Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jones Equipment is a private company that sells and installs HVAC systems. Jones offer payment terms of 2/10, n/30, where customers making payment within

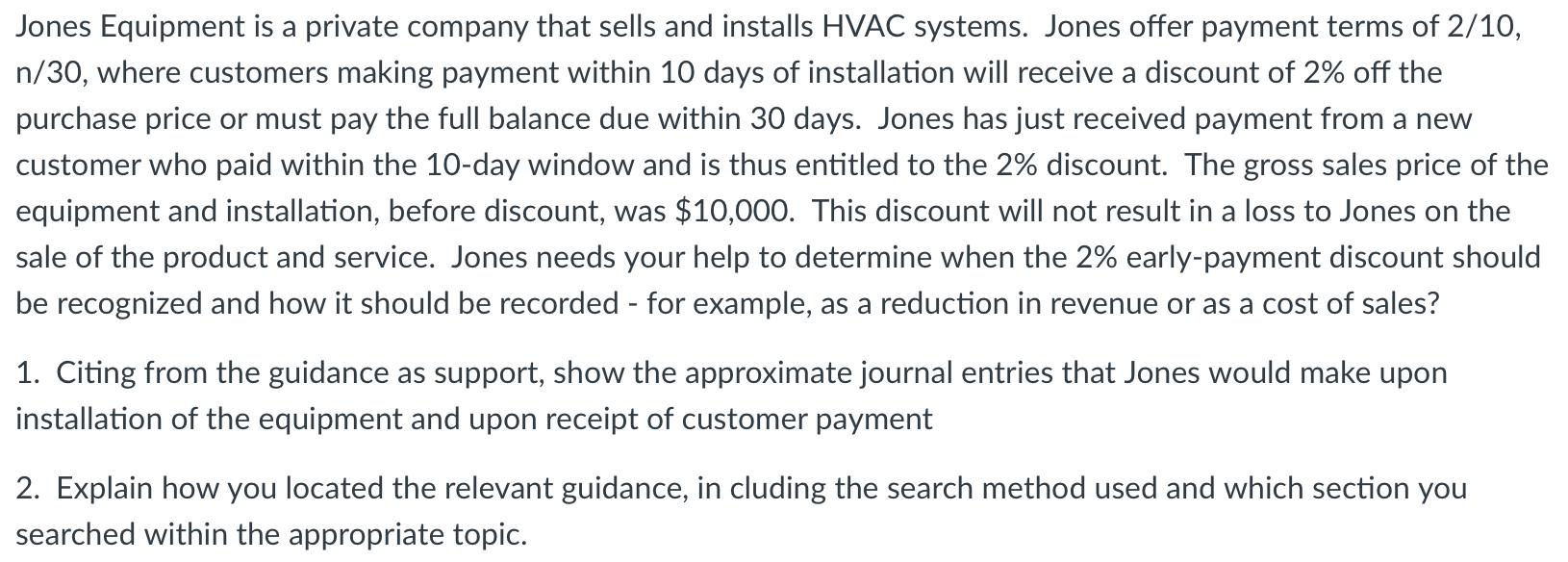

Jones Equipment is a private company that sells and installs HVAC systems. Jones offer payment terms of 2/10, n/30, where customers making payment within 10 days of installation will receive a discount of 2% off the purchase price or must pay the full balance due within 30 days. Jones has just received payment from a new customer who paid within the 10-day window and is thus entitled to the 2% discount. The gross sales price of the equipment and installation, before discount, was $10,000. This discount will not result in a loss to Jones on the sale of the product and service. Jones needs your help to determine when the 2% early-payment discount should be recognized and how it should be recorded - for example, as a reduction in revenue or as a cost of sales? 1. Citing from the guidance as support, show the approximate journal entries that Jones would make upon installation of the equipment and upon receipt of customer payment 2. Explain how you located the relevant guidance, in cluding the search method used and which section you searched within the appropriate topic.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started