Answered step by step

Verified Expert Solution

Question

1 Approved Answer

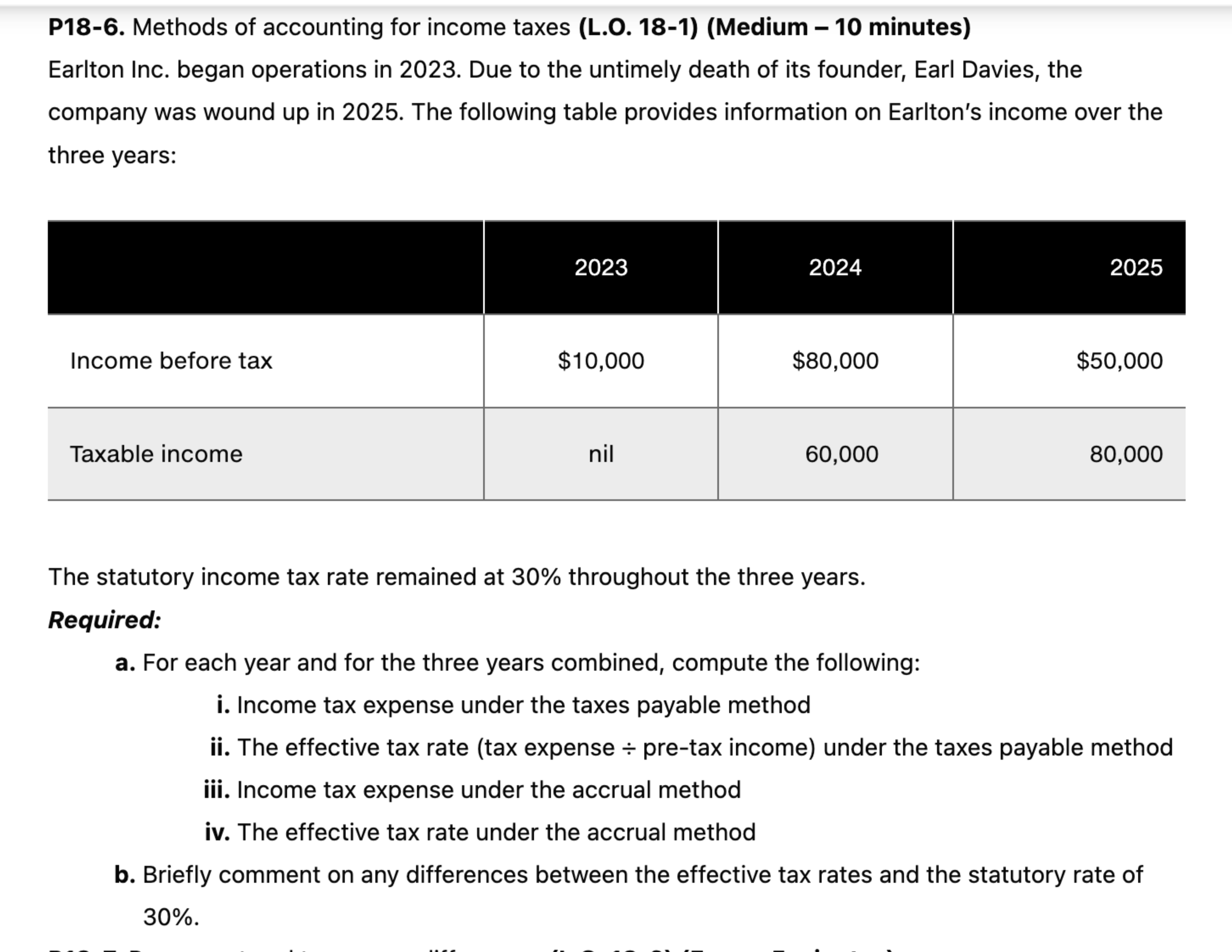

Earlton Inc. began operations in 2 0 2 3 . Due to the untimely death of its founder, Earl Davies, the company was wound up

Earlton Inc. began operations in Due to the untimely death of its founder, Earl Davies, the company was wound up in The following table provides information on Earlton's income over the three years:

The statutory income tax rate remained at throughout the three years.

Required:

a For each year and for the three years combined, compute the following:

i Income tax expense under the taxes payable method

ii The effective tax rate tax expense pretax income under the taxes payable method

iii. Income tax expense under the accrual method

iv The effective tax rate under the accrual method

b Briefly comment on any differences between the effective tax rates and the statutory rate of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started