Question

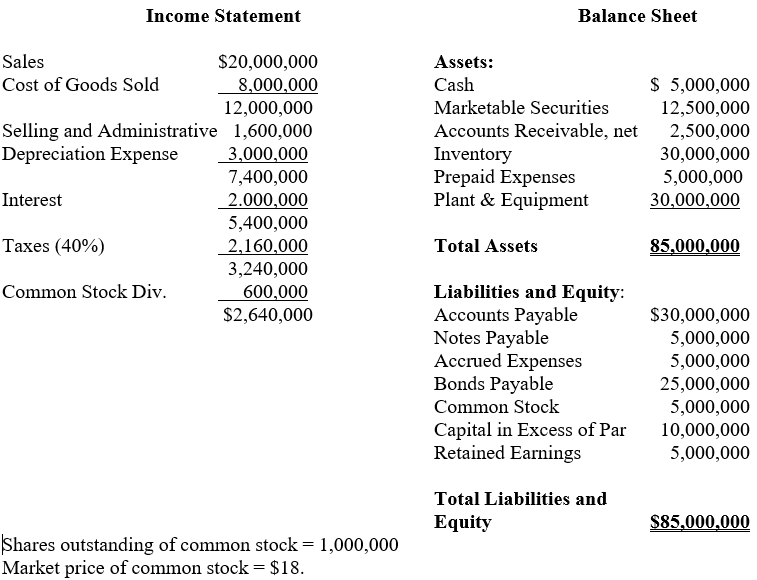

e.Based on the table below, the Inventory Turnover ratio is: 1.5 times 0.67% 0.67 times 1.5% .47 times f.Based on the table below, the Market

e.Based on the table below, the Inventory Turnover ratio is:

1.5 times

0.67%

0.67 times

1.5%

.47 times

f.Based on the table below, the Market to Book ratio is:

0.15

0.90

2.45

6.57

0.51

g.Based on the table below, the Net Profit margin is:

16.2%

60%

37%

13.7%

50%

h.Based on the table below, the Return on Equity is:

0.162%

16.2%

8.77%

13.7%

3.81%

i.Based on the table below, the Times Interest Earned ratio is:

3.7

0.62

1.5

0.27

2.7

j.Based on the table below, the Total Asset Turnover ratio is:

4.25 times

4.25 times

2.35 times

0.24 times

1.57 times

k.Based on the table below, the Total Debt to Total Asset ratio is:

0.76

0.59

1.31

76.4

.35

Income Statement Balance Sheet Sales $20,000,000 Cost of Goods Sold 8,000,000 12,000,000 Selling and Administrative 1,600,000 Depreciation Expense 3,000,000 7,400,000 Interest 2.000,000 5,400,000 Taxes (40%) 2,160,000 3,240,000 Common Stock Div. 600,000 $2,640,000 Assets: Cash Marketable Securities Accounts Receivable, net Inventory Prepaid Expenses Plant & Equipment $ 5,000,000 12,500,000 2,500,000 30,000,000 5,000,000 30,000,000 Total Assets 85,000,000 Liabilities and Equity: Accounts Payable Notes Payable Accrued Expenses Bonds Payable Common Stock Capital in Excess of Par Retained Earnings $30,000,000 5,000,000 5,000,000 25,000,000 5,000,000 10,000,000 5,000,000 Total Liabilities and Equity $85,000,000 Shares outstanding of common stock = 1,000,000 Market price of common stock = $18Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started