Answered step by step

Verified Expert Solution

Question

1 Approved Answer

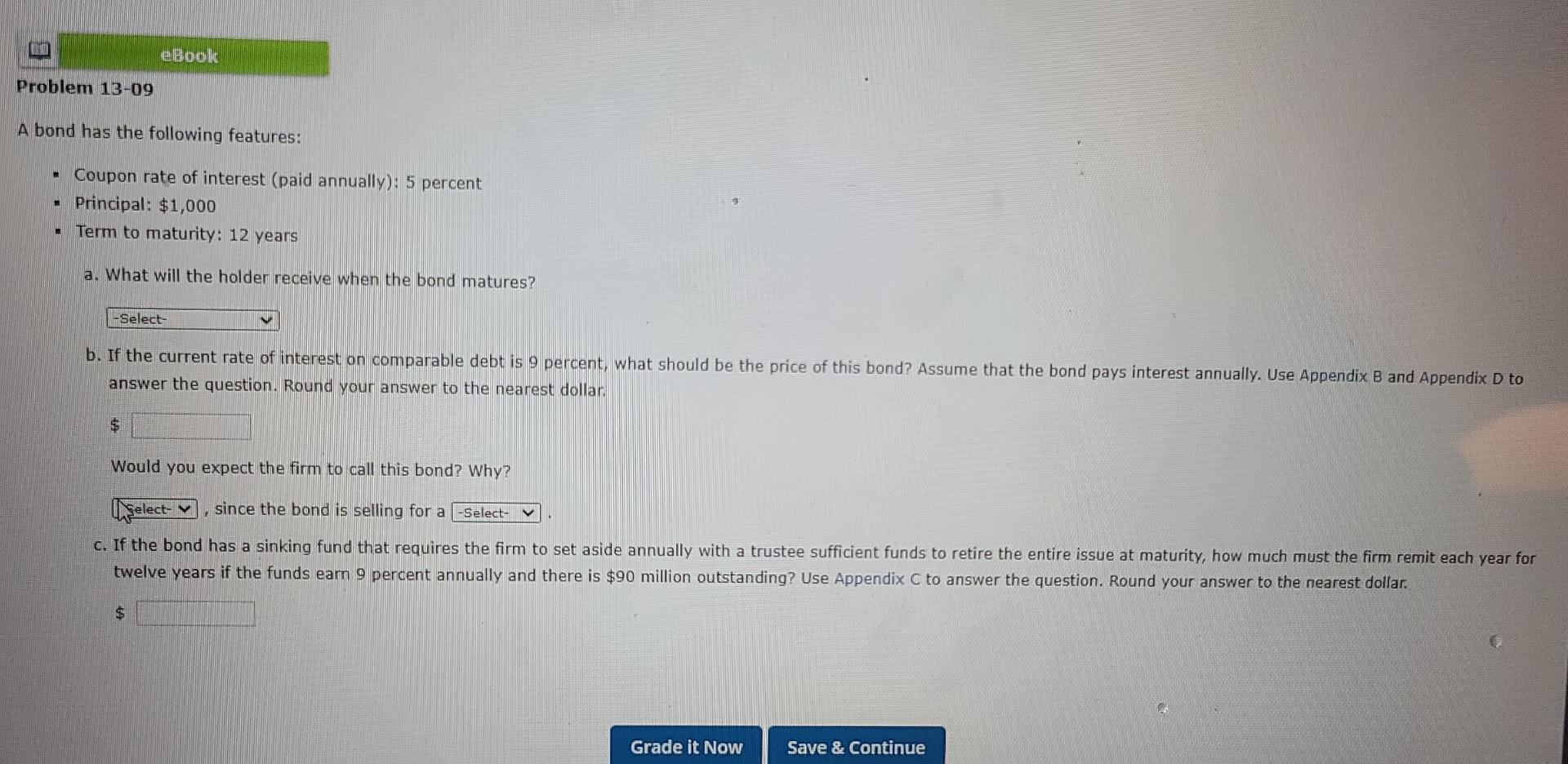

eBook Problem 13-09 A bond has the following features: - Coupon rate of interest (paid annually): 5 percent Principal: $1,000 Term to maturity: 12 years

eBook Problem 13-09 A bond has the following features: - Coupon rate of interest (paid annually): 5 percent Principal: $1,000 Term to maturity: 12 years a. What will the holder receive when the bond matures? -Select- b. If the current rate of interest on comparable debt is 9 percent, what should be the price of this bond? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. $ Would you expect the firm to call this bond? Why? Select-, since the bond is selling for a -Select- c. If the bond has a sinking fund that requires the firm to set aside annually with a trustee sufficient funds to retire the entire issue at maturity, how much must the firm remit each year for twelve years if the funds earn 9 percent annually and there is $90 million outstanding? Use Appendix C to answer the question. Round your answer to the nearest dollar. $ 10 Grade it Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started