Answered step by step

Verified Expert Solution

Question

1 Approved Answer

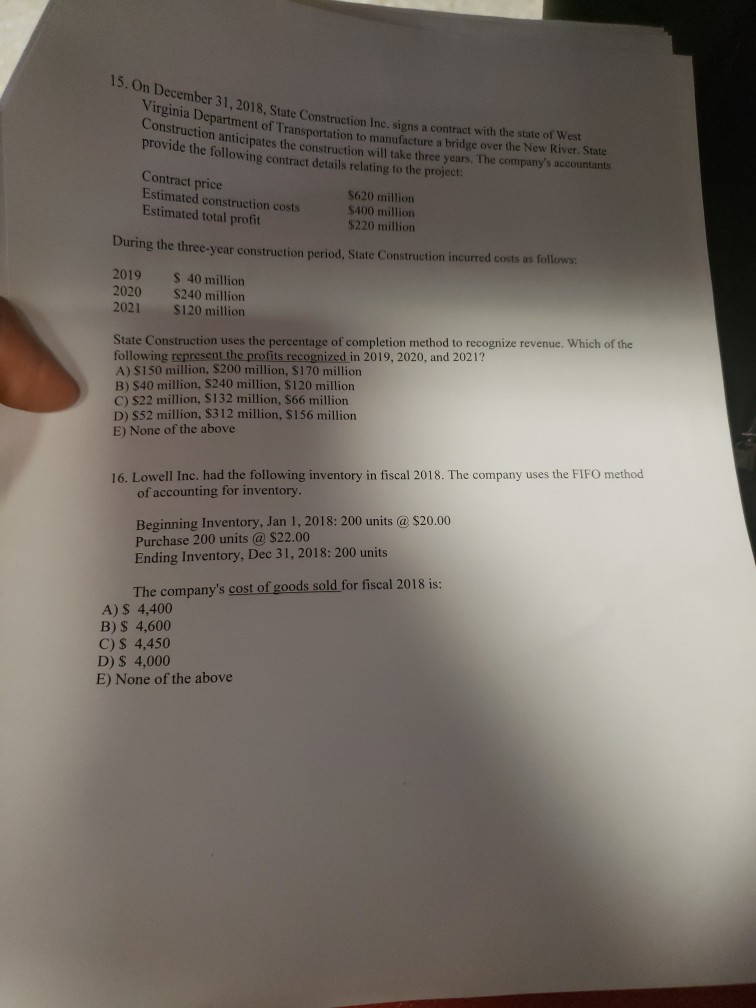

ecember 31, 2018, State Construction lne. siens a contract with the state of Wet ginma Department of Transportation to manufacture a bridge over the New

ecember 31, 2018, State Construction lne. siens a contract with the state of Wet ginma Department of Transportation to manufacture a bridge over the New River. State onstruction anticipates the construction will take three years. The company's provide the following contract details relating to the project. Contract price $620 million $400 million Estimated construction costs Estimated total profit $220 million During the three-year construction period, State Construction incurred costs as follows: 2019 2020 2021 S 40 million $240 million S120 million State Construction uses the percentage of completion method to recognize revenue. Which of the following represent the profits recognized in 2019, 2020, and 2021? A) $150 million, $200 million, S170 million B) S40 million, $240 million, $120 million C) S22 million, $132 million, S66 million D) S52 million, $312 million, $156 million E) None of the above 16. Lowell Inc. had the following inventory in fiscal 2018. The company uses the FIFO method of accounting for inventory Beginning Inventory, Jan 1, 2018: 200 units @ $20.00 Purchase 200 units @ $22.00 Ending Inventory, Dec 31, 2018: 200 units The company's cost of goods sold for fiscal 2018 is A) S 4,400 B) S 4,600 C) $ 4,450 D) S 4,000 E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started