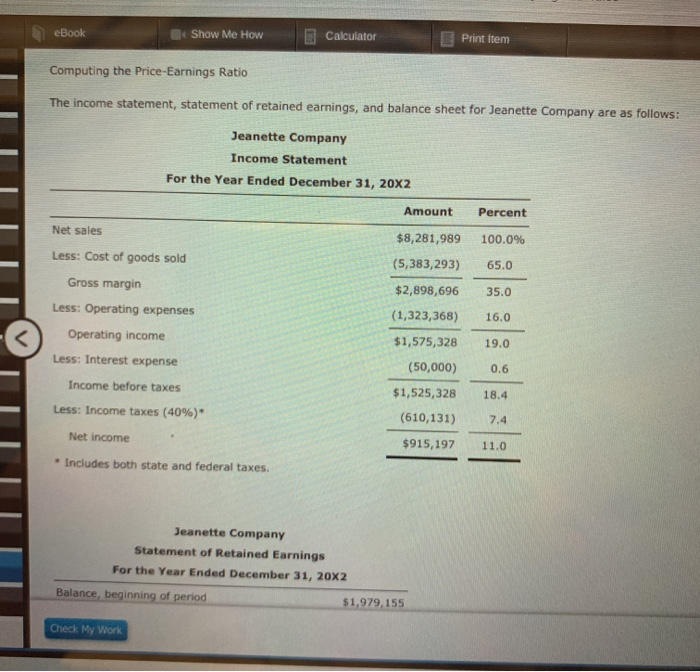

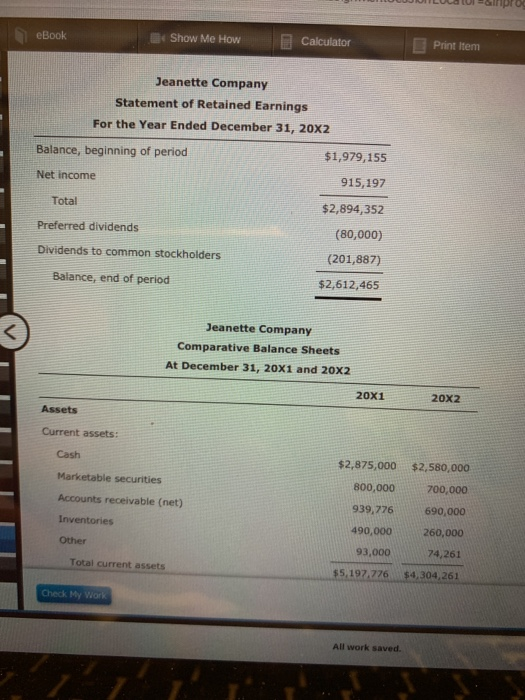

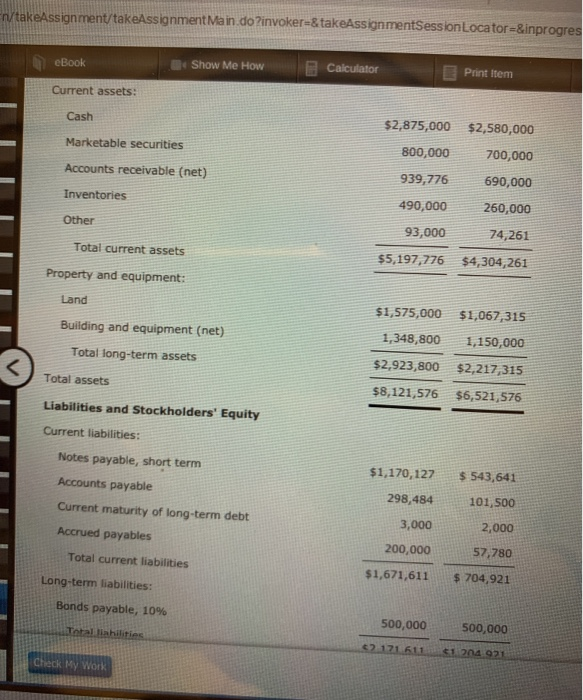

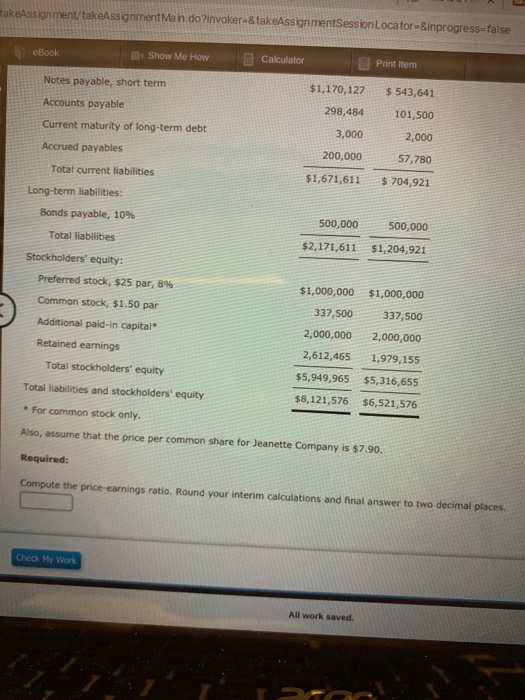

eBook Show Me How Calculator Print Item Computing the Price-Earnings Ratio The income statement, statement of retained earnings, and balance sheet for Jeanette Company are as follows: Percent 100.0% 65.0 Jeanette Company Income Statement For the Year Ended December 31, 20X2 Amount Net sales $8,281,989 Less: Cost of goods sold (5,383,293) Gross margin $2,898,696 Less: Operating expenses (1,323,368) Operating income $1,575,328 Less: Interest expense (50,000) Income before taxes $1,525,328 Less: Income taxes (40%) (610,131) Net income $915,197 35.0 16.0 19.0 0.6 18.4 7.4 11.0 * Includes both state and federal taxes. Jeanette Company Statement of Retained Earnings For the Year Ended December 31, 20x2 Balance, beginning of period $1,979,155 Check My Work eBook Show Me How Calculator Print Item Jeanette Company Statement of Retained Earnings For the Year Ended December 31, 20x2 Balance, beginning of period $1,979,155 915,197 Net income Total $2,894,352 Preferred dividends (80,000) Dividends to common stockholders (201,887) Balance, end of period $2,612,465 Jeanette Company Comparative Balance Sheets At December 31, 20x1 and 20x2 20x1 20x2 Assets Current assets: Cash Marketable securities Accounts receivable (net) Inventories $2,875,000 800,000 939,776 490,000 93,000 $5,197,776 $2,580,000 700,000 690,000 260,000 Other Total current assets $4,304,261 Check My Work All work saved n/takeAssignment/takeAssignment Main.do?invoker-& takeAssignmentSession Locator -&inprogres * Show Me How eBook Current assets: Calculator Print item Cash $2,875,000 $2,580,000 800,000 Marketable securities Accounts receivable (net) Inventories 700,000 690,000 939,776 490,000 93,000 260,000 Other 74,261 Total current assets $5,197,776 $4,304,261 Property and equipment: Land $1,575,000 $1,067,315 Building and equipment (net) Total long-term assets 1,150,000 1,348,800 $2,923,800 $2,217, 315 Total assets $8,121,576 $6,521,576 Liabilities and Stockholders' Equity Current liabilities: Notes payable, short term Accounts payable Current maturity of long-term debt Accrued payables Total current liabilities Long-term liabilities: Bands payable, 10% $1,170,127 298,484 3,000 200,000 $1,671,611 543,641 101,500 2,000 57,780 $ 704,921 Total liabilities 500,000 4217L611 500,000 31 204 921 Check My Work takeassignment/takeAssignment Man.do?invoker-&takeAssignmentSession Locator=&inprogress-false eBook Show Me How Calculator Print item Notes payable, short term $1,170,127 Accounts payable 298,484 Current maturity of long-term debt $ 543,641 101,500 2,000 57,780 $ 704,921 3,000 200,000 $1,671,611 Accrued payables Total current liabilities Long-term liabilities: Bonds payable, 10% 500,000 500,000 Total liabilities $2,171,611 $1,204,921 Stockholders' equity: Preferred stock, $25 par, 8% Common stock, $1.50 par Additional paid-in capital $1,000,000 337,500 2,000,000 2,612,465 $1,000,000 337,500 2,000,000 1,979,155 Retained earnings Total stockholders' equity $5,949,965 $5,316,655 Total liabilities and stockholders' equity $8,121,576 $6,521,576 * For common stock only. Also, assume that the price per common share for Jeanette Company is $7.90 Required: Compute the price-earnings ratio. Round your interim calculations and final answer to two decimal places Check My Work All work saved