio? Round your answer to two decimal places. c. If Earleton's sales incredse 30\%, how large of an incresse in fixed assets whll the company need to meet its target fixed assetsisales ratio? Write out. your answer completely, Do not round intermediate calculations, Round your answer to the nearest dollar: Maggle's Muffins, Inc, generated $2,000,000 in sales during 2015, and its year-end total assets were $1,300,000. Also, at year-end 2015, current liabilities were $1,000,000, consisting of $300,000 of notes payable, $500,000 of accounts poyable, and $200,000 of accruals. Looking ahead to 2016 , the company estimates that its assets must increase at the same rate as sales, its spontaneous habilities will increase ot the same rate as sales, its profit margin will be 6%, and its payout ratio will be 60%. The data has been collected in the Microsoft Excel Online fle below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet How large a sales increase can the company achieve without having to raise funds externally; that is, what is its self-supporting growth rate? Do not round intermediate calculations. Round your answers to the nearesf whole number. sales can increase bys that is by At year-end 2015, Wallace Landscaping's total assets were $1.5 million and its accounts payable were $335,000. Sales, which in 2015 were $2.6 million, are expected to increase by 30% in 2016. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current llabilities other than accounts payable. Common stock amounted to $480,000 in 2015 , and retained earnings were $245,000. Wallace has arranged to sell $155,000 of new common stock in 2016 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2016. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on saies is 3%, and 35% of earnings will be paid out as dividends. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What was Wallace's total long-term debt in 20157 Round your answer to the nearest dollar. What were Wallace's total liablities in 20157 Do not round intermediate calculations. Round your answer to the nearest doilar. 5 b. How much new long-term debtfinancing will be nceded in 2016? (Hint: AfN - New stock = New long-term debt.) Do not round intermediate calculations. Round your answer to the nearest dollar. 5