EBIT was not given in the question. Is there any way in getting that information with what you have?

EBIT was not given in the question. Is there any way in getting that information with what you have?

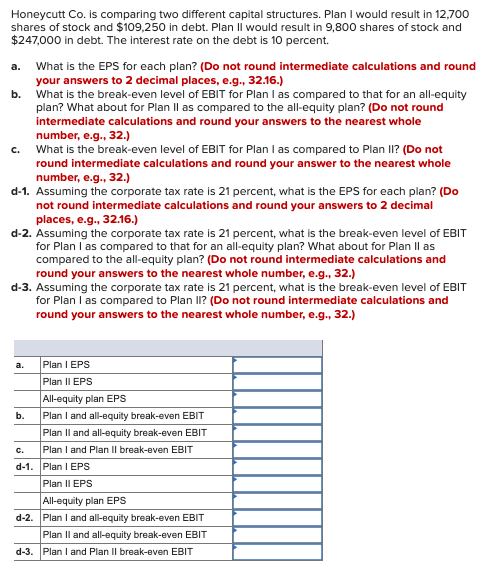

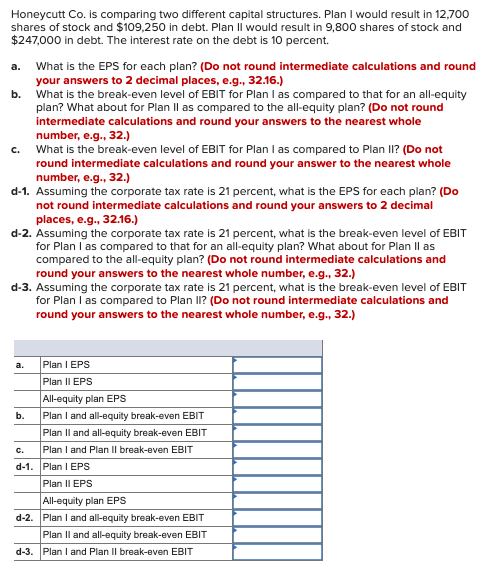

Honeycutt Co. is comparing two different capital structures. Plan I would result in 12,700 shares of stock and $109.250 in debt. Plan II would result in 9,800 shares of stock and $247,000 in debt. The interest rate on the debt is 10 percent. a. What is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. What is the break-even level of EBIT for Plan las compared to that for an all-equity plan? What about for Plan Il as compared to the all-equity plan? (Do not round Intermediate calculations and round your answers to the nearest whole number, e.g., 32.) What is the break-even level of EBIT for Plan I as compared to Plan II? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d-1. Assuming the corporate tax rate is 21 percent, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d-2. Assuming the corporate tax rate is 21 percent, what is the break-even level of EBIT for Plan I as compared to that for an all-equity plan? What about for Plan Il as compared to the all-equity plan? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) d-3. Assuming the corporate tax rate is 21 percent, what is the break-even level of EBIT for Plan las compared to Plan II? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Plan l EPS Plan II EPS All-equity plan EPS Plan I and all-equity break-even EBIT Plan II and all-equity break-even EBIT Plan I and Plan Il break-even EBIT Plan I EPS Plan II EPS d-1 d-2 All-equity plan EPS Plan I and all-equity break-even EBIT Plan II and all-equity break-even EBIT d-3. Plan and Plan Il break-even EBIT Honeycutt Co. is comparing two different capital structures. Plan I would result in 12,700 shares of stock and $109.250 in debt. Plan II would result in 9,800 shares of stock and $247,000 in debt. The interest rate on the debt is 10 percent. a. What is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. What is the break-even level of EBIT for Plan las compared to that for an all-equity plan? What about for Plan Il as compared to the all-equity plan? (Do not round Intermediate calculations and round your answers to the nearest whole number, e.g., 32.) What is the break-even level of EBIT for Plan I as compared to Plan II? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d-1. Assuming the corporate tax rate is 21 percent, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d-2. Assuming the corporate tax rate is 21 percent, what is the break-even level of EBIT for Plan I as compared to that for an all-equity plan? What about for Plan Il as compared to the all-equity plan? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) d-3. Assuming the corporate tax rate is 21 percent, what is the break-even level of EBIT for Plan las compared to Plan II? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Plan l EPS Plan II EPS All-equity plan EPS Plan I and all-equity break-even EBIT Plan II and all-equity break-even EBIT Plan I and Plan Il break-even EBIT Plan I EPS Plan II EPS d-1 d-2 All-equity plan EPS Plan I and all-equity break-even EBIT Plan II and all-equity break-even EBIT d-3. Plan and Plan Il break-even EBIT

EBIT was not given in the question. Is there any way in getting that information with what you have?

EBIT was not given in the question. Is there any way in getting that information with what you have?