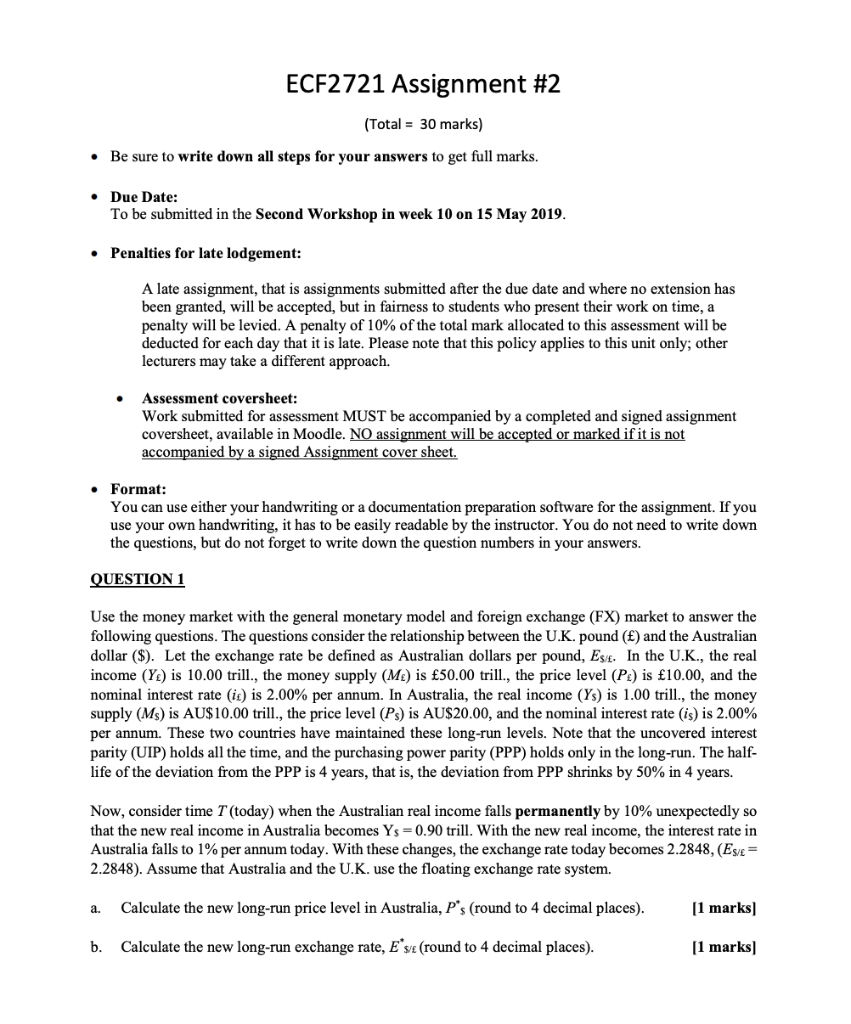

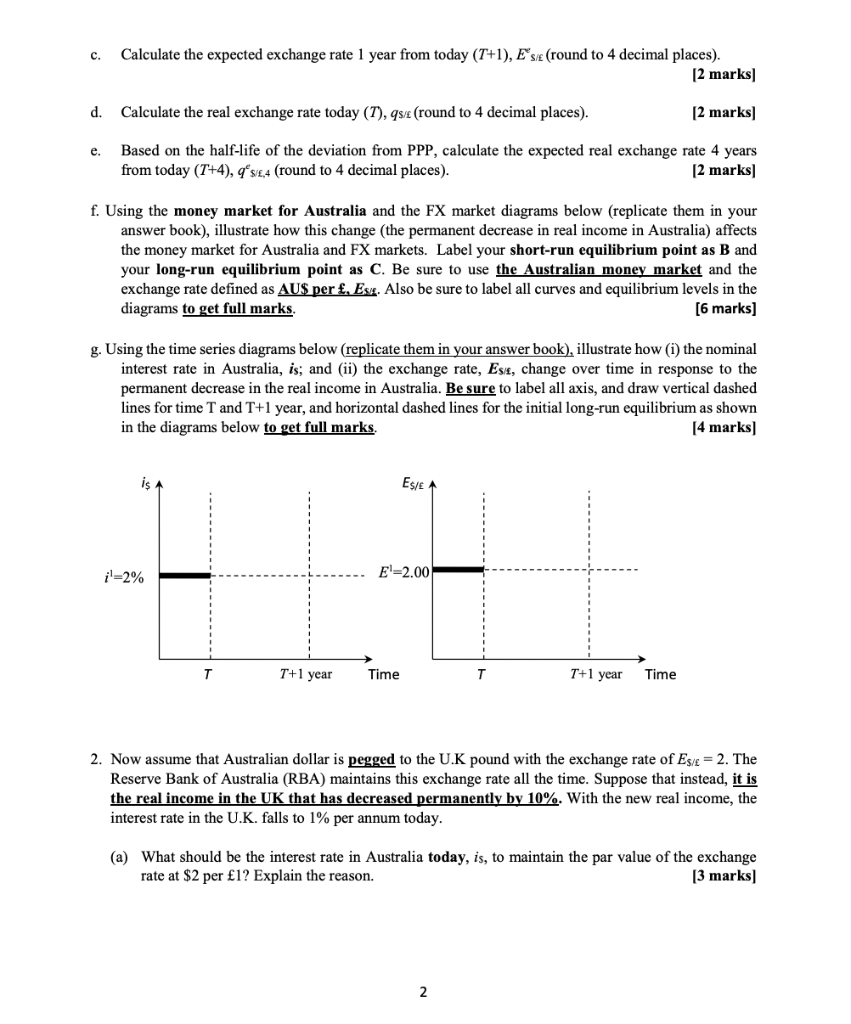

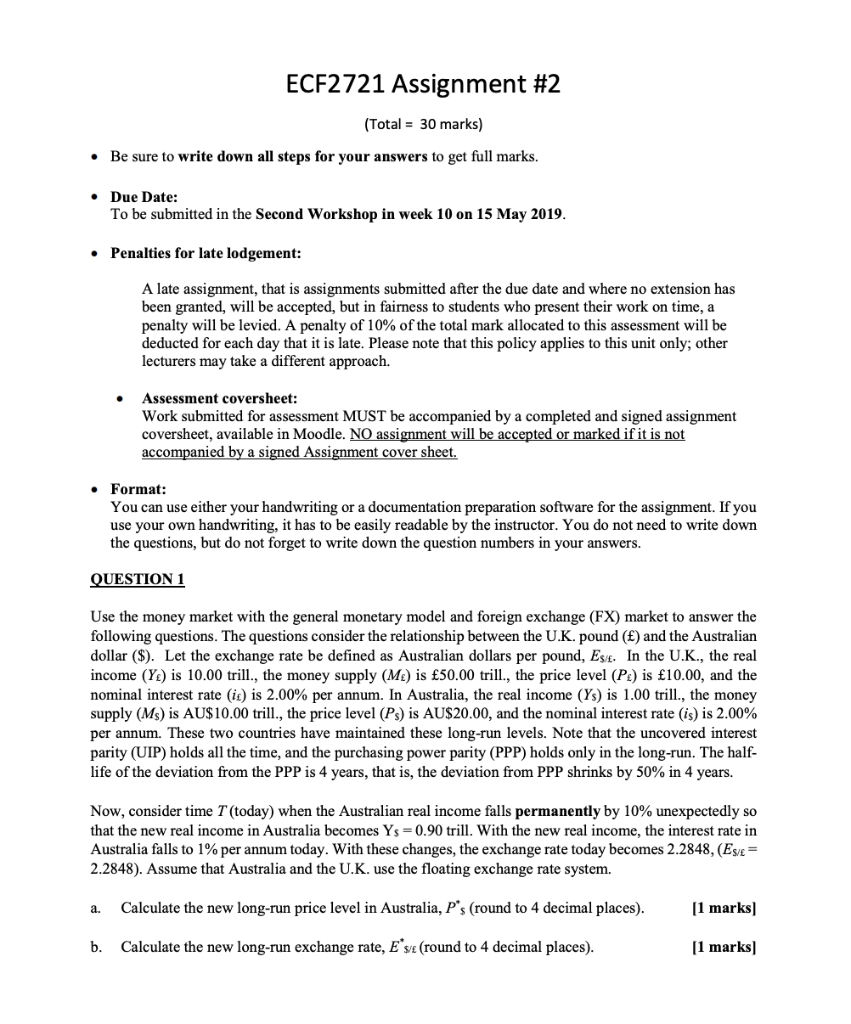

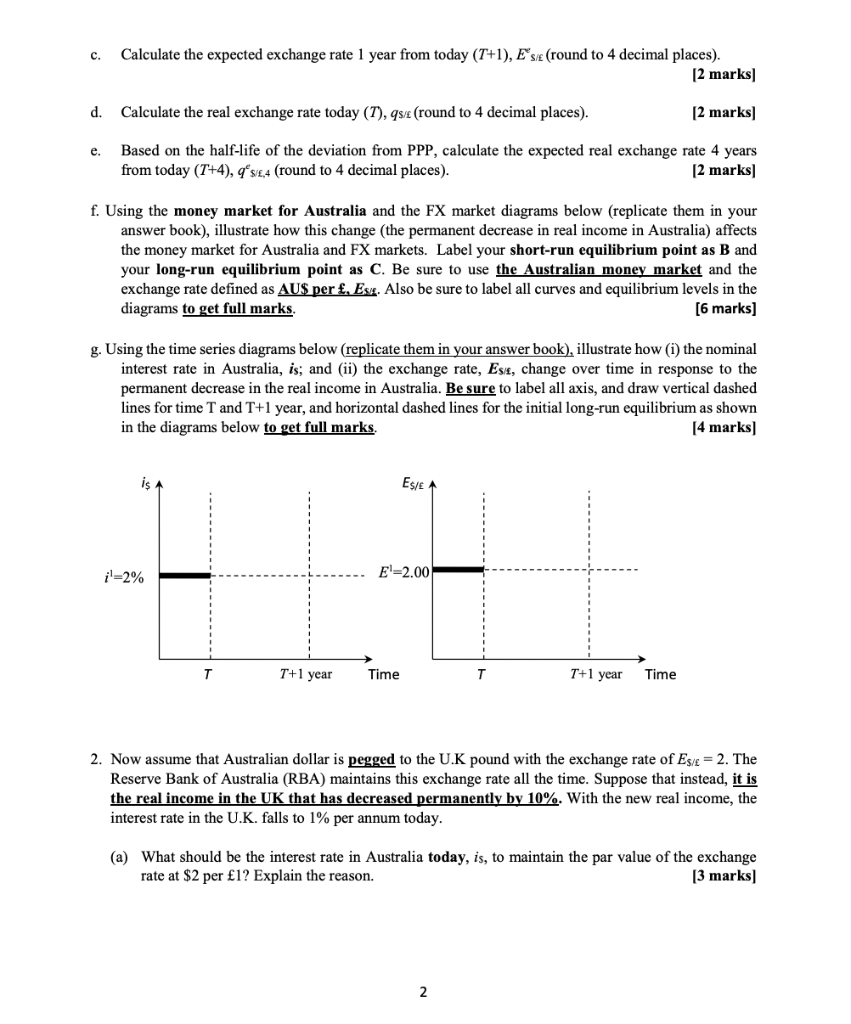

ECF2 721 Assignment #2 Total 30 marks) Be sure to write down all steps for your answers to get full marks. . Due Date: To be submitted in the Second Workshop in week 10 on 15 May 2019 Penalties for late lodgement: . A late assignment, that is assignments submitted after the due date and where no extension has been granted, will be accepted, but in fairness to students who present their work on time, a penalty will be levied. A penalty of 10% of the total mark allocated to this assessment will be deducted for each day that it is late. Please note that this policy applies to this unit only; other lecturers may take a different approach. Assessment coversheet Work submitted for assessment MUST be accompanied by a completed and signed assignment coversheet, available in Moodle. NO assignment will be accepted or marked if it is not acco a signed Assignment cover sheet anie Format: You can use either your handwriting or a documentation preparation software for the assignment. If you use your own handwriting, it has to be easily readable by the instructor. You do not need to write down the questions, but do not forget to write down the question numbers in your answers. QUESTION1 Use the money market with the general monetary model and foreign exchange (FX) market to answer the following questions. The questions consider the relationship between the U.K. pound (E) and the Australian dollar (S). Let the exchange rate be defined as Australian dollars per pound, Es/E. In the U.K., the real income (Ye) is 10.00 trill., the money supply (Me) is 50.00 trill., the price level (Pe) is 10.00, and the nominal interest rate (i:) is 2.00% per annum. In Australia, the real income (YS) is 1.00 tril., the money supply (MS) is AU$ 10.00 trill., the price level (Ps) is AU$20.00, and the nominal interest rate (is) is 2.00% per annum. These two countries have maintained these long-run levels. Note that the uncovered interest parity (UIP) holds all the time, and the purchasing power parity (PPP) holds only in the long-run. The half life of the deviation from the PPP is 4 years, that is, the deviation from PPP shrinks by 50% in 4 years. Now, consider time T (today) when the Australian real income falls permanently by 10% unexpectedly so that the new real income in Australia becomes Ys-0.90 trill. With the new real income, the interest rate in Australia falls to 1% per annum today. With these changes, the exchange rate today becomes 2.2848, (ESE 2.2848). Assume that Australia and the U.K. use the floating exchange rate system. Calculate the new long-run price level in Australia, Ps (round to 4 decimal places) 1 marksl a. b. Calculate the new long-run exchange rate, E s (round to 4 decimal places) 1 marks c. Calculate the expected exchange rate 1 year from today (T+1), EsE (round to 4 decimal places). 12 marks] d. Calculate the real exchange rate today (T), qs/E (round to 4 decimal places). [2 marks] Based on the half-life of the deviation from PPP, calculate the expected real exchange rate 4 years [2 marks] e. from today (T+4), qse4 (round to 4 decimal places) f. Using the money market for Australia and the FX market diagrams below (replicate them in your answer book), illustrate how this change (the permanent decrease in real income in Australia) affects market for Australia and FX markets. Label your short-run equilibrium point as B and your long-run equilibrium point as C. Be sure to use the Australian money market and the exchange rate defined as AUS perf. Es. Also be sure to label all curves and equilibrium levels in the [6 marks] the money diagrams to get full marks g. Using the time series diagrams below (replicate them in your answer book), illustrate how (i) the nominal interest rate in Australia, is; and (ii) the exchange rate, Ess, change over time in response to the permanent decrease in the real income in Australia. Be sure to label all axis, and draw vertical dashed lines for time T and T+1 year, and horizontal dashed lines for the initial long-run equilibrium as showin 4 marks] in the diagrams below to get full marks S/E /-2% T+1 year Time T+1 year Time 2. Now assume that Australian dollar is pegged to the U.K pound with the exchange rate of Es/E 2. The Reserve Bank of Australia (RBA) maintains this exchange rate all the time. Suppose that instead, it is the real income in the UK that has decreased permanently by 10%. With the new real income, the interest rate in the UK, falls to 1% per annum today (a) What should be the interest rate in Australia today, is, to maintain the par value of the exchange rate at $2 per 1? Explain the reason. 3 marks] (b) Should the RBA raise or reduce the money supply in Australia today to maintain the par value of the exchange rate at S2 per 1? Explain the reason and illustrate the answer in the diagrams below. (Replicate them in your answer book). Be sure to label your short run equilibrium B and your long run equilibrium C 6 marksl MS1 Returns (in AUS) 2% DR1 FR1 MD M/p Ms/Ps EAU/US (c) What should be the Australian money supply in the long-run to maintain the par value of the 13 marks exchange rate at $2 per 1? Explain the reason. ECF2 721 Assignment #2 Total 30 marks) Be sure to write down all steps for your answers to get full marks. . Due Date: To be submitted in the Second Workshop in week 10 on 15 May 2019 Penalties for late lodgement: . A late assignment, that is assignments submitted after the due date and where no extension has been granted, will be accepted, but in fairness to students who present their work on time, a penalty will be levied. A penalty of 10% of the total mark allocated to this assessment will be deducted for each day that it is late. Please note that this policy applies to this unit only; other lecturers may take a different approach. Assessment coversheet Work submitted for assessment MUST be accompanied by a completed and signed assignment coversheet, available in Moodle. NO assignment will be accepted or marked if it is not acco a signed Assignment cover sheet anie Format: You can use either your handwriting or a documentation preparation software for the assignment. If you use your own handwriting, it has to be easily readable by the instructor. You do not need to write down the questions, but do not forget to write down the question numbers in your answers. QUESTION1 Use the money market with the general monetary model and foreign exchange (FX) market to answer the following questions. The questions consider the relationship between the U.K. pound (E) and the Australian dollar (S). Let the exchange rate be defined as Australian dollars per pound, Es/E. In the U.K., the real income (Ye) is 10.00 trill., the money supply (Me) is 50.00 trill., the price level (Pe) is 10.00, and the nominal interest rate (i:) is 2.00% per annum. In Australia, the real income (YS) is 1.00 tril., the money supply (MS) is AU$ 10.00 trill., the price level (Ps) is AU$20.00, and the nominal interest rate (is) is 2.00% per annum. These two countries have maintained these long-run levels. Note that the uncovered interest parity (UIP) holds all the time, and the purchasing power parity (PPP) holds only in the long-run. The half life of the deviation from the PPP is 4 years, that is, the deviation from PPP shrinks by 50% in 4 years. Now, consider time T (today) when the Australian real income falls permanently by 10% unexpectedly so that the new real income in Australia becomes Ys-0.90 trill. With the new real income, the interest rate in Australia falls to 1% per annum today. With these changes, the exchange rate today becomes 2.2848, (ESE 2.2848). Assume that Australia and the U.K. use the floating exchange rate system. Calculate the new long-run price level in Australia, Ps (round to 4 decimal places) 1 marksl a. b. Calculate the new long-run exchange rate, E s (round to 4 decimal places) 1 marks c. Calculate the expected exchange rate 1 year from today (T+1), EsE (round to 4 decimal places). 12 marks] d. Calculate the real exchange rate today (T), qs/E (round to 4 decimal places). [2 marks] Based on the half-life of the deviation from PPP, calculate the expected real exchange rate 4 years [2 marks] e. from today (T+4), qse4 (round to 4 decimal places) f. Using the money market for Australia and the FX market diagrams below (replicate them in your answer book), illustrate how this change (the permanent decrease in real income in Australia) affects market for Australia and FX markets. Label your short-run equilibrium point as B and your long-run equilibrium point as C. Be sure to use the Australian money market and the exchange rate defined as AUS perf. Es. Also be sure to label all curves and equilibrium levels in the [6 marks] the money diagrams to get full marks g. Using the time series diagrams below (replicate them in your answer book), illustrate how (i) the nominal interest rate in Australia, is; and (ii) the exchange rate, Ess, change over time in response to the permanent decrease in the real income in Australia. Be sure to label all axis, and draw vertical dashed lines for time T and T+1 year, and horizontal dashed lines for the initial long-run equilibrium as showin 4 marks] in the diagrams below to get full marks S/E /-2% T+1 year Time T+1 year Time 2. Now assume that Australian dollar is pegged to the U.K pound with the exchange rate of Es/E 2. The Reserve Bank of Australia (RBA) maintains this exchange rate all the time. Suppose that instead, it is the real income in the UK that has decreased permanently by 10%. With the new real income, the interest rate in the UK, falls to 1% per annum today (a) What should be the interest rate in Australia today, is, to maintain the par value of the exchange rate at $2 per 1? Explain the reason. 3 marks] (b) Should the RBA raise or reduce the money supply in Australia today to maintain the par value of the exchange rate at S2 per 1? Explain the reason and illustrate the answer in the diagrams below. (Replicate them in your answer book). Be sure to label your short run equilibrium B and your long run equilibrium C 6 marksl MS1 Returns (in AUS) 2% DR1 FR1 MD M/p Ms/Ps EAU/US (c) What should be the Australian money supply in the long-run to maintain the par value of the 13 marks exchange rate at $2 per 1? Explain the reason