Question

Early in 2019, Feller Corporation was formed with authorization to issue 50,000 shares of $1 par value common stock. All shares were issued at a

Early in 2019, Feller Corporation was formed with authorization to issue 50,000 shares of $1 par value common stock. All shares were issued at a price of $8 per share. The corporation reported net income of $95,000 in 2019, $27,500 in 2020, and $75,700 in 2021. No dividends were declared in any of these three years.

In 2020, the company purchased its own shares for $35,000 in the open market. In 2021, it reissued all of its treasury stock for $40,000.

Required:

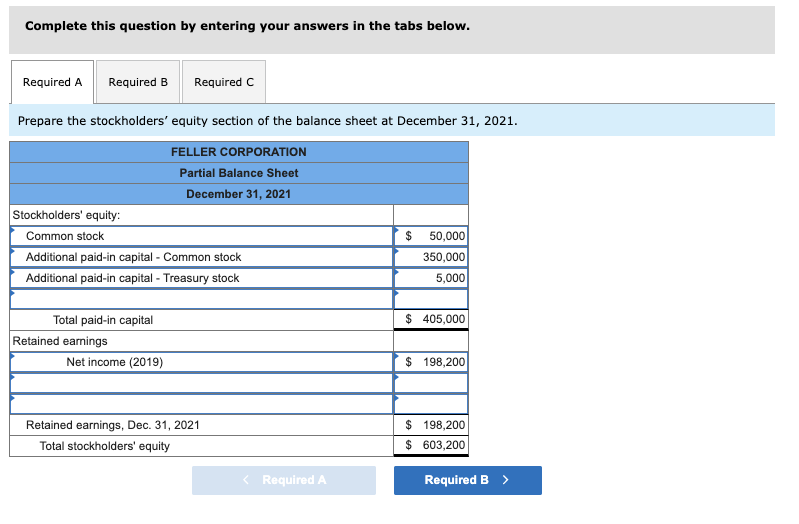

a. Prepare the stockholders equity section of the balance sheet at December 31, 2021.

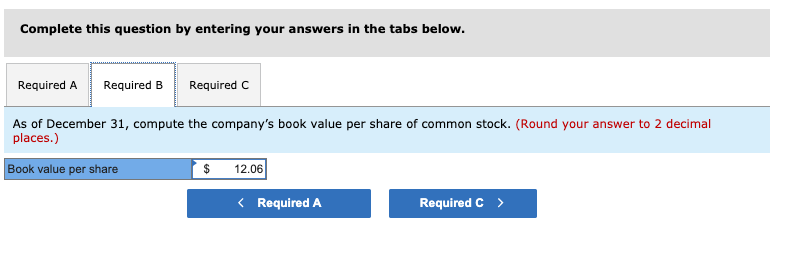

b. As of December 31, compute the companys book value per share of common stock.

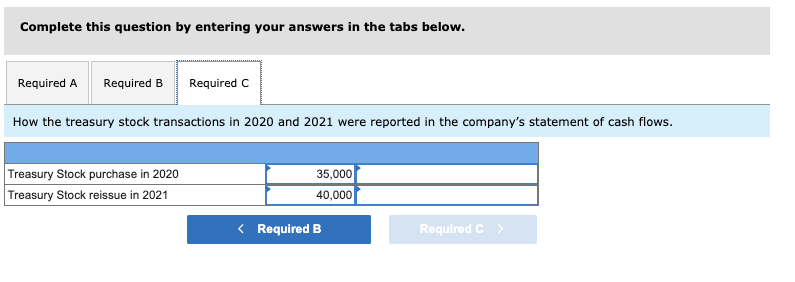

c. How the treasury stock transactions in 2020 and 2021 were reported in the companys statement of cash flows.

Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare the stockholders' equity section of the balance sheet at December 31, 2021. FELLER CORPORATION Partial Balance Sheet December 31, 2021 Stockholders' equity: Common stock Additional paid-in capital - Common stock Additional paid-in capital - Treasury stock $ 50,000 350,000 5,000 $ 405,000 Total paid-in capital Retained earnings Net income (2019) $ 198,200 Retained earnings, Dec. 31, 2021 Total stockholders' equity $ 198,200 $ 603,200 Required A Required B > Complete this question by entering your answers in the tabs below. Required A Required B Required As of December 31, compute the company's book value per share of common stock. (Round your answer to 2 decimal places.) Book value per share 12.06 Complete this question by entering your answers in the tabs below. Required A Required B Required C How the treasury stock transactions in 2020 and 2021 were reported in the company's statement of cash flows. Treasury Stock purchase in 2020 Treasury Stock reissue in 2021 35,000 40,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started