Answered step by step

Verified Expert Solution

Question

1 Approved Answer

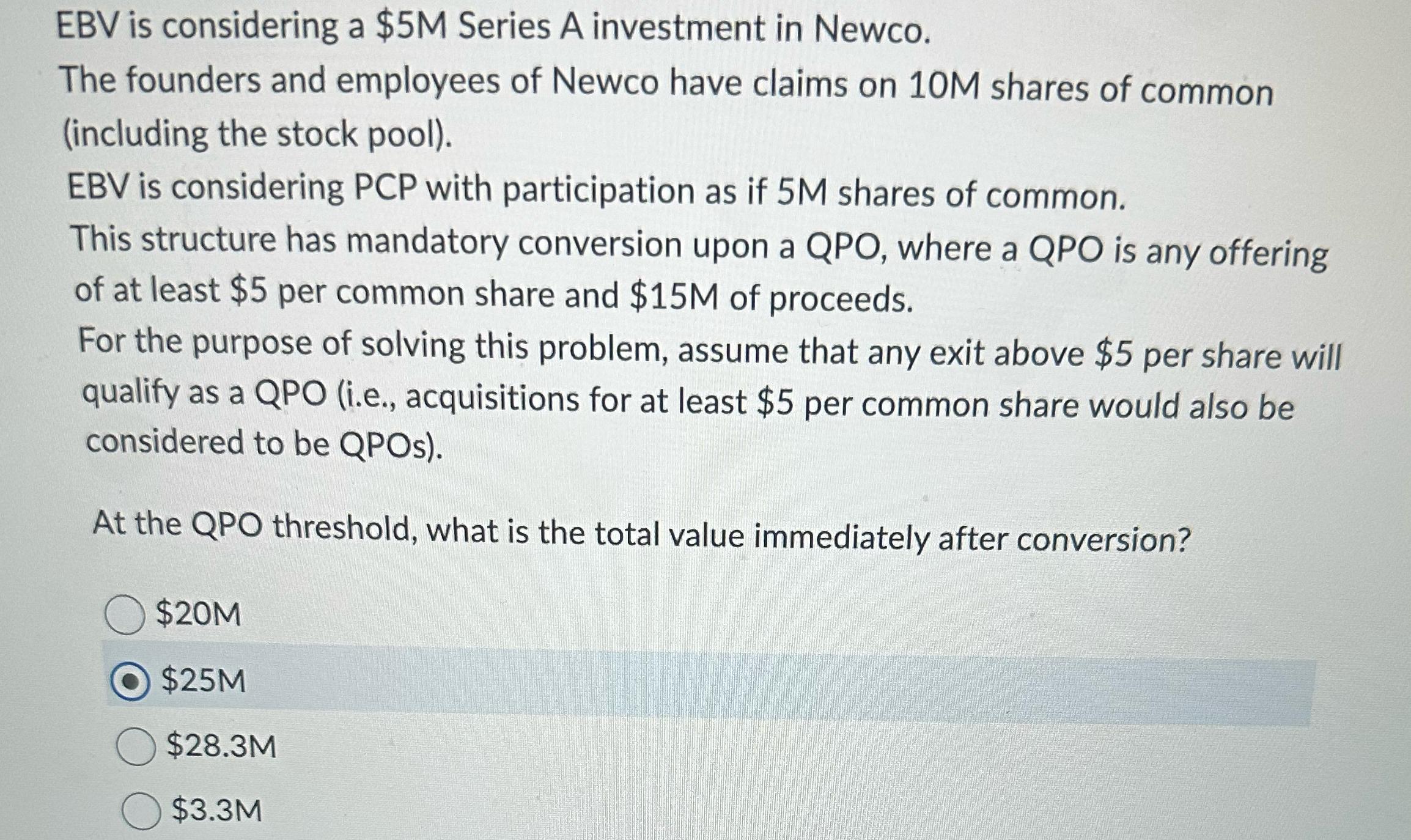

EBV is considering a $ 5 M Series A investment in Newco. The founders and employees of Newco have claims on 1 0 M shares

EBV is considering a $ Series A investment in Newco.

The founders and employees of Newco have claims on shares of common including the stock pool

EBV is considering PCP with participation as if shares of common.

This structure has mandatory conversion upon a QPO, where a QPO is any offering of at least $ per common share and $ of proceeds.

For the purpose of solving this problem, assume that any exit above $ per share will qualify as a QPO ie acquisitions for at least $ per common share would also be considered to be QPOs

At the QPO threshold, what is the total value immediately after conversion?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started