Answered step by step

Verified Expert Solution

Question

1 Approved Answer

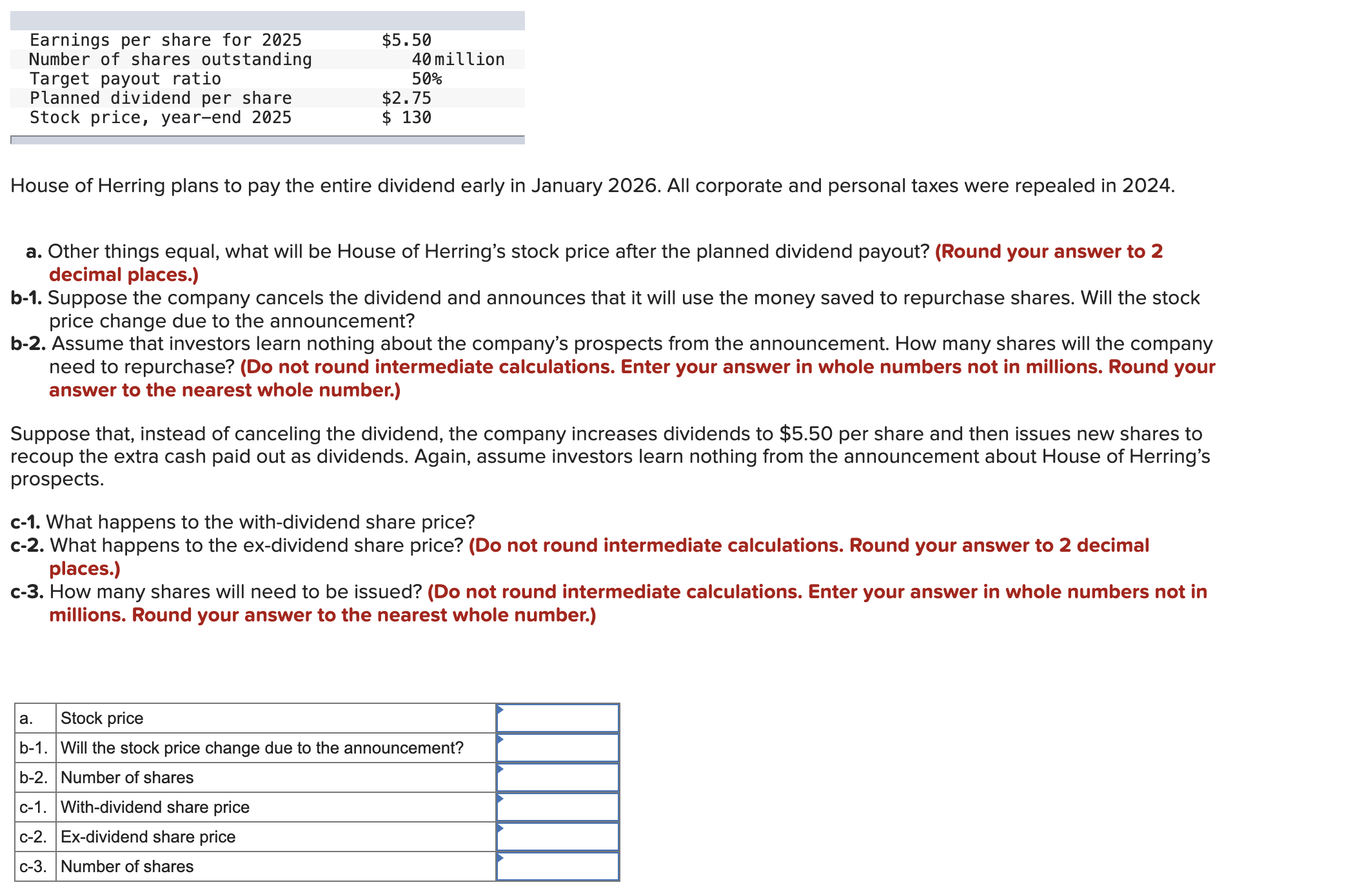

Earnings per share for 2 0 2 5 Number of shares outstanding Target payout ratio Planned dividend per share Stock price, year - end 2

Earnings per share for

Number of shares outstanding

Target payout ratio

Planned dividend per share

Stock price, yearend

$

million

$

$

House of Herring plans to pay the entire dividend early in January All corporate and personal taxes were repealed in

a Other things equal, what will be House of Herring's stock price after the planned dividend payout? Round your answer to

decimal places.

b Suppose the company cancels the dividend and announces that it will use the money saved to repurchase shares. Will the stock

price change due to the announcement?

b Assume that investors learn nothing about the company's prospects from the announcement. How many shares will the company

need to repurchase? Do not round intermediate calculations. Enter your answer in whole numbers not in millions. Round your

answer to the nearest whole number.

Suppose that, instead of canceling the dividend, the company increases dividends to $ per share and then issues new shares to

recoup the extra cash paid out as dividends. Again, assume investors learn nothing from the announcement about House of Herring's

prospects.

c What happens to the withdividend share price?

c What happens to the exdividend share price? Do not round intermediate calculations. Round your answer to decimal

places.

c How many shares will need to be issued? Do not round intermediate calculations. Enter your answer in whole numbers not in

millions. Round your answer to the nearest whole number.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started