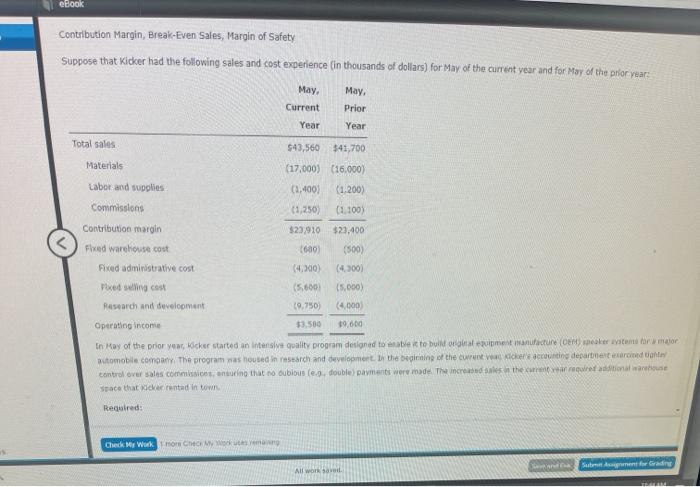

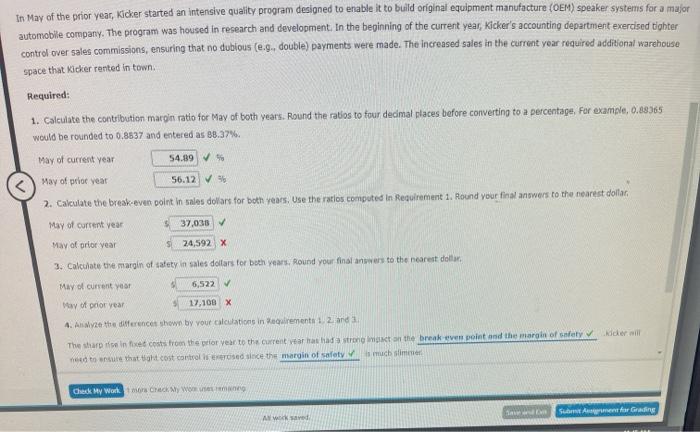

eBook Contribution Margin, Break-Even Sales, Margin of Safety Suppose that Kicker had the following sales and cost experience (in thousands of dollars) for May of the current year and for May of the prior year: May May, Current Prior Year Year Total sales 543,560 $41,700 Materials (17,000) (16.000 Labor and supplies (1,400 (1/200) Commissions (1,250 01.100) Contribution margin $23,910 $23.400 Fixed warehouse cost 1600) (500) Fixed administrative cost (4.300) (300) Pedig cost (5.600) (5.000) Research and development 19.750 (4.000 Operating income $3.500 19.000 In May of the prior wear, kicker started an intensive quality program designed to enable it to bololate menuicture emaker van tormator automobile comany. The program was housed in restarch and development in the beginning of the car accounting departmestered in control over sales comis, anting that no dubious .. double pamants were madeThe increas the required to war space that kiderenta in town Regered: Check My Wok Chem Sunset All work savol In May of the prior year, Kicker started an intensive quality program designed to enable it to build original equipment manufacture (OEM) speaker systems for a major automobile company. The program was housed in research and development. In the beginning of the current year, Kicker's accounting department exercised tighter control over sales commissions, ensuring that no dubious (e... double) payments were made. The increased sales in the current year required additional warehouse space that Kicker rented in town. Required: 1. Calculate the contribution margin ratio for May of both years. Round the ratios to four decimal places before converting to a percentage. For example, 0.88365 would be rounded to 0.8537 and entered as 88.37% May of current year 54.89 May of prior Year 56.12 9 2. Calculate the break-even point in sales dollars for both years. Use the ratios computed In Requirement 1. Round your final answers to the nearest dollar May of current year 37,033 May of prior year 24,592 X 3. Calculate the margin of safety in sales dollars for both years. Round your final awwers to the nearest dollar May of current year 6,5227 May of prior year 17,100 X 4. Analyze the efference shown by your calculations incrementa 1.2 and The share infine controm the prior year to the current years had a strong to the break even point and the margin of safety der will need to ensure that it cost controllerersed since the margin of safety much time Check My Works Crack My We Sub Anment for Gradine ANW