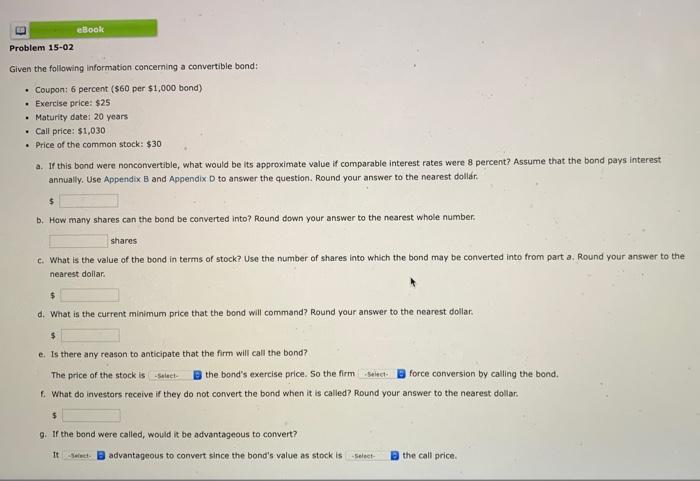

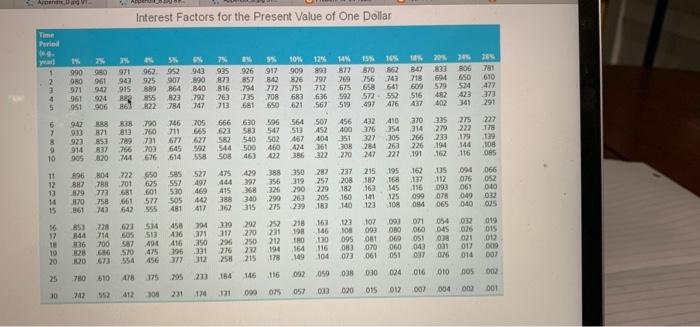

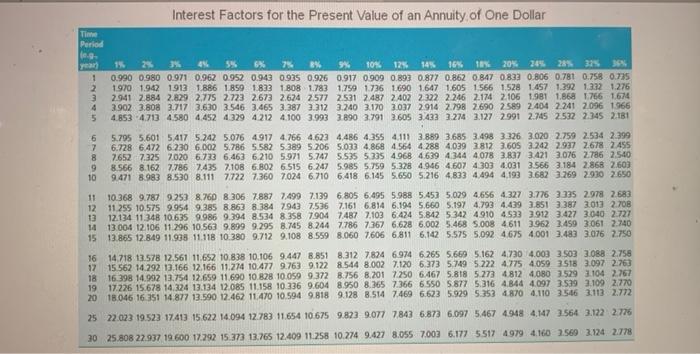

eBook Problem 15-02 Given the following information concerning a convertible bond: Coupon: 6 percent ($60 per $1,000 bond) Exercise price: $25 Maturity date: 20 years Call price: $1,030 Price of the common stock: $30 a. If this bond were nonconvertible, what would be its approximate value if comparable interest rates were 8 percent? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar $ b. How many shares can the bond be converted into? Round down your answer to the nearest whole number shares c. What is the value of the bond in terms of stock? Use the number of shares into which the bond may be converted into from part a, Round your answer to the nearest dollar $ d. What is the current minimum price that the bond will command? Round your answer to the nearest dollar. $ e. Is there any reason to anticipate that the firm will call the bond? The price of the stock is select the bond's exercise price. So the firm that force conversion by calling the bond. 1. What do investors receive if they do not convert the bond when it is called? Round your answer to the nearest dollar. $ 9. If the bond were called, would it be advantageous to convert? Itact advantageous to convert since the bond's value as stock is -Select the call price www ww Interest Factors for the Present Value of One Dollar % 7 m * mm www mm Time Period E========= Interest Factors for the Present Value of an Annuity of One Dollar Time Period . yan 1% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 325 36% 1 0.990 0.980 0,971 0.962 0.952 0.943 0935 0.926 0917 0909 0.893 0.877 0.862 0.847 0832 0.806 0.781 0.758 0.735 2 1970 1942 1913 1886 1859 1833 1808 1.783 1759 1736 1.690 1.647 1605 1 566 1.528 1.457 1.392 1332 1.275 3 2941 2884 2.829 2.775 2723 2.673 2624 2577 2531 2487 2402 2322 2.246 2.174 2.106 1981 1.868 1766 1674 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3037 2.914 2.798 2690 2589 2404 2.241 2.096 1966 5 4.853 4.713 4.580 4.452 4.329 4212 4.100 3.993 3890 3.791 3.605 3.433 3.274 2.127 2991 2.745 2532 2.345 2.181 . 6 5.795 5.601 5417 5.242 5.076 4917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 2812 3.605 3.242 2.937 2.678 2455 8 7.652 7.325 2020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4344 4.078 3.837 3.421 3.076 2.786 2.540 9 8.566 8.162 7.786 7435 7108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4 303 4,031 3.566 3.184 2.868 2603 10 9.471 8.983 8.530 8.111 7.722 7.360 7024 6.710 6.418 6.145 5.650 5.216 4,833 4.494 4,193 3.682 3.269 2.930 2650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.452 5.079 4.656 4.327 3.776 3335 2.978 2683 12 11.255 10.575 9.954 9.385 8.863 8.384 7943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3013 2.708 13 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7487 7.103 6.424 5.842 5 342 4910 4533 3.912 3.427 3.040 2.727 1413004 12 106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6,628 6.002 5.468 5.008 4611 3962 3.459 3061 2.740 15 13.865 12.849 11.938 11.118 10 380 9.712 9.108 8.559 8.060 7606 6,811 6.142 5.575 5.092 4.675 4001 3.483 3.076 2.750 16 14.718 13.578 12.561 11652 10.838 10.106 9.447 8.851 8.312 7.824 6974 6.265 5.669 5.162 4.7304.003 3503 3.088 2.758 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3518 3.097 2763 18 16 398 14.902 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4812 4.080 1529 1104 2.767 19 17.226 15678 14.324 13.134 12.085 11.158 10 336 9.604 8.950 8.365 7.366 6550 5.877 5.316 4.846 4.097 3519 2.109 2.770 2018.046 16 351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3516 3.113 2.772 25 22.023 19.523 17413 15.622 14.094 12.783 11.654 10 675 9.8239.077 7.843 6.873 6.097 5.467 4948 4.147 3564 3.122 2.776 30 25.808 22.937 19.600 17.292 15:373 13.765 12.409 11.258 10.274 9.427 8.055 7003 6.177 5517 4979 4.160 2.569 2.124 2.778