ec3 please respond to a b & c with explanation

I will upvote!

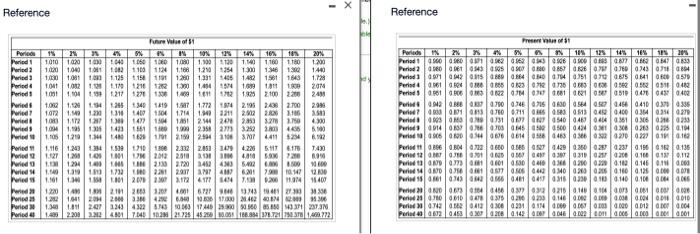

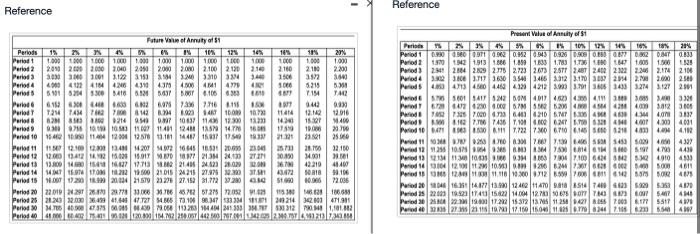

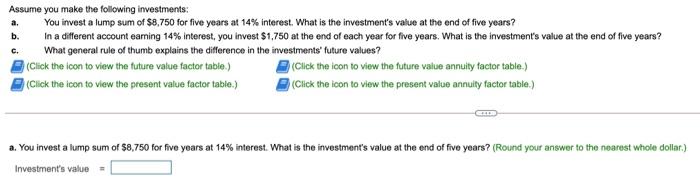

x - Reference Reference V W ML CERD 1980 13 US WES Pure Velo Periods 14 2 4% 0% 10% 12 16% 20% Priet 1010 1020 TO 640 1060 SED 1040 1990 130 1.140 1160 LO 1 200 Period 120 100 101 102 1 100 1104 1. 1.210 1354 1.300 1346 130 1440 Period 1.000000 1125 150 119 1280 1331 485 15011643 1.728 Period 10 10x210 120 1210 12013201494 SAN 18 2014 Period 101 1904130 2171271 106 14 972 1925 2.100 2.200 240 Predt 1 OR 1.121.142851349 1219 1.772 2195 2.438 2700 2941 Pred 10T2 1.1 131 1412 1904 1.14 1.12.12 ON 16 widt 100 1.7217101477 1404 1401 21442000 2003 4300 Pwed 1.6 1.95 1431 110 1002351 23252 140169 110 2189244310 3.71 4411 Pored 1.116 1.243.334.53 210 1366 2.3322,451 4.220 5.11 6.179 1430 red 1.127 1.200 101 2012 2011 201 14.00 wed 1. 12041202.720 241 40 5402 100 1.140 139 11.02.2011 2017 41211 12100 ed 1.101 1.11.11.201209201.1724177 140200 11400 122014121203069433200 pri 1.390 1420H204.37.00 214020001366 pored 1.361.81 2er 1244322 61000017446230909600515033 23 3N Pored 1.625 2.200 2.224.017.048 9020 21.725 450 10.00 168.84 178.21 280 31.08.772 19 16 VEI M. BEI 019 Presente Po 2% X % 0% 104 125 145 16% 2014 Ponad 90005 52036906080003067 HES0647 Pened 200.000.00086706D0843 Periods 0.0010542880064 0.00740.351704100579 Perid 6.0.600123007300020520310410 Periods 0.00060012010088702103510047 048.402 Perle 0.0 0.0 0.0 0.750 0.74 0.71 0.60 0.22 046704100.37 0.336 Period 001 070 07110513040400 354030379 Periods 0310070540941940403810306099 Purid 91400701450505004400300003950194 Period 100 10676405046638600200000.142 Period 088604221600.650.7042003602823 0.19 120.136 Priset 2002 0.31 02392 0.100.150.112 Period 170001010.5304100200000.102.140.10.06 Period 4 000 000 0.000200020010 0.125.000 P06049933001001001000000 Per NO 0.64 0.39902 02100100000000000000 Per 9.00010437502002304.100.000.000 0.00 0.00 09.010 Period 0742 04130306029101N0.000 0.00 0.00 0.00000120004 Period 4 02048 Pwed 6 663 w OD 2010 DAKO 1000 DWD1100 Reference Reference - 22 30 116 Future Value of Annuity of 51 Periods 15 65 10% 12 14% 165 11% 20% Paradt 1.000 100 1000 10000 100110 1100 TE 1000 1.000 1.000 Period 2099 2000 2000 2000 2001 2000 3.000 2100 210 2100 2100 2100 Period 300 33001312215 M 331034 1506 Pero 401 402 4104426 43 4.500 4141 47 306 5215 11 period 591504 3300 418 31M w 4.106 33 2018 7154 TA2 Puro 6162 1 2012 9:43 0933 Period T 1448124 1023 HART 10 100 144 12.12 2016 Pard 8830 0.7063211213 143 15:27 46 Period 30010111141124125701601 1789 1 200 Period 10154112012578 13.11 40 50 1750 19. 21221 2101 25.6 Pero 11 11.12.10 12.00 13.4.2012 16:45 16:50 20:00 23:04 28.750 12.150 Perlot 212000134121426020159170821221302 30.090 2001 11 Purbolt 13.800 NA 17.713 2140 21220020 42210 1400 Pro 14 97 TO 1.2217.00 2101 2215 21.975 4342 018 196 Pulo 15.00 1720 R12000421570 212 2715281.712281 50 06 72.006 Patios 70 22.010 29 28 27783361672672772.052 1.03 118300 Periods 212312.030 9900172 173 1096.347 33 334 330926432.401 471.91 106.5 Period 0.32 0.400 0113200 421553 753121,101.12 Periode 23.120 121 122 42 22 2203 MM Pre Value of any of 1 Pure 4% 0% I'S 105 1471 18 214 Period 1 4300800911 922 0.9520.5430926 090800277002 DAT 001 Period 190 1942 1943 1886 1.859 1833 1780 1781 1871.00 1.500 120 Period 282842.000 2.75 27232073 2.STT 24BT 2.40221222305 2.174 210 Period 3.302 303717365035483466 312 3.1703 294 2.0 20.0 2.500 Periods 40473 4.50 4.40 4320 42123.933.9 345 34333214 3.122 Periods SANDOM 401 40300430 333 102023007204400 3312300 od 73 7.000 6.40 216.146.3137 Period 17.766 7436T. OM MAN 404304001 Pod 101300 17.722730670.1455121444112 Wed 11 S 4 S 4 4339 Pred 12 255105AAM SAGTHSHS 40 4438 Period 14.10.00.100271000 SM 4910459 Period 10 01001202 100.000 0.00 0.00 Soon 4011 Period 1 12.01.10.2012 1.399 700N 5 SO 4875 Pred 201614177 13.000 12.460 11701 17480235 034120 Period 220019 ITAU 1582 14.04 12.78000 TO 5411 411 period 20 2219.00 1520 15372 1 128 3166 700 55114393 Pened 1333 292118 19 2017.100 ISO 1347105 41 Assume you make the following investments: a. You invest a lump sum of $8,750 for five years at 14% interest. What is the investment's value at the end of five years? b. In a different account eaming 14% interest, you invest $1,750 at the end of each year for five years. What is the investment's value at the end of five years? What general rule of thumb explains the difference in the investments' future values? (Click the icon to view the future value factor table) (Click the icon to view the future value annuity factor table.) (Click the icon to view the present value factor table.) Click the icon to view the present value annuity factor table.) c. a. You invest a lump sum of $8,750 for five years at 14% interest. What is the investment's value at the end of five years? (Round your answer to the nearest whole dollar) Investment's value =