Question

Earlier today I posted the problem listed below and I received the answers in the below screenshot. However, I am confused because I was under

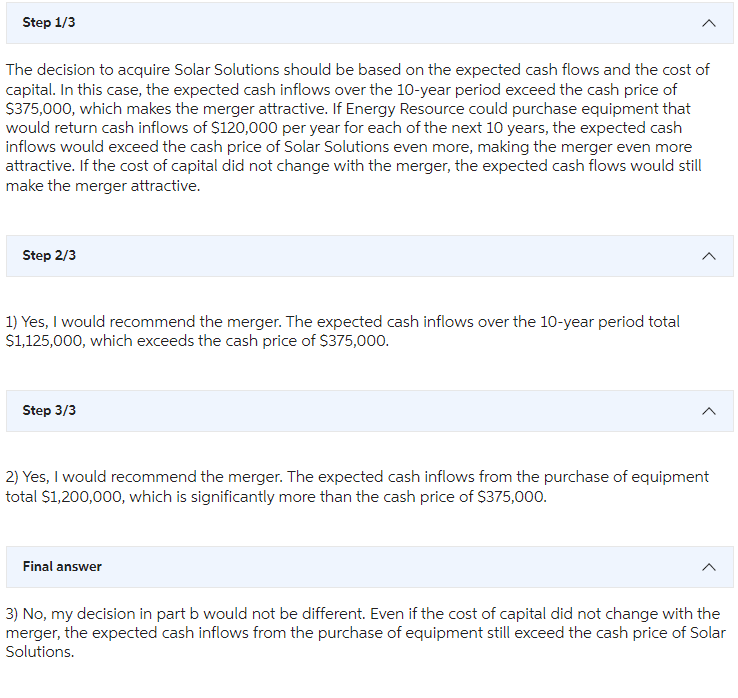

Earlier today I posted the problem listed below and I received the answers in the below screenshot. However, I am confused because I was under the impression that this problem required the calculation of the net present value of the cash inflows. I'm I wrong in thinking that NPV should be calculated or is the answer that was provided incorrect?

=======================================================================================================================================

THE PROBLEM I POSTED:

Cash acquisition decision Solar Solutions is being considered for acquisition by Energy Resource. Energy Resource believes the combination would increase its cash inflows by $75,000 for each of the next five years and by $150,000 for each of the following five years. Solar Solutions has high financial leverage and Energy Resource can expect its cost of capital to increase from 11% to 14% if the merger is undertaken. The cash price of Solar Solutions is $375,000.

1) Would you recommend the merger?

2) Would you recommend the merger if Energy Resource could use the $375,000 to purchase equipment that will return cash inflows of $120,000 per year for each of the next 10 years?

3) If the cost of capital did not change with the merger, would your decision in part b be different? Explain.

THE ANSWERS THAT WERE PROVIDED:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started