Answered step by step

Verified Expert Solution

Question

1 Approved Answer

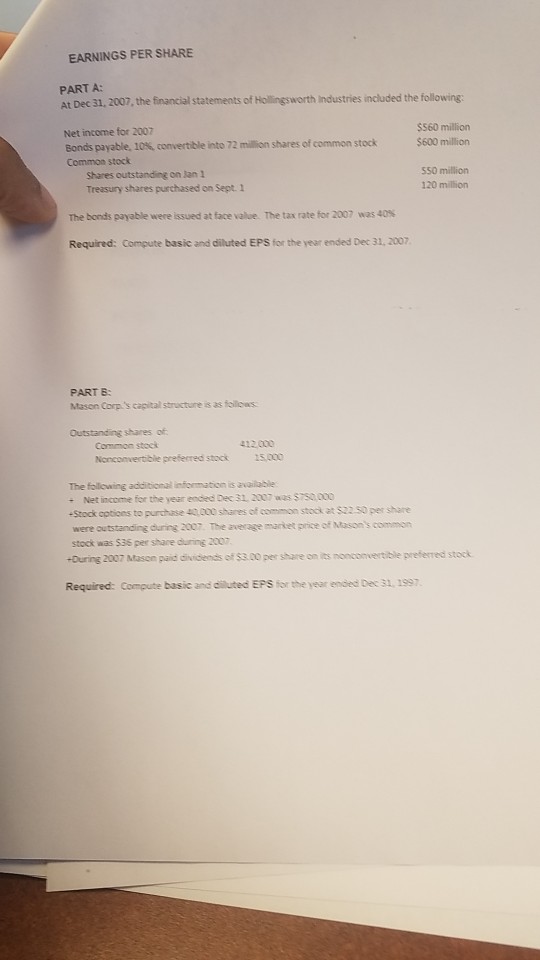

EARNINGS PER SHARE PART A: At Dec 31, 2007, the financial statements of Hiollingsworth Industries included the following Net income for 2007 Bonds payable, 10%

EARNINGS PER SHARE PART A: At Dec 31, 2007, the financial statements of Hiollingsworth Industries included the following Net income for 2007 Bonds payable, 10% convertible into 72 million shares of common stock Common stock $560 milliorn $600 million 550 milliorn Shares outstanding on Jan 1 Treasury shares purchased on Sept. 1 120 million The bonds payable were issued at face value. Thetar rate for 2007 was 40% Required: Compute basic and diluted EPS for the year ended Dec 31, 2007 PART B Mason Corp's capital structure is as follows Outstanding shares of Common stock 412 000 Nonconvertibile preferred stock 25.000 The follewing additional information is available : Net income for the year endes bc 31 300 w sa -Stock cptices to purchase 40.000 shares ofcmmon stock at $22 50 per share were outstanding during 2007. The average market price of Mason's common stock was S3s per share during 200 +During 2007 Masce paid dividends of $3.00 per share on its nonconvertible preferred stock Required: Compute basic and diluted EPS for the year ended Dec 31, 1997

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started