Question

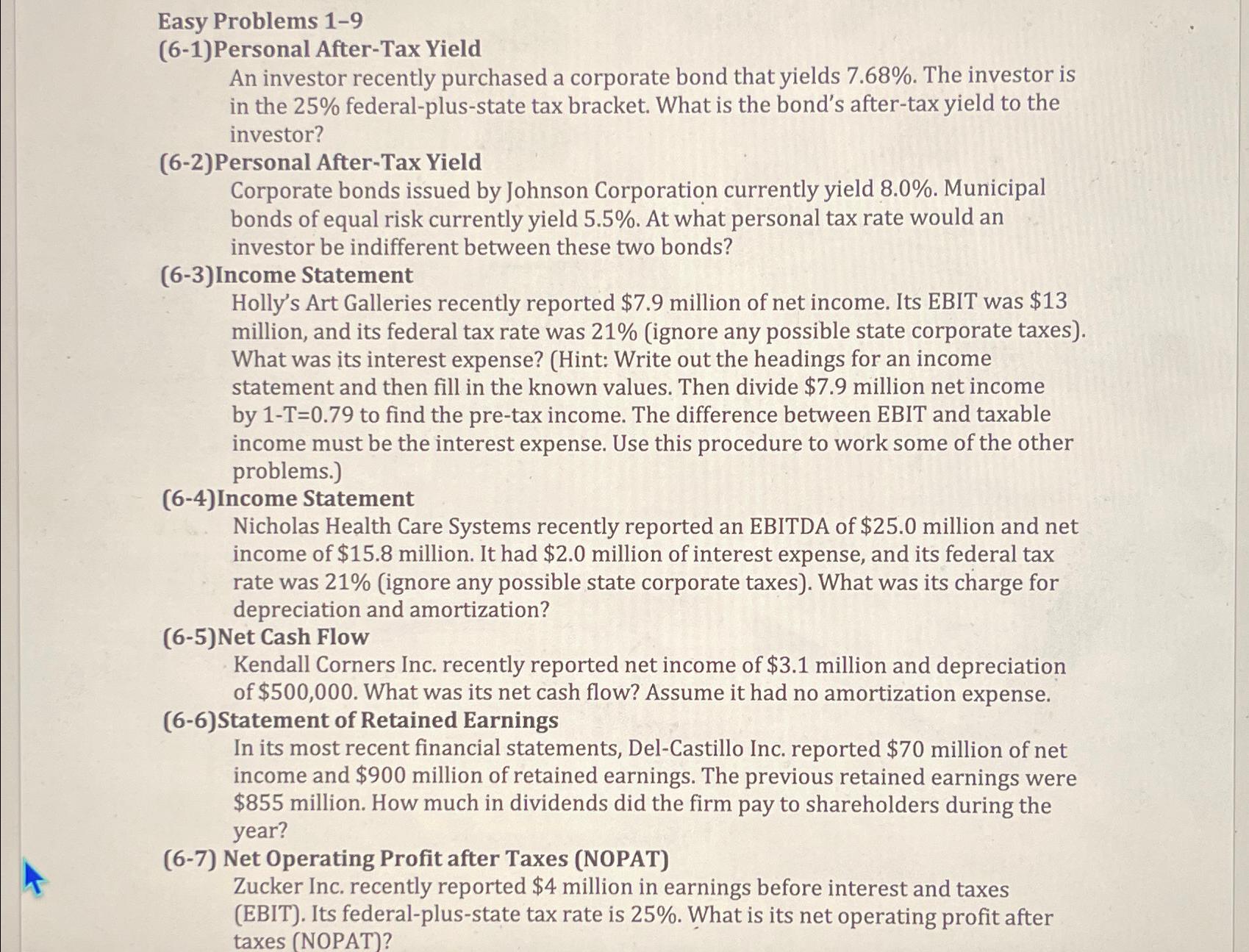

Easy Problems 1-9 (6-1)Personal After-Tax Yield An investor recently purchased a corporate bond that yields 7.68%. The investor is in the 25% federal-plus-state tax bracket.

Easy Problems 1-9\ (6-1)Personal After-Tax Yield\ An investor recently purchased a corporate bond that yields 7.68%. The investor is in the

25%federal-plus-state tax bracket. What is the bond's after-tax yield to the investor?\ (6-2)Personal After-Tax Yield\ Corporate bonds issued by Johnson Corporation currently yield 8.0%. Municipal bonds of equal risk currently yield

5.5%. At what personal tax rate would an investor be indifferent between these two bonds?\ (6-3)Income Statement\ Holly's Art Galleries recently reported

$7.9million of net income. Its EBIT was

$13million, and its federal tax rate was

21%(ignore any possible state corporate taxes). What was its interest expense? (Hint: Write out the headings for an income statement and then fill in the known values. Then divide

$7.9million net income by

1-T=0.79to find the pre-tax income. The difference between EBIT and taxable income must be the interest expense. Use this procedure to work some of the other problems.)\ (6-4)Income Statement\ Nicholas Health Care Systems recently reported an EBITDA of

$25.0million and net income of

$15.8million. It had

$2.0million of interest expense, and its federal tax rate was

21%(ignore any possible state corporate taxes). What was its charge for depreciation and amortization?\ (6-5)Net Cash Flow\ Kendall Corners Inc. recently reported net income of

$3.1million and depreciation of

$500,000. What was its net cash flow? Assume it had no amortization expense.\ (6-6)Statement of Retained Earnings\ In its most recent financial statements, Del-Castillo Inc. reported

$70million of net income and

$900million of retained earnings. The previous retained earnings were

$855million. How much in dividends did the firm pay to shareholders during the year?\ (6-7) Net Operating Profit after Taxes (NOPAT)\ Zucker Inc. recently reported $4 million in earnings before interest and taxes\ (EBIT). Its federal-plus-state tax rate is

25%. What is its net operating profit after taxes (NOPAT)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started