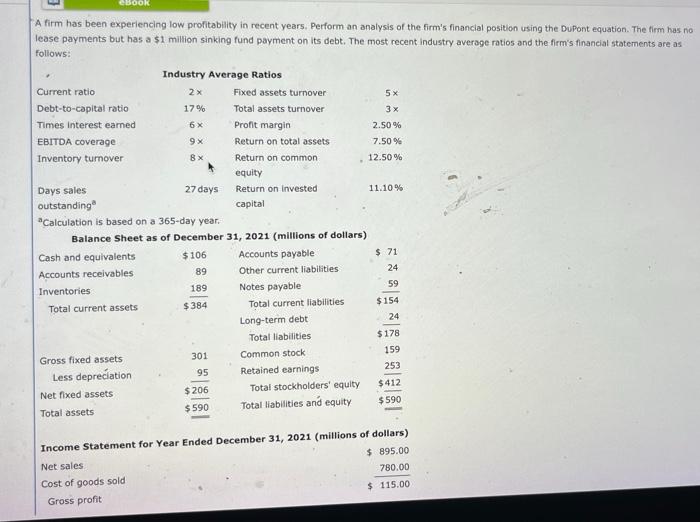

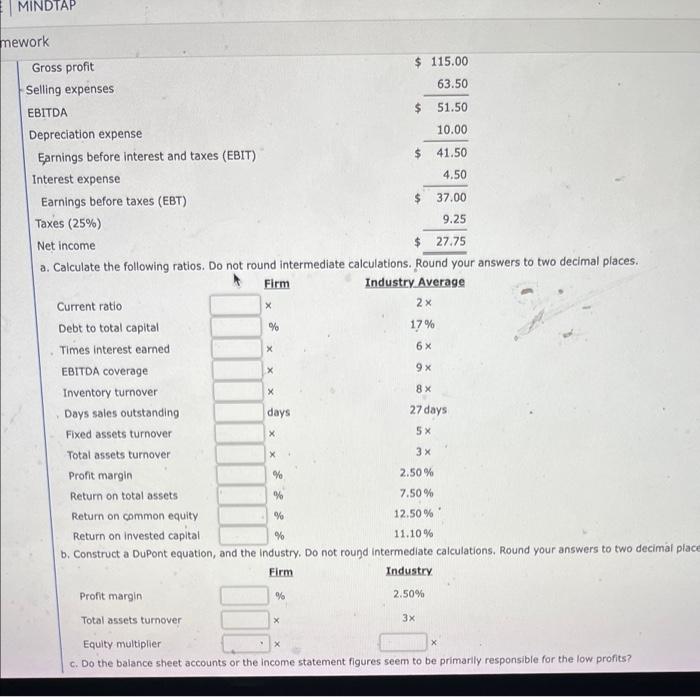

eBook A firm has been experiencing low profitability in recent years. Perform an analysis of the firm's financial position using the DuPont equation. The firm has no lease payments but has a $1 million sinking fund payment on its debt. The most recent industry average ratios and the firm's financial statements are as follows: Industry Average Ratios Current ratio. Fixed assets turnover 5x 2x 17% Debt-to-capital ratio Total assets turnover 3x Times Interest earned 6x Profit margin 2.50% EBITDA coverage 9x Return on total assets 7.50% Inventory turnover 8x Return on common 12.50% equity Days sales 27 days Return on invested 11.10% outstanding capital "Calculation is based on a 365-day year. Balance Sheet as of December 31, 2021 (millions of dollars) Cash and equivalents $106 Accounts payable $ 71 Accounts receivables 89 Other current liabilities 24 Inventories 189 Notes payable 59 Total current assets $384 Total current liabilities $154 24 $178 301 Common stock 159 253 95 Retained earnings $412 Net fixed assets $206 Total stockholders' equity Total liabilities and equity $590 $590 Total assets Income Statement for Year Ended December 31, 2021 (millions of dollars) $ 895.00 Net sales Cost of goods sold 780.00 $115.00 Gross profit Gross fixed assets Less depreciation Long-term debt Total liabilities MINDTAP mework Gross profit $115.00 63.50 Selling expenses 51.50 EBITDA 10.00 Depreciation expense 41.50 Earnings before interest and taxes (EBIT) Interest expense 4.50 Earnings before taxes (EBT) 37.00 Taxes (25%) 9.25 27.75 Net income a. Calculate the following ratios. Do not round intermediate calculations. Round your answers to two decimal places. Firm Industry Average Current ratio X 2x 17% Debt to total capital Times interest earned 6x EBITDA coverage 9x 8x Inventory turnover Days sales outstanding 27 days Y Fixed assets turnover 5X Total assets turnover 3x Profit margin % 2.50% Return on total assets % 7.50% Return on common equity % 12.50% Return on invested capital % 11.10% b. Construct a DuPont equation, and the industry. Do not round intermediate calculations. Round your answers to two decimal place Firm Industry 2.50% Profit margin % Total assets turnover X 3x X Equity multiplier c. Do the balance sheet accounts or the income statement figures seem to be primarily responsible for the low profits? % X Xx days X