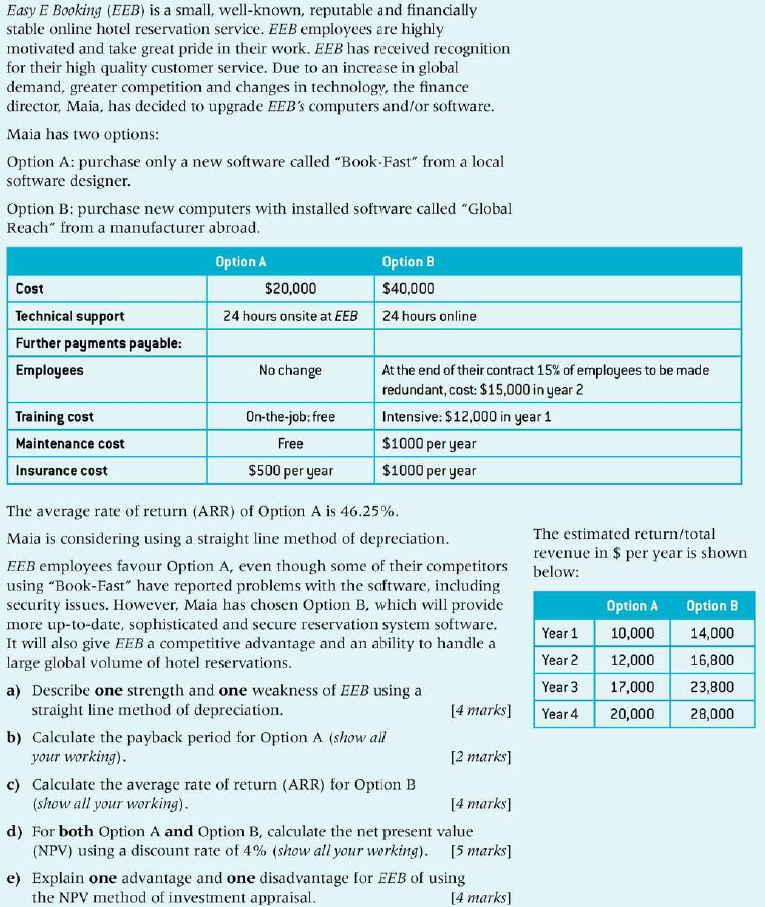

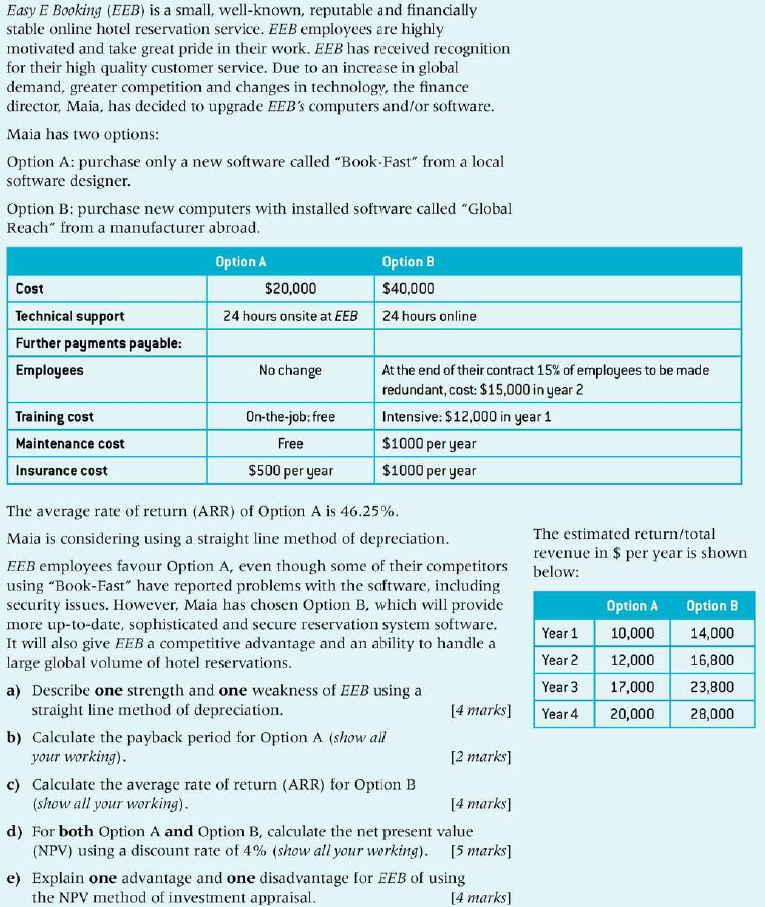

Easy E Booking (EEB) is a small, well-known, reputable and financially stable online hotel reservation service. EEB employees are highly motivated and take great pride in their work. EEB has received recognition for their high quality customer service. Due to an increase in global demand greater competition and changes in technology, the finance director, Maia, has decided to upgrade EEB's computers and/or software. Maia has two options: Option A: purchase only a new software called "Book-Fast" from a local software designer. Option B: purchase new computers with installed software called "Global Reach" from a manufacturer abroad. Option A Option B Cost $20,000 $40,000 Technical support 24 hours onsite at EEB 24 hours online Further payments payable: Employees No change At the end of their contract 15% of employees to be made redundant, cost: $15,000 in year 2 Training cost On-the-job: free Intensive: $12,000 in year 1 Maintenance cost Free $1000 per year Insurance cost $500 per year $1000 per year The estimated return/total revenue in $ per year is shown below: The average rate of return (ARR) of Option A is 46.25%. Maia is considering using a straight line method of depreciation. EEB employees favour Option A, even though some of their competitors using "Book-Fast" have reported problems with the software, including security issues. However, Maia has chosen Option B, which will provide more up-to-date, sophisticated and secure reservation system software. It will also give EEB a competitive advantage and an ability to handle a large global volume of hotel reservations. a) Describe one strength and one weakness of EEB using a straight line method of depreciation. [4 marks] b) Calculate the payback period for Option A (show all your working). [2 marks] c) Calculate the average rate of return (ARR) for Option B (show all your working). [4 marks] d) For both Option A and Option B, calculate the net present value (NPV) using a discount rate of 4% (show all your working). [5 marks] e) Explain one advantage and one disadvantage for EEB of using the NPV method of investment appraisal. [4 marks) Year 1 Year 2 Year 3 Year 4 Option A 10,000 12,000 17,000 20,000 Option B 14,000 16,800 23,800 28,000