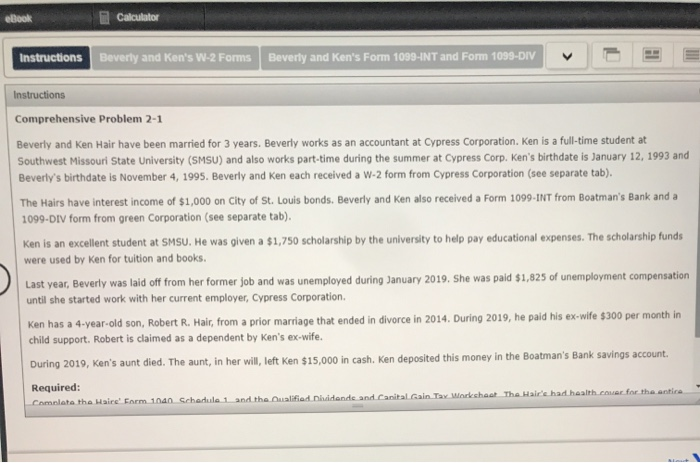

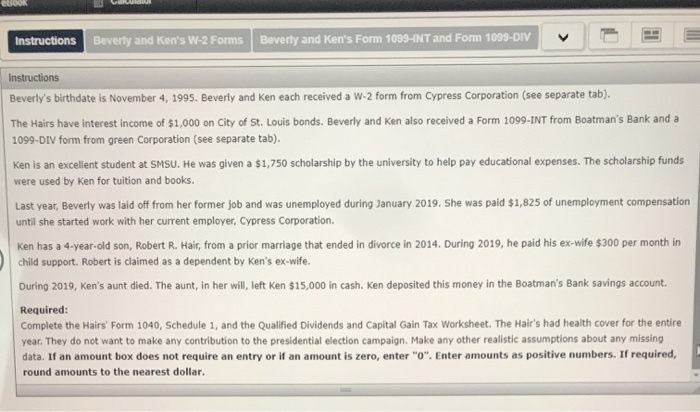

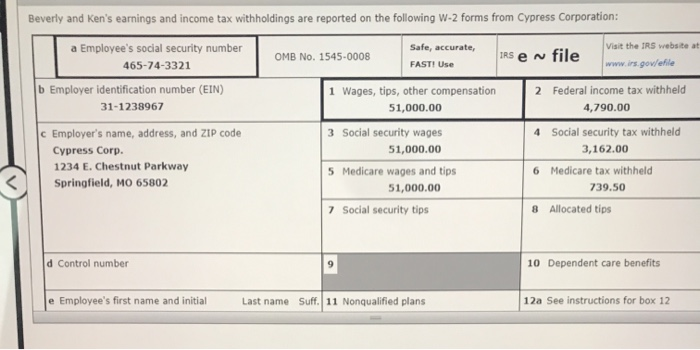

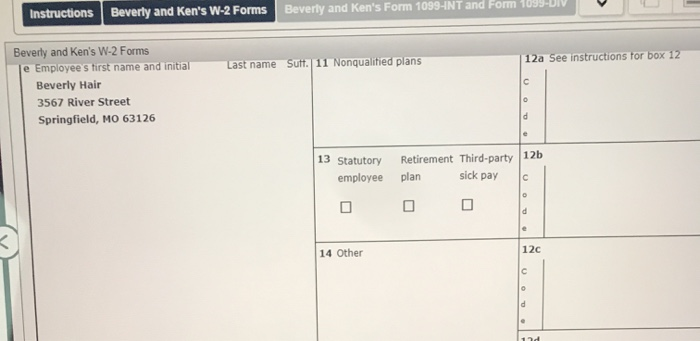

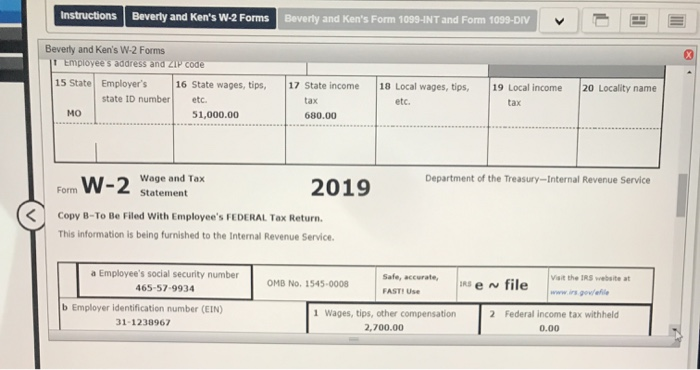

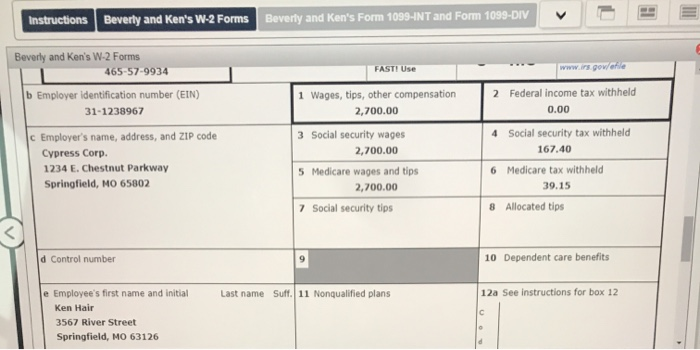

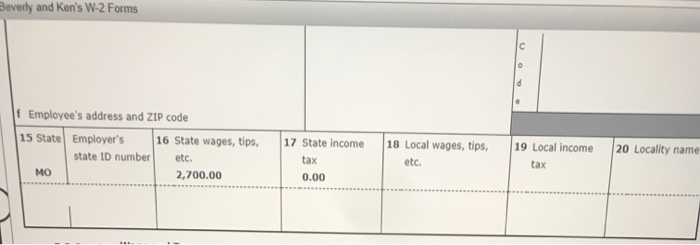

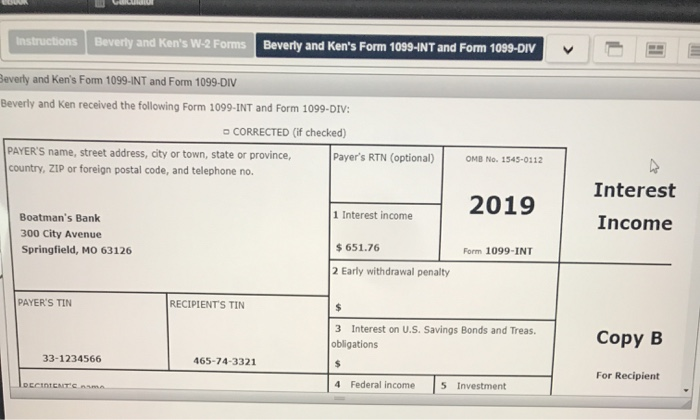

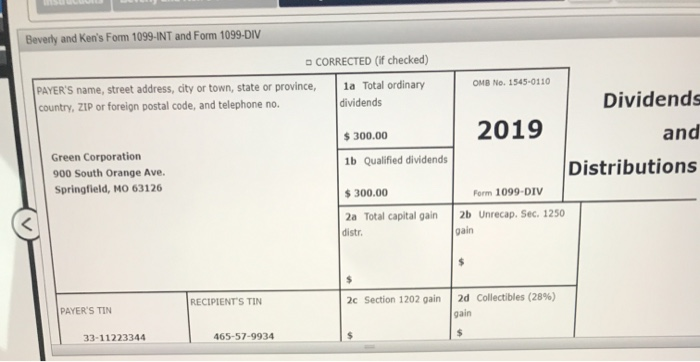

eBook Calculator Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV Instructions Comprehensive Problem 2-1 Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress Corporation. Ken is a full-time student at Southwest Missouri State University (SMSU) and also works part-time during the summer at Cypress Corp. Ken's birthdate is January 12, 1993 and Beverly's birthdate is November 4, 1995. Beverly and Ken each received a W-2 form from Cypress Corporation (see separate tab). The Hairs have interest income of $1,000 on City of St. Louis bonds. Beverly and Ken also received a Form 1099-INT from Boatman's Bank and a 1099-DIV form from green Corporation (see separate tab). Ken is an excellent student at SMSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Ken for tuition and books. Last year, Beverly was laid off from her former job and was unemployed during January 2019. She was paid $1,825 of unemployment compensation until she started work with her current employer, Cypress Corporation Ken has a 4-year-old son, Robert R. Hair, from a prior marriage that ended in divorce in 2014. During 2019, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Ken's ex-wife. During 2019, Ken's aunt died. The aunt, in her will, left Ken $15,000 in cash. Ken deposited this money in the Boatman's Bank savings account. Required: Comolate the Haire' Form 1040 Schedule 1 and the Qualified Dividende and Canital Gain Tax Worksheet The Hair'e had health come for the entire Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV V Instructions Beverly's birthdate is November 4, 1995. Beverly and Ken each received a W-2 form from Cypress Corporation (see separate tab). The Hairs have interest income of $1,000 on City of St. Louis bonds. Beverly and Ken also received a Form 1099-INT from Boatman's Bank and a 1099-DIV form from green Corporation (see separate tab). Ken is an excellent student at SMSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Ken for tuition and books. Last year, Beverly was laid off from her former job and was unemployed during January 2019. She was paid $1,825 of unemployment compensation until she started work with her current employer, Cypress Corporation. Ken has a 4-year-old son, Robert R. Hair, from a prior marriage that ended in divorce in 2014. During 2019, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Ken's ex-wife. During 2019, Ken's aunt died. The aunt, in her will, left Ken $15,000 in cash. Ken deposited this money in the Boatman's Bank savings account. Required: Complete the Hairs' Form 1040, Schedule 1, and the Qualified Dividends and Capital Gain Tax Worksheet. The Hair's had health cover for the entire year. They do not want to make any contribution to the presidential election campaign. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or if an amount is zero, enter "0". Enter amounts as positive numbers. If required, round amounts to the nearest dollar. Visit the IRS website at Beverly and Ken's earnings and income tax withholdings are reported on the following W-2 forms from Cypress Corporation: a Employee's social security number Safe, accurate, 465-74-3321 OMB No 1545-0008 IRS en file FASTI Use www.irs.gov/elle b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 31-1238967 51,000.00 4,790.00 C Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld Cypress Corp. 51,000.00 3,162.00 1234 E. Chestnut Parkway 5 Medicare wages and tips 6 Medicare tax withheld Springfield, MO 65802 51,000.00 739.50 Social security tips 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV Last name Sutt. 11 Nonqualified plans 12a See instructions for box 12 c Beverly and Ken's W-2 Forms e Employee's first name and initial Beverly Hair 3567 River Street Springfield, MO 63126 d 13 Statutory employee Retirement Third-party 12b plan sick pay d 14 Other 12c d Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV Beverly and Ken's W-2 Forms 1 Employees address and ZIP Code 15 State Employer's 16 State wages, tips, state ID number 51,000.00 20 Locality name etc. 17 State income tax 680.00 18 Local wages, tips, etc. 19 Local income tax MO Department of the Treasury-Internal Revenue Service Form W-2 Wage and Tax Statement 2019 Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. OMB No. 1545-0008 Safe, accurate, FAST! Use Refile a Employee's social security number 465-57-9934 b Employer identification number (EIN) 31-1238967 Visit the IRS website at 1 Wages, tips, other compensation 2,700.00 2 Federal income tax withheld 0.00 III Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV FASTI Use Beverly and Ken's W-2 Forms 465-57-9934 Employer identification number (EIN) 31-1238967 C Employer's name, address, and ZIP code Cypress Corp 1234 E. Chestnut Parkway Springfield, MO 65802 www.irs poulette 2 Federal income tax withheld 0.00 4 Social security tax withheld 1 Wages, tips, other compensation 2,700.00 3 Social security wages 2,700.00 5 Medicare wages and tips 2,700.00 7 Social security tips 167.40 6 Medicare tax withheld 39.15 8 Allocated tips d Control number 10 Dependent care benefits Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 e Employee's first name and initial Ken Hair 3567 River Street Springfield, MO 63126 Beverly and Ken's W-2 Forms d Employee's address and ZIP code 15 State Employer's 16 State wages, tips, state ID number etc. 2,700.00 17 State income tax 0.00 18 Local wages, tips, etc. 19 Local income tax 20 Locality name MO Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV Beverly and Ken's Form 1099-INT and Form 1099-DIV Beverly and Ken received the following Form 1099-INT and Form 1099-DIV: - CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, Payer's RTN (optional) country, ZIP or foreign postal code, and telephone no. OMB No 1545-0112 2019 1 Interest income Interest Income Boatman's Bank 300 City Avenue Springfield, MO 63126 Form 1099-INT $ 651.76 2 Early withdrawal penalty PAYER'S TIN RECIPIENT'S TIN $ 3 Interest on U.S. Savings Bonds and Treas. obligations Copy B 33-1234566 465-74-3321 $ For Recipient DECICNTC Am 4 Federal income 5 Investment OMB No. 1545-0110 Beverly and Ken's Form 1099-INT and Form 1099-DIV CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, 1a Total ordinary country, ZIP or foreign postal code, and telephone no. dividends Dividends $ 300.00 2019 and Green Corporation 900 South Orange Ave. 1b Qualified dividends Distributions Springfield, MO 63126 $ 300.00 Form 1099-DIV 2a Total capital gain 2b Unrecap. Sec. 1250 distr. gain RECIPIENT'S TIN 2c Section 1202 gain PAYER'S TIN 2d Collectibles (28%) gain $ 33-11223344 465-57-9934 eBook Calculator Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV Instructions Comprehensive Problem 2-1 Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress Corporation. Ken is a full-time student at Southwest Missouri State University (SMSU) and also works part-time during the summer at Cypress Corp. Ken's birthdate is January 12, 1993 and Beverly's birthdate is November 4, 1995. Beverly and Ken each received a W-2 form from Cypress Corporation (see separate tab). The Hairs have interest income of $1,000 on City of St. Louis bonds. Beverly and Ken also received a Form 1099-INT from Boatman's Bank and a 1099-DIV form from green Corporation (see separate tab). Ken is an excellent student at SMSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Ken for tuition and books. Last year, Beverly was laid off from her former job and was unemployed during January 2019. She was paid $1,825 of unemployment compensation until she started work with her current employer, Cypress Corporation Ken has a 4-year-old son, Robert R. Hair, from a prior marriage that ended in divorce in 2014. During 2019, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Ken's ex-wife. During 2019, Ken's aunt died. The aunt, in her will, left Ken $15,000 in cash. Ken deposited this money in the Boatman's Bank savings account. Required: Comolate the Haire' Form 1040 Schedule 1 and the Qualified Dividende and Canital Gain Tax Worksheet The Hair'e had health come for the entire Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV V Instructions Beverly's birthdate is November 4, 1995. Beverly and Ken each received a W-2 form from Cypress Corporation (see separate tab). The Hairs have interest income of $1,000 on City of St. Louis bonds. Beverly and Ken also received a Form 1099-INT from Boatman's Bank and a 1099-DIV form from green Corporation (see separate tab). Ken is an excellent student at SMSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Ken for tuition and books. Last year, Beverly was laid off from her former job and was unemployed during January 2019. She was paid $1,825 of unemployment compensation until she started work with her current employer, Cypress Corporation. Ken has a 4-year-old son, Robert R. Hair, from a prior marriage that ended in divorce in 2014. During 2019, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Ken's ex-wife. During 2019, Ken's aunt died. The aunt, in her will, left Ken $15,000 in cash. Ken deposited this money in the Boatman's Bank savings account. Required: Complete the Hairs' Form 1040, Schedule 1, and the Qualified Dividends and Capital Gain Tax Worksheet. The Hair's had health cover for the entire year. They do not want to make any contribution to the presidential election campaign. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or if an amount is zero, enter "0". Enter amounts as positive numbers. If required, round amounts to the nearest dollar. Visit the IRS website at Beverly and Ken's earnings and income tax withholdings are reported on the following W-2 forms from Cypress Corporation: a Employee's social security number Safe, accurate, 465-74-3321 OMB No 1545-0008 IRS en file FASTI Use www.irs.gov/elle b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 31-1238967 51,000.00 4,790.00 C Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld Cypress Corp. 51,000.00 3,162.00 1234 E. Chestnut Parkway 5 Medicare wages and tips 6 Medicare tax withheld Springfield, MO 65802 51,000.00 739.50 Social security tips 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV Last name Sutt. 11 Nonqualified plans 12a See instructions for box 12 c Beverly and Ken's W-2 Forms e Employee's first name and initial Beverly Hair 3567 River Street Springfield, MO 63126 d 13 Statutory employee Retirement Third-party 12b plan sick pay d 14 Other 12c d Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV Beverly and Ken's W-2 Forms 1 Employees address and ZIP Code 15 State Employer's 16 State wages, tips, state ID number 51,000.00 20 Locality name etc. 17 State income tax 680.00 18 Local wages, tips, etc. 19 Local income tax MO Department of the Treasury-Internal Revenue Service Form W-2 Wage and Tax Statement 2019 Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. OMB No. 1545-0008 Safe, accurate, FAST! Use Refile a Employee's social security number 465-57-9934 b Employer identification number (EIN) 31-1238967 Visit the IRS website at 1 Wages, tips, other compensation 2,700.00 2 Federal income tax withheld 0.00 III Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV FASTI Use Beverly and Ken's W-2 Forms 465-57-9934 Employer identification number (EIN) 31-1238967 C Employer's name, address, and ZIP code Cypress Corp 1234 E. Chestnut Parkway Springfield, MO 65802 www.irs poulette 2 Federal income tax withheld 0.00 4 Social security tax withheld 1 Wages, tips, other compensation 2,700.00 3 Social security wages 2,700.00 5 Medicare wages and tips 2,700.00 7 Social security tips 167.40 6 Medicare tax withheld 39.15 8 Allocated tips d Control number 10 Dependent care benefits Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 e Employee's first name and initial Ken Hair 3567 River Street Springfield, MO 63126 Beverly and Ken's W-2 Forms d Employee's address and ZIP code 15 State Employer's 16 State wages, tips, state ID number etc. 2,700.00 17 State income tax 0.00 18 Local wages, tips, etc. 19 Local income tax 20 Locality name MO Instructions Beverly and Ken's W-2 Forms Beverly and Ken's Form 1099-INT and Form 1099-DIV Beverly and Ken's Form 1099-INT and Form 1099-DIV Beverly and Ken received the following Form 1099-INT and Form 1099-DIV: - CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, Payer's RTN (optional) country, ZIP or foreign postal code, and telephone no. OMB No 1545-0112 2019 1 Interest income Interest Income Boatman's Bank 300 City Avenue Springfield, MO 63126 Form 1099-INT $ 651.76 2 Early withdrawal penalty PAYER'S TIN RECIPIENT'S TIN $ 3 Interest on U.S. Savings Bonds and Treas. obligations Copy B 33-1234566 465-74-3321 $ For Recipient DECICNTC Am 4 Federal income 5 Investment OMB No. 1545-0110 Beverly and Ken's Form 1099-INT and Form 1099-DIV CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, 1a Total ordinary country, ZIP or foreign postal code, and telephone no. dividends Dividends $ 300.00 2019 and Green Corporation 900 South Orange Ave. 1b Qualified dividends Distributions Springfield, MO 63126 $ 300.00 Form 1099-DIV 2a Total capital gain 2b Unrecap. Sec. 1250 distr. gain RECIPIENT'S TIN 2c Section 1202 gain PAYER'S TIN 2d Collectibles (28%) gain $ 33-11223344 465-57-9934