Answered step by step

Verified Expert Solution

Question

1 Approved Answer

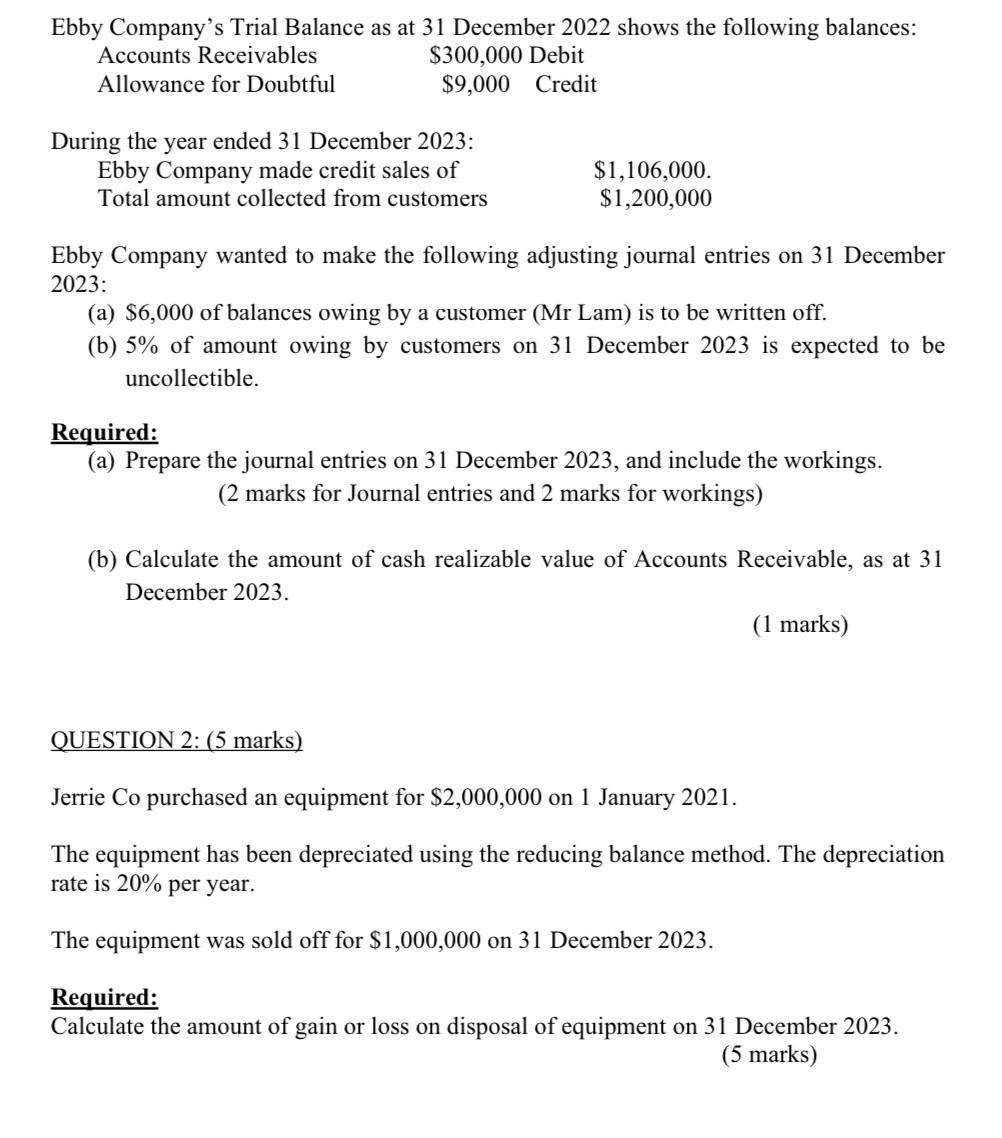

Ebby Company's Trial Balance as at 31 December 2022 shows the following balances: Accounts Receivables Allowance for Doubtful $300,000 Debit $9,000 Credit During the

Ebby Company's Trial Balance as at 31 December 2022 shows the following balances: Accounts Receivables Allowance for Doubtful $300,000 Debit $9,000 Credit During the year ended 31 December 2023: Ebby Company made credit sales of Total amount collected from customers $1,106,000. $1,200,000 Ebby Company wanted to make the following adjusting journal entries on 31 December 2023: (a) $6,000 of balances owing by a customer (Mr Lam) is to be written off. (b) 5% of amount owing by customers on 31 December 2023 is expected to be uncollectible. Required: (a) Prepare the journal entries on 31 December 2023, and include the workings. (2 marks for Journal entries and 2 marks for workings) (b) Calculate the amount of cash realizable value of Accounts Receivable, as at 31 December 2023. (1 marks) QUESTION 2: (5 marks) Jerrie Co purchased an equipment for $2,000,000 on 1 January 2021. The equipment has been depreciated using the reducing balance method. The depreciation rate is 20% per year. The equipment was sold off for $1,000,000 on 31 December 2023. Required: Calculate the amount of gain or loss on disposal of equipment on 31 December 2023. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Journal Entries on 31 December 2023 1 Write off balances owing by Mr Lam Date December 31 2023 Gen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663da36b7535f_964142.pdf

180 KBs PDF File

663da36b7535f_964142.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started